by Louis H-P

August 24, 2021 Updated July 24, 2023

894

1 votes

Reading time: 14 minutes

Dividend investing offers the chance to earn a consistent income from stocks that you own.

In this guide you’ll learn about the basics of dividend investing, starting with what, exactly, dividends are.

We’ll also review some important metrics you’ll want to know about to find legitimate trading opportunities, and also some tips to get you started with dividend investing.

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also. At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

Dividends are payments made to the shareholders of a company.

The shareholders actually own the corporation in which they hold shares.

As an owner, you are entitled to the earnings of the companies you invest in. Though companies are not required to pay dividends, many of them do. You can think of these payments as your “share” of the company’s profits for the quarter and year.

As you would expect, special dividends happen only in special situations. They are rare, and you generally cannot predict them, or count on receiving them on any kind of schedule. A typical example is when a company has accumulated more cash than it needs to fund normal operations. This can be after selling a division or spinning off a subsidiary.

Rather than just keep excess cash in the bank, companies will sometimes issue special dividends to shareholders. For instance, Costco Wholesale (ticker: COST) declared a giant $10 per share special dividend on the heels of a banner year in 2020.

Keep in mind that Costco’s regular quarterly dividend is $2.80 per share. On the other hand, regular quarterly dividends are usually paid consistently as a company earns money quarter by quarter. Regular dividends are not as large as special dividends, but they can add up over time. Regular dividends have great appeal to those looking to supplement fixed incomes, like retirees.

Dividend investing, then, is the process of research, selection, and holding of companies that pay dividends. Investors want to own companies that will not only keep paying dividends, but pay larger dividends over time. When this happens, investors have the opportunity to earn money in two ways:

We will talk more about this in a bit, but the income you can earn from dividends can help smooth out your investment returns, and offset any losses you might experience in other shares or if momentum investing.

Dividend investing aims to make money over time by focusing on companies that pay dividends. Dividends are payments from companies to shareholders – it’s often considered a good retirement plan, as the potential for reinvestment in other dividends using the proceeds can help compound your capital.

These payments generally represent some part of the income the company earned for the quarter or year. Dividend investors focus on how much a company pays in dividends and also how likely the company is to keep paying the dividend.

In this way, dividend investing is similar to value investing. The idea is to make money consistently over time, rather than looking for large gains that sometimes come from active traders who use technical analysis and partake in cryptocurrency trading. Dividend investing is a time-tested strategy with many famous proponents like Warren Buffet.

He has stated that Berkshire Hathaway’s (the holding company he runs), major stock holdings “pay consistent dividends, generally trying to increase them annually and cutting them very reluctantly.”

Dividend investing has several great benefits.

First of all, dividend payments are literally cash deposits paid to you from the companies you own.

In a sense, they are “free” money. If you own shares and the company declares a dividend, you receive cash in your investment account.

These amounts can range from a few cents per year to several dollars per share per year. the best dividend stocks can make investors significant amounts of passive income.

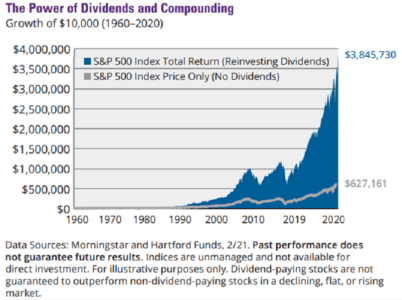

Since 1970, 84% of the S&P 500’s total return can be attributed to reinvested dividends and the power of compounding. In other words, investment strategies that target only the price performance of the S&P miss out on a substantial return.

Something to bear in mind if you are using copy trading. Besides the boost to your stock portfolio in the form of cash deposits, dividend-paying stocks also tend to be less volatile than the market as a whole. Lower volatility can lead to fewer and smaller losses over the long haul. Basically, dividends can smooth out your returns while letting you accumulate a steady stream of cash payments.

Do not forget capital gains from a market rally, either. Dividend-paying stocks tend to rise along with the rest of the market, so you can also make money from rising prices, especially during bull market periods like we are currently in.

So, just because you use a dividend investing strategy does not mean that you are doomed to small gains. Just the opposite. You can receive a steady stream of cash returns with potential price appreciation. All with lower volatility. It can be a really good deal.

When you do any research into dividend-paying stocks, you will soon come across the “dividend yield.” or the dividend payout ratio.

This is a key number to understand and keep your eye on.

The dividend is calculated like this:

Annualized dividend payment divided by the current stock price.

Keep in mind that some financial media websites might take the most recent quarterly dividend paid and multiply it by four to calculate an annual dividend. On the other hand, you can add-up the last four dividends paid to perform the calculation.

This method is a little more conservative because it is based on what has already happened. When you multiply the last dividend paid by four, you are projecting that that dividend payment will be sustained, which may or may not turn out to be true.

The dividend yield is important because it gives you an idea of how much you are “earning” on your investment. A low yield means that the dividend is small compared to the price per share. A high dividend yield means just the opposite.

Serious dividend investors target companies with higher dividend yields. However, you can have too much of a good thing, and some super-high yields can be a sign of trouble for a company.

We will cover some of the risks of dividend investing a little later on. For now, you will want to remember that an ultra-high dividend yield could be a sign of a problem. The company may not be able to afford to continue paying such a high dividend over the long haul. Or, that the company is financially weak and just about to go bust.

It is very easy to get started with dividend investing.

You can use this strategy with almost any trading account or brokerage. You will need to be able to purchase stocks and hold them. Optimally, you will be able to do research on companies using the same platform, but that is not essential. You can talk to a financial advisor about which growth stocks to invest in, or which are the safest, highest dividend investments – or just use the information provided below to get started.

The key to dividend investing is to be consistent.

You will want to commit to depositing into your account on a regular basis.

You will want to make sure you are diversifying by buying shares in multiple companies over time. Plus, if you add regularly to your positions, you can take advantage of dollar cost averaging, especially during periods of falling prices.

Dollar-cost averaging is the process of using a fixed amount of money to buy and hold shares of a stock on a regular basis, no matter what the price of the stock is. In this way, you will buy more shares for the same total cost when the share price is low and fewer shares when prices are higher.

Over time, your average price per share tends to be lower than if you only bought when shares were doing “well.” The lower your average purchase price, the higher your dividend yield will be, and the bigger your overall profit, too, as the price of the stock rises over time.

You are probably ready for some examples, so here are 30 examples of high yielding stocks. To make sure readers all over the world can access high-yielding stocks, you will see a good mix of US-based and international stocks listed below. These stocks all meet these criteria:

All data was compiled by performing a stock screen and Google search.

| Name | Ticker | Country | Exchange | Industry | Dividend Yield |

|---|---|---|---|---|---|

| BAE Systems | BAESY | UK | LSE / OTC | Aerospace | 4.40% |

| Bank of Montreal | BMO | Canada | Toronto / NYSE | Banking | 3.49% |

| British American Tobacco | BTI | UK | LSE / OTC | Consumer Products | 7.28% |

| DNB Asa | DNHBY | Norway | Oslo SE / OTC | Banking | 4.43% |

| Enagas | ENGGY | Spain | Madrid SE / OTC | Gas & Energy | 8.30% |

| Engie Brasil Energia Sa | EGIEY | Brazil | B3 SE / OTC | Alternative Energy | 5.89% |

| First Busey Corp. | BUSE | USA | NASDAQ | Banking | 3.62% |

| Fortescue Metals Group Ltd | FSUGY | Australia | Australian SE / OTC | Iron & Steel | 12.92% |

| Groupe Bruxelles Lambert | GBLBY | Belgium | Euronext / OTC | Investment Holding | 5.71% |

| Irsa Propiedades Comerciales SA | IRCP | Argentina | NASDAQ | Real Estate Holding | 43.46% |

| KT Corporation | KT | South Korea | Korea SE / NYSE | Telecomm | 4.42% |

| Legal & General Group | LGGNF | UK | LSE / OTC | Savings & Insurance | 5.94% |

| Manulife Financial Corp | MFC | Canada | TSE / NYSE | Life Insurance | 4.25% |

| Mercury General Corp | MCY | USA | NYSE | Property & Casualty Insurance | 3.77% |

| Orange Sa | ORAN | France | Euronext / NYSE | Telecomm | 5.53% |

| Orix Corp | IX | Japan | Tokyo SE / NYSE | Mortgage Finance | 4.20% |

| Principal Financial Group | PFG | USA | NASDAQ | Life Insurance | 3.72% |

| Red Electrica | RDEIY | Spain | Madrid SE / OTC | Energy Transmission | 6.15% |

| Safety Insurance Group | SAFT | USA | NASDAQ | Property & Casualty Insurance | 4.13% |

| Sanofi S.A. | SNY | France | Euronext / NASDAQ | Pharmaceuticals | 3.63% |

| Shinhan Financial Group | SHG | South Korea | Korea SE / NASDAQ | Banking | 7.71% |

| Sibanye Stillwater LTD | SBSW | South Africa | Johannesburg SE / NYSE | Platinum & Precious Metals | 5.38% |

| Sumitomo Mitsui Financial | SMFG | Japan | Tokyo SE / NYSE | Banking | 5.06% |

| Swiss RE | SSREY | Switzerland | SIX Swiss / NYSE | Insurance | 12.82% |

| Ternium Sa | TX | Luxembourg | NYSE | Iron & Steel | 5.25% |

| Top Glove International Berhad | TGLVY | Malaysia | Bursa Malaysia / OTC | Medical Supplies | 10.18% |

| Toronto-Dominion Bank | TD | Canada | Toronto / NYSE | Banking | 3.56% |

| Unilever | UL | UK | LSE / NYSE | Consumer Products | 3.26% |

| Unum Group | UNM | USA | NYSE | Life Insurance | 3.77% |

| Western Union Company | WU | USA | NYSE | Transaction Processing | 3.78% |

It can be tempting to look only at dividend yields, but you will want to consider more than just this single number.

Instead, you will want to employ a complete strategy for dividend investing. Your strategy should consist of these elements at a minimum:

We have already talked about dividend yield. You should also consider a minimum market capitalisation. In our list of 30 high-dividend stocks, we chose $1bn as our minimum. In today’s market, that is a fairly small market cap; you may want to aim higher if you like the comfort of a big market to trade in.

Whatever you choose, you need to be comfortable with it. Dividend investing should bring you great peace of mind – you do not want to be investing in tiny microcap stocks that might disappear overnight.

You might choose to focus your trading strategy on companies in certain industries or in some parts of the world. On the other hand, you might want to cast a wide net by being open to high dividend payers in all industries, all around the world.

If you look for high-yield stocks in differing industries and in more than one international market, you will employ a more balanced and diversified approach, allowing for smoother returns. Make sure you understand the downside risks, and potential rewards, of either approach.

Another statistic that is quite important to dividend investors is the dividend growth rate. A solid dividend is all well and good, but dividend investing pros crave companies that consistently raise their dividends over time. Given the choice between two strong and compelling companies, dividend investors prefer the one that has a history of hiking its dividend.

The last, and probably most important, aspect of dividend investing is understanding the payout ratio. This ratio, in simple terms, shows you how much of a company’s earnings or cash flow is being paid out as dividends.

In general, lower ratios indicate that the dividend payment is likely to be continued by the company. Dividend investors would say that a low payout ratio means that the dividend is “safe.” A safe dividend is expected to continue without being cut or eliminated.

To calculate the payout ratio on your own, you will need to look at the company’s cash flow statement, and income statement, and you will need to know the total number of shares outstanding. You can calculate the payout ratio using either net income or free cash flow:

As we said before, dividend investors generally prefer companies with lower payout ratios. This is because lower payout ratios tend to ensure that a company will continue to pay its dividend.

However, some kinds of dividend-paying companies have very high payout ratios: Real Estate Investment Trusts (REITs) and Master Limited Partnerships (MLPs). In the case of REITs, they are required by law to pay out at least 90% of their income as dividends. In this case, a high payout ratio is not a cause for concern.

The best way to find stocks for your dividend investing strategy is to use a stock screener. Stock screeners are available from every investment stockbroker, investing app, and financial news site on the market.

For instance, CNBC’s stock screener has a default dividend-focused stock screener. Depending on the specific screener you use, you can look for and sort stocks by the most important criteria to dividend investors:

By using a screener, you will turn up a list of many companies. You will want to do further research to whittle your list down to a handful or so to make your final selections from.

Taking the cons first, it really boils down to psychology and opportunity cost. Dividend investing focuses on a proven track record over the long-term.

You might miss out on great opportunities from more active styles of trading in the short term. When the market is up and certain non-dividend paying companies like tech stocks are doing really well, you might feel like you are missing out. And you might actually be missing out, not just feeling that way. If your money is tied up in a dividend portfolio, then it is not available to invest in other areas such as art investing. This could cause you to miss out on higher gains, and also cause anxiety, depression, or tempt you to change strategies based on emotion rather than careful consideration.

On the other hand, the pros of dividend investing are quite compelling. Receiving a steady stream of cash year after year can improve your overall returns. In fact, keeping at your dividend investing strategy over the long-haul will probably earn you higher returns than had you chased high-growth tech hot stocks. But, you have to have the discipline to stay the course. Besides higher income, you’ll also experience lower volatility than if you trade non-dividend-paying stocks.

Reinvesting dividends can add an even higher boost to your investment returns. By reinvesting your dividends, you are essentially receiving “free” shares over time. As the value of your stocks increase over time, you earn even higher gains. By reinvesting dividends you are doubling down on the power of compounding interest.

Just like with the other aspects of dividend investing, make sure you have a solid plan for putting your dividends to good use.

While a sound dividend investing strategy should lower your overall investment risks, you still need to consider a few specific risks. First of all, if you choose tiny companies that are not financially sound, they might go out of business. In this case, you would lose your investment.

Secondly, a company may reduce or eliminate its dividend. While you can monitor payout ratios, sometimes markets and economies tank without much warning (think 2020 and Coronavirus!), and dividends are often slashed during times like these.

A last risk is that dividend investing will tie up your money, preventing you from using other strategies. These strategies might make you more money in the short term.

There is a lot of similarity between value investing and dividend investing. In general, both strategies:

The main difference is one of intention. The dividend investor is looking for solid dividend income, while the value investor is most concerned with finding “cheap” stocks – whether or not they pay a dividend.

Growth investing, on the other hand, is more concerned with finding stocks that are likely to offer market-beating returns from “high-flying” stocks. Growth investors tend to favor thematic investing stocks in cutting-edge industries that often receive high valuations from investors.

Usually (but not always) these companies do not pay dividends. Instead, any income generated by the business is ploughed back into the business, aiming to fuel outsized growth. Growth companies tend to become overvalued stocks.

As a general rule, value and dividend investing will experience lower volatility. Growth investing has the potential for both higher gains, and larger losses.

Dividend investing shares many attributes with value investing. Many famous and successful investors are known for owning dividend-paying stocks. Probably the most famous is Warren Buffet. He and his partner Charlie Munger are synonymous with value investing.

They were both protégés of Benjamin Graham, and are known for owning shares that pay dividends. Other current proponents of value and dividend investing include Joel Greenblatt, Seth Klarman, and Whitney Tilson.

You can think of dividend investing as the original investment strategy. When stock markets were still new, investors expected to receive dividends in return for buying shares in a company. For instance, the Dutch East India Company paid a dividend of almost 18% from the 1600s to the 1800s record date.

Dividend payments are generally smaller and less common today. Many companies, especially fast-growing technology companies, choose to reinvest any profits or positive cash flow back into the business in search of even more growth. Also, the tax rates of dividends can be a drawback to investors who hold shares in taxable accounts.

Although dividend payments have shrunk over time, and the number of publicly traded companies that pay dividends is much lower now, dividend investing has always attracted investors who like getting paid to own stocks.

In some ways, dividend investing has come “full circle” – after falling almost totally out of fashion during the 1990s tech boom, dividends are playing a bigger role in stock investing today. This is perhaps due to the amazing volatility seen in three major market crashes since the year 2000. Market corrections have tended to be more frequent.

If you are looking to make steady cash income from your investments, with reduced volatility, dividend investing could be right for you. If you are willing to do a little research, you can start finding safe, high-yielding dividends today.

You will need to take the information from this guide and use a stock screener to begin finding dividend gems. As you refine your approach, and discover which metrics are most important to you, you will be able to put the power of compounding to work in your portfolio, earning cash each quarter while reducing volatility, in a true “win-win” situation.

Dividends can be a good investment for investors seeking consistent income and lower volatility in their portfolios. However, it’s essential to research and select financially stable companies with a history of paying dividends and strong growth potential.

To get $1,000 a month in dividends, first determine the average dividend yield of your desired investments, and then calculate the required portfolio size to generate that income. Invest in a diverse mix of dividend-paying stocks or funds, focusing on companies with strong financials and a history of consistent dividend payments.

The highest dividend-paying stock varies over time due to market conditions and company performance. Generally, high dividend-paying stocks can be found in sectors like utilities, real estate investment trusts (REITs), and consumer staples, but it’s crucial to research individual stocks for their dividend history and financial stability.