June 9, 2022 Updated October 22, 2023

391

1 votes

Reading time: 12 minutes

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also.

During the COVID-19 pandemic, many professional and amateur sports leagues were cancelled. Sports enthusiasts languished at home, yearning for their fixes of NBA basketball, premier league soccer, or NHL hockey. The result? Many turned to sports card investing.

Fantasy leagues, where players create their own digital teams and compete with others based on their players’ statistics, had been popular for a while as a form of sports gaming. However, the surge in sales of sports cards that occurred as a form of entertainment and investing during the pandemic was unexpected. eBay, for example, reported a 300 percent increase in gross sales of basketball cards in 2020.

At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

A sports card is a card that features a famous sportsperson. Sports cards feature players from most major sports, particularly those popular in North America—American football, soccer, baseball, basketball, ice hockey, racing, and tennis. Sports cards typically show an image of the player on one side and statistics on the other. They are one of the earliest forms of collectibles.

The first set of sports cards were issued in 1896 by a British tobacco manufacturing company. W.D & H.O. Wills from Bristol in the United Kingdom issued a series featuring 50 cricket players. The idea was to sell sports cards with cigarettes to boost brand loyalty. Sports cards took off and began to appear for soccer, baseball, and hockey in the 19th and early 20th century. They were known as cigarette or tobacco cards because tobacco companies inserted them into cigarette packets.

Today, card sets are issued each season for major professional sports. Companies pay players for the right to use their images, and most sports cards feature professional athletes. Mike Trout (baseball), Lebron James (basketball), Tom Brady (American football), and Wayne Gretzky (ice hockey) rookie cards, and others have increased significantly in value over the past few years, and some have resulted in million-dollar pay outs for sports card investors.

Sports cards that pre-date 1980 can fetch a high price if in good condition, and rookie hall of fame sports cards can be worth thousands of dollars. Unfortunately, they are hard to find because a trend among children was to place the cards between the spokes on their bicycle wheels, obviously damaging the cards.

Sports cards were produced in greater numbers in the 1980s and 1990s, and collectors began to realize their investment value. However, because there were more cards in the market, the values remained low, so scarcer versions of cards were issued by companies to stimulate investor interest.

Investment in trading cards reached new heights in 2021. eBay, the e-commerce trading platform, noted a 142 percent surge in trading card growth with four million collectible sport and non-sport trading cards sold in 2020 than in 2019. Gross sales of basketball cards were up by over 300 percent, and sports cards have been selling for over $500,000. What’s behind this trend?

According to Darren Rovell, a sports business analyst and collector interviewed by eBay, the interest was fueled to a large extent by COVID. People were staying at home during lockdown and looking for entertainment. Because most sports leagues ceased on TV during lockdown, sports enthusiasts turned to trading sports cards instead.

Investors are now turning to sports cards to diversify their stock portfolios. Younger generations may be buying up sneakers on StockX or speculating with crypto, but they are also seeing sports as a way to pursue a passion and make money. For older generations, many families have a stash of sports cards hidden in the corner of the attic somewhere, and it’s fun to dig them out and see which ones might fetch a bob or two on the market.

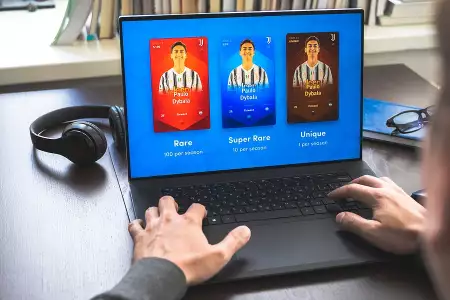

It’s also easy to trade in sports cards compared to, say, the luxury watch market. You don’t need thousands to buy a physical rookie LeBron James card. Fractional investing is growing in popularity, whereby an investor can buy fractions of cards through a digital broker.

There are typically low or no minimum investment requirements, and investors don’t actually need to hold a physical card. Rally Rd. and Collectable are such platforms. Fractional investing is a way to hold a portion of a few favorite players’ cards, track their performance, and literally invest in their sports careers.

Sports cards as assets have an advantage over stocks in that they are uncorrelated to the markets. The value of a sports card is largely unaffected by interest rate adjustments or wars in far-flung countries overseas. That makes them a good option for diversifying a portfolio and reducing overall risk. However, although sports card investing has seen recent gains, there is still too little data to fully make sense of the world of cards. Here are some of the pros and cons.

Potential for ROI – Some consider sports cards an untapped investment vehicle, and there could be potential for significant ROI.

Reduced Risk – Some manufacturers are introducing standards and valuation indices so that a card or asset does not lose value.

Access – Compared to other markets, like real estate, diamonds, or watches, sports card trading is easy to access.

Liquidity—There is a vibrant market for sports cards on trading platforms like eBay, so they are easily converted to cash

Risk – Cards can be damaged, lost, or stolen.

Limited Data – Although market research companies are providing more data on sports cards as investments, the practice is still in its infancy, and there is not enough data for investors to base a strategy around.

Volatility – The value of new rookie cards depends on how their career plays out, which is difficult to predict.

Inflated Prices – The sports card market may be temporarily inflated because of the COVID-19 outbreak, and there could be substantial downward risk in the near future.

Like any new venture, starting out requires learning as much as possible and preparing a strategy. Here’s a general walk through of a sensible approach to sports card investing for the uninitiated.

You wouldn’t buy a car without researching the model and the brand first. It’s the same with investing. Learn as much as you can about sports card investing before you start. Find recommended books, bloggers, and listen to podcasts.

Webcasts and YouTube videos can be informative, but be careful. There are many self-acclaimed “gurus” out there ready and willing to have you subscribe to material that is neither reliable nor informed. Discussion forums are a good place to get recommendations, second opinions, and learn from others.

Choose a sport that you have an interest and knowledge in. This will play to your advantage when making investment decisions.

Find reliable markets and online platforms to trade your sports cards. Some examples are eBay, trade shows, auctions, and through collectors and experts. eBay is a good option for beginners because it has buyer protections.

Realize that any investment is risky. Never invest more than you can afford to lose, so set a budget and stick to it. You only need $5 to start investing in sports cards, but it’s easy to lose a lot more.

Novices should rely on data to develop a strategy. The website “Sports Cards Investor” is a valuable resource that offers market news and investor tips and tricks.

Your investment strategy will depend on your risk tolerance and your timeline. Long-term investing has less risk, and both vintage and modern cards lend themselves to long-term ROI potential. Cards can take many years to increase in value. Think about whether the player will still be relevant in five or ten years. If so, the card might be a good buy.

For traders who like risk, flipping is a short-term, fast trading strategy whereby investors buy cards when the value drops and sell them once the value has bounced back. This strategy calls for extensive knowledge about games, players, tournaments, and the market.

Next, decide what players and cards you want to invest in depending on your strategy and purchase them. Popular cards that are relatively low in price are a good place to start. For example, the 2019 Topps Chrome UCL Kylian Mbappe Sapphire #26 PSA 10 GEM MINT can be purchased on eBay for around $100. The same soccer player’s 2017 Kylian Mbappe Panini Select Silver Prizm Rookie Card PSA 9 is going for over $800, which is illustrative of the potential of the player’s cards to gain value.

Alternatively, your strategy might be to invest in your favorite players, cards that you believe are undervalued, or you might play it safe and buy rookie cards of hall of fame players like Wayne Gretzky.

Before you buy a card, estimate the value by looking at past prices on eBay (look your card up and check “sold items,”) or check other platforms like PWCC Market Price research. Conduct a quick analysis by comparing three different historic prices and studying the past year’s price trend to see how the price is moving. Also, compare your player’s card with another player’s card that has gone up in value and consider whether your player could match that player’s success.

Now you’ve identified the cards you’d like to buy, you can search local card shops, eBay, Facebook, and other platforms to find them.

Now comes the fun part—calculating your ROI over time. Record the price you paid and the price over time for a card on popular sites like eBay. An Excel spreadsheet will do the trick. Be sure to include all taxes and fees in the price of your card to get an accurate picture of your ROI.

Just like sports card investing suddenly became hugely popular during the COVID-19 pandemic, it may suddenly become hugely unpopular, and cards may drop in value. Another factor to consider is that the price of modern sports cards, not vintage cards, reflect a player’s performance, which is hard to predict.

Investors who are investing for the short term can lose money due to hype. Hype occurs when players are suddenly the next best thing, and the value of their cards goes up. A season later, a card’s value can tank if the player is injured or plays poorly. How good are you at understanding players and the hype surrounding them?

Lastly, it’s highly possible to buy a counterfeit sports card, particularly if it is a well-known and valuable card. Some ways to avoid buying a counterfeit card are to consult a knowledgeable collector on an online forum such as Collectors Universe or NET 54.

Another way to mitigate the chances of buying a fake are to compare the card to a high-resolution scan of an original. Check the printing technique. Vintage cards used different printing techniques, so learn about them, and check a card out under magnification. Also, look at the card’s physical properties, such as the size and the weight. Can you get another card from the same set to compare?

Lastly, buy from a reputable source. High-value cards should be purchased from a reliable and well-known dealer, not Craigslist. And if a price seems too good to be true, it probably is.

What are the three most expensive sports cards to date? Vintage cards featuring Honus Wagner, Babe Ruth, and Roberto Clemente used to fetch the highest prices, but the cards of these icons have recently been eclipsed by NBA players like Lebron James and Luka Doncic.

In 2021, a LeBron James autographed rookie basketball card sold for $5.2 million. It tied with a 1952 Mickey Mantle card as the most expensive sports card ever sold. It was a 2003-04 Upper Deck Exquisite Collection RPA (rookie patch autograph) parallel with the No. 23 etched on it. The card skyrocketed from $1.85 million to $5.2 million in value within a summer.

The 1952 Topps Mantle baseball card sold for $5.2 million in 2021 to become the most expensive sports card of all time, tied with LeBron James Autographed Rookie Basketball Card, according to PWCC Marketplace. The card is valued so highly partly because it is Mantle’s rookie card and belongs to the Topps’ first annual set. Mickey Mantle was a Major League Baseball player from 1951 to 1968 for the New York Yankees, and many consider him the greatest switch hitter ever.

In March 2021, the Luka Doncic Panini National Treasures Logoman RPA sold for $4.6 million. Luka Doncic is a Slovenian NBA star who plays for the Dallas Mavericks. Logoman means that the NBA logo is embedded in the card. Logoman cards skyrocket in value because they are so rare. The 1/1 (1-of-1) means there is only one card of this type in existence, and it will never be produced again.

Like most investments, the value of a sports card is determined largely by supply and demand, and there is no real tangible value to them, unlike precious metals like gold or silver. After all, the raw materials used in the production of the sports card and the logo design will account for very little value on their own! A sports cards value is derived from an athlete’s profile, and the value can be volatile depending on the career of the player.

Here are five tips to profiting from buying sports cards.

eBay is probably the best source for sports cards for the average investor. The platform has competitive auctions and tools that help the investor to value a card accurately. There are also protections for buyers.

Some cards are graded by professional certification services like Professional Sports Authenticator (PSA) and Beckett Grading Services (BGS). Cards are graded on a scale of 1 to 10 based on their condition, corners, edges, surface, and centering. Graded cards are a better choice, particularly PSA 10 or PSA 9 cards. Safer cards are those for present and future Hall of Fame Players’ PSA 10 graded rookie cards.

Raw cards (ungraded cards) are easy to get, and many newbie investors are drawn to them because of their low cost. They are a risky investment, however. You can send your card to a certification service and have it graded. You may then be able to sell it and see a reasonable return.

You should know the sport in which you are investing because that will help you in your decisions. If you follow more than one sport, fantastic! Buy sports cards from multiple sports to reduce risk and diversify your portfolio. Also, invest in other safer assets like stocks and bonds.

Buying sports cards should be fun, but if you want to know if you are making money, you will have to keep track of your transactions. Track your purchases in a spreadsheet and monitor the value of the cards. It takes some work, but it’s the only way to know how good a sports card investor you are.

Knowing an experienced trader can be invaluable. Perhaps there is a shop down the road that sells sports cards, and the owner is a mine of information. Give them your business and ask their advice. Building relationships like this can give you a leg up on the competition and flatten the learning curve.

Autograph Card – A trading card that has the signature of the athlete.

Base or Base Card – A standard card within a pack without a number variation, parallel, refractor, autograph, or other insert. Base sets are typically higher in quantity.

Blank Back – A card with no design or printing on the back, typically due to error or short prints.

Facsimile Autograph or Facsimile Signature Card – A card with a signature that is a replication of the actual autograph of the player.

Gem Insert – A sports card with a real gem embedded within the card, such as a diamond, to increase the value of the card.

Gem Mint or GEM-MT – A card that contains the highest grade from a third-party grading company. For example, a BGS 9.5 to a PSA 10.

Numbered Cards – A card with a specific print run. Card could be 1 of 1 (1/1) or have runs of three, five, 10, 25, 50, 100. Numbered cards are higher in value and harder to obtain.

Prospect Card – A card of a player prior to joining a major league team. Prospect cards are common within baseball cards and feature players within the minor league organization.

Raw Card – A card not yet graded or encapsulated by a grading card company.

RC Card – A player’s rookie card during their rookie year within the professional organization.

SSP – Super Short Print (SSP) are inserts that are harder to obtain than short print cards. There are typically less than 10 within the print run.

So, is sports card investing for you? By all accounts, official predictions imply that the sports card trading market will be worth almost $100 billion by 2027. That means it is a new and potentially burgeoning market that has yet to show its full potential. Still, the jury is out as to whether anyone really makes substantial ROI with sports cards, and that will be the case for a while.

Bottom line. If you love sports and think you know a thing or two about certain players. It could be a way to prove to yourself that you do. If you invest wisely, treat it as a hobby and not your day job, and don’t spend more than you can afford to lose, it is likely to be something that you will not regret. Particularly if you choose sports cards as a way to diversity an already strong portfolio.

According to research, the sports card market is expected to continue to grow at a CAGR of 23% for the next five years, reaching an estimated market capitalization of over $98.7 billion by 2027. However, this does not mean that sports cards are necessarily a good investment.

One bright spot is that the sports card market has not yet been exploited, unlike other alternative investments like fine arts, real estate crowdfunding, precious metals, diamonds, watches, and commodities, so it is somewhat of an untapped opportunity.

Cards that are a little unusual, hard to get, but have been popular will continue to hold their value. Examples are the 1986 Michael Jordan Fleer and Bumblebee Tuna “The Rock” card. Vintage ‘80s and ‘90s basketball cards will also continue to be good investments. Kobe Bryant cards, Michael Jordan, and LeBron James are all legends whose cards have great potential.

In 2021, a LeBron James Autographed Rookie Basketball Card sold for $5.2 million and tied with a 1952 Mickey Mantle card as the most expensive sports card ever sold.

The main variable affecting a card’s value are its condition (surface, corners, centering, scratches, creases, edges), brand (Prizm, Mosaic, Optic), scarcity, grading, and an athlete’s career and cultural relevance.

The main card classifications are rookie cards (first year debuting in a prestigious league), inserts, complete sets, boxes, autographed cards, jersey patch cards, and error cards.