March 7, 2022 Updated August 1, 2023

438

1 votes

Reading time: 11 minutes

Stocks, cryptocurrencies, and bonds are not your only choices when it comes to investing. You can invest in materials like grains, oil, gold, and coffee. These are known as commodities. This guide will help you understand how commodities are traded so you can profit from a market you may not have considered before. Read on to learn about worldwide commodities trading.

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also. At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

Commodities are raw materials. They are bought and sold in the marketplace, and prices fluctuate daily. Buyers and sellers negotiate prices in hopes of making a profit. Contracts to buy/sell a contract for a commodity trade on exchanges, much like stocks trade on the stock exchange.

With the exception of gold, it is rare for the average trader to actually take possession of any commodity. An investor in oil does not place barrels of oil in the backyard or keep a herd of cattle on the front lawn. Instead, commodities contracts are cashed in and the investor puts the profits in the bank or investment account. Of course, the investor can also lose money in commodities trading.

Commodities trading is ancient, dating back to the days when farmers bartered, using their crops as a means of exchange. In the 18th century, a rice trader named Munehisa Homma made $10 billion in today’s dollars. He used his understanding of charts to profit, and his technique, known as candlestick trading, is still in use today for all types of assets, from stocks to gold.

The United States created an exchange for the trading of commodities in 1848. This exchange, The Chicago Board of Trade, is still in operation today.

Prices rise and fall based on anticipated supply and demand. If supply is short and demand is high, prices go up. If there is more supply than buyers want, prices go down. Much of the money made in commodities comes from anticipating increased supply or demand in the near future.

Soft commodities are things like grains, soybeans, coffee, sugar, and livestock.

Hard commodities are materials that are mined or derived from any kind of extraction process, such as gold, oil, silver, and rubber.

Gold and silver are two of the most well-known hard commodities. During times of inflation, investors may flock to these metals to protect themselves from rising prices in other goods and services. They are considered solid, reliable metals, although their prices fluctuate.

Some investors like to hold the physical metal in a vault, but many invest in futures and options.

Still, others buy shares in Exchange-Traded Funds (ETFs) that offer exposure to the metals markets without purchasing the underlying asset.

Other exotic metals also trade on the commodities exchanges. Because they have uses in industrial applications, they rise and fall with manufacturing productivity in addition to market supply and demand.

Traders deal with different types of oil.

Light, sweet crude oil can be distilled into other products, like gasoline. You trade this oil on the New York Mercantile Exchange (NYMEX). Brent Blend Crude is traded mostly in London, and West Texas Intermediate is oil from the United States. It is traded on the Chicago Mercantile Exchange.

Brent Blend Crude is the one used as the standard for setting gasoline prices. Of course, you do not travel to the exchanges to make your trades. It is all done online.

This includes things like coffee, soybeans, sugar, and livestock. These items trade daily, and they fluctuate in price daily. Some investors prefer agricultural because it is easy to understand the effects of weather, farm productivity, and demand.

There are four primary ways to participate in the commodities markets.

Buy physical commodities.

This is most common with precious metals. Investors can buy coins and bars of gold, silver, platinum, and palladium and store them.

Buy specific commodity-based ETFs and Mutual Funds

Both types of funds offer investors a way to participate in the commodities market by purchasing shares. The fund mimics the performance of the underlying commodity. They pool the money of investors to purchase a broad portfolio that individual investors cannot afford to buy. You get more commodity exposure for your buck with ETF investing.

This ETF allows you to invest in all commodities at once. You own a piece of every commodity that is available. The idea here is to limit risk–if one commodity fails, the others may make up for it.

Oil companies, agricultural producers, and metals miners sell shares in their companies on the stock exchange. This allows the investors to participate in commodities markets through the familiar method of buying stocks.

Investors who find stocks intimidating and cryptocurrencies confusing often find commodities more attractive.

Even a beginner can see how the global economy can affect commodity prices. Oil production is down, causing less supply, so your contract to sell oil becomes worth more. Freezing wipes out the orange crop, so orange juice prices will increase. The supply chain breaks out of its blockage, so more commodities will be available, meaning prices will drop due to increased supply.

This is not to say you will always be right, but you can understand what is causing commodity prices to change. It is all about supply and demand. When supply exceeds demand, prices drop. When demand exceeds supply (scarcity), prices rise. The trick is predicting these rises and falls in supply and demand.

Many commodities are items you use regularly. For example, car drivers are quite aware of the price of gasoline, which is refined from oil. You can see prices going up or down at the pump. Another example: though you may not own bars of gold, you have seen or bought jewelry made from gold. The average investor will understand how these and other commodities are used in everyday life.

When war breaks out in an oil-rich region, you can trade based on an expectation of increased oil prices if oil production is interrupted. In times of high inflation, many investors buy gold as a hedge. These are examples of trading the news. You anticipate decreased supply or demand due to geopolitical risk.

Another attraction is the ability to make money quickly when commodities have dramatic upticks. This is a speculative form of investment with high risks, but the appeal of better-than-average returns in the short term lures many investors.

Note that those who claim huge profits often leave out the number of losing trades they had made before the big one that worked.

Commodities should be understood as unique. They do not always move in the same direction as stocks and they do not offer the same benefits and risks.

Commodities are real, tangible products – You can anticipate price changes based on global conditions, not company profits.

You add international exposure through commodities – Many stock investors only look for opportunities in their own country, but commodities reflect world prices.

Profits can be larger with commodities – Because they are more volatile, you can have bigger gains than you might expect with stocks.

Commodities may not be as liquid at times – When there is a glut of supply, it can be hard to sell the commodities contracts you own.

Bad weather can cause a shortage of agricultural products – On the other hand, stocks are relatively impervious to climate change and weather conditions.

You are often guessing about the future – Whereas stocks have some fairly sustainable trends, commodities prices can change drastically due to sudden events.

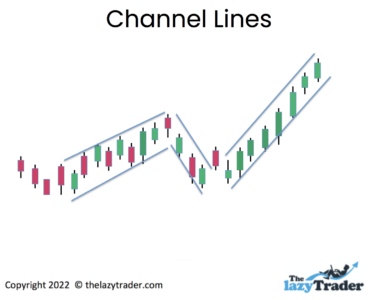

Technical traders use price patterns to trade stocks, but they can also use charts to trade commodities. In the absence of disruptive world events, commodities prices follow trends that can be seen on a chart.

If you draw lines across the highs and lows of recent prices, you can see a channel that reveals the current price trend. Trends continue until a new buy or sell signal occurs that will disrupt the pattern.

Channel lines are not exact. You can draw them as an approximation of the trend.

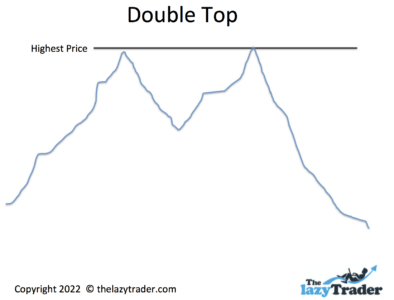

When prices retreat from a high twice, it is known as a double top. It suggests that buyers do not have enough buying power to move the price above the high point. This can signal a beginning of a downtrend.

Note that this pattern can take days or weeks to form.

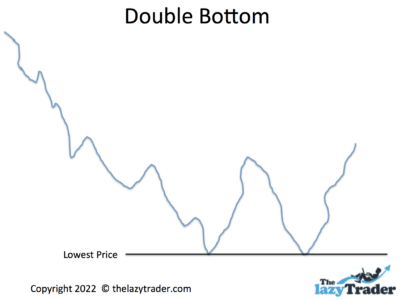

When prices hit a low twice and rebound, prices may be on their way back up.

The prices at the bottom don’t have to be an exact match.

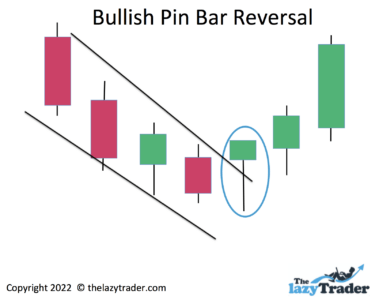

When one day’s price rebounds from a low and closes near a high, buyers may be stepping in to drive prices up in a new trend.

Watch for the price to close above the upper trend line. “Bullish” indicates an uptrend

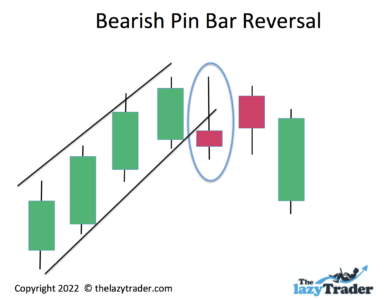

When single-day action shows sellers taking over after a price hits a high, a reversal may in imminent. “Bearish” means a downtrend.

This pattern is most significant when it breaks the trend line.

For a complete guide to trading patterns read here

Getting started trading commodities is as simple as finding an app or platform. These resources allow you to buy and sell commodities contracts–agreements to buy and sell quantities for a set price.

Here are some suggestions

This popular platform allows you to trade gold, silver, copper, wheat-–13 different commodities. You can also trade oil here. (This applies to non-US users).

This is a broker that executes trades for oil, gas, various metals, and products from agriculture. Note that Libertex charges a fixed commission for each trade, which can be as low as .1%, depending on the traded asset. The popularity of this platform is based on the wide array of products that can be traded.

This is an app for trading on mobile devices. You can trade 16 different commodities. The social-trading app, AvaSocial, allows you to communicate with commodities traders globally so you can learn from what they are doing.

Ava does charge fees, but they are among the lowest in the industry.

This app for trading on mobile devices works well for beginners. It offers 22 different commodities, and perhaps most importantly, it offers charts, alerts, and watchlists to help you make informed trading decisions.

It charges fees, but they are considered extremely low by industry standards.

Commodities are speculative. That is, you must make an educated guess about where prices are headed. This presents some definite risks you should be aware of.

Despite the fact that there are chart patterns that can help you predict prices, sudden events can change everything. A war, bad weather, and the loss of production facilities for oil can cause a dramatic turnaround in prices.

A derivative is an investment where you do not buy the underlying asset. In commodities, this means you can buy a contract-an agreement to buy or sell the commodity at a specific price at a future date.

The risk comes from the fact that you control more of the commodity than you would if you bought it outright. You might buy the right to profit from a commodity by only paying 10% of the cost of the whole commodity lot, for example. You profit from the full lot. This is called leverage.

But if prices go against you, you also suffer the losses of the whole lot. Your money can dwindle quickly because you lose money on more products than you own.

To give an example, the United States Oil Fund (USO) bought near-term oil contracts, but prices dropped, forcing them to bail out of their contracts at a loss. The fund lost huge amounts of money, and of course, so did shareholders.

Go into commodities trading with your eyes open. Investors share some common concerns.

Though charts can help you anticipate price directions, commodities can be volatile. Even major investment banks get the trend wrong. This is the type of investment you should watch daily.

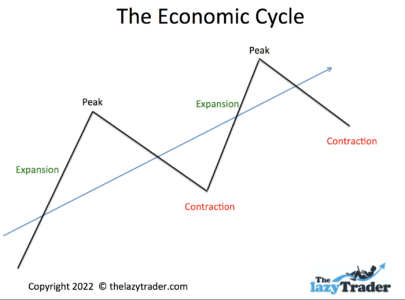

As they follow the economic cycle, they do well for a period before dropping in value due to an economic crash.

Futures contracts are an agreement to buy or sell a commodity at a given price at some point in the future. The contract itself can be sold. It rises and falls in value depending on how the underlying commodity behaves and how near the deadline you are. That means you must monitor not only the commodity, but the value of your contract.

Many stocks pay a monthly or quarterly dividend to shareholders, providing income in addition to price appreciation. Commodities are a pure profit play. You receive no interest or dividend income.

Beginners would be wise to begin commodity investing through ETFs. You can get a feel for how commodities behave, including how they respond to news and market fluctuations.

Prices drop during a recession, and it is easy to lose money making bets on where prices will be in the coming weeks and months.

A gap occurs when prices jump to a new level without trading at any point between the jump and the last price. This occurs in times of turmoil, such as when world events make headlines. Investors like certainty, and any news about wars, bad economic reports, climate change, and the like can spook investors.

It is vital to realize the difference between the stock market and the economy. Commodities depend on current worldwide economic conditions, whereas stock traders look six months ahead.

The economy proceeds in cycles. During a time of expansion, you can expect a general upward trend, but such trends are always followed by a period of downward price action. Though these trends are hard to predict, you should be wary and watch your investments more closely when you start to see conditions that signal a possible recession. Get out if a recession hits. In particular, avoid stocks of oil companies engaged in exploration and production (E&P), as these can become volatile.

ARTWORK

ARTWORK

This stands for “exchange-traded fund. The fund buys commodities and commodities contracts. It pools investors’ money so that it can buy large quantities. You buy shares in an ETF just like you would buy shares of a stock. The idea is that the fund will mimic the rises and falls of the underlying commodity. An ETF seeks to match the price action of the commodity.

An index is the average of all the prices from commodities trades. For example, a gold index would show price trends for gold for any given period. The chart of the index shows the average price of all gold transactions. Most ETFs try to match the action in an index.

The ability to find buyers and sellers is called liquidity. High liquidity means buyers and sellers are readily available, and low liquidity means you may have trouble finding someone to buy or sell shares. ETFs tend to be a bit more liquid than the commodities themselves. Thousands to millions of shares change hands daily. This can be important when you want to get out or in quickly.

You can profit from commodities. But remember, the higher the potential reward, the higher the risk. Never invest more than 1-2% of your investment account value in any particular trade. If you elect to put your money in an ETF or mutual fund, you may place more than 1-2%, but monitor your fund daily. Note that when you sell an ETF, you can do so immediately, selling shares on the market. Mutual funds wait until the end of the day to execute your sell order, so if prices are sliding, you cannot get out immediately.

That does not mean you have to live with high stress just because there may be high risk. It does mean you need to do your homework and due diligence, and set rules for when to get out of an investment that turns against you. You can profit if you build your investing acumen and trim your losses.

Some commodity traders are actually planning to buy the raw materials. They work for a business that needs the materials to operate. They spend their time negotiating the best price for goods to help keep business expenses down.

Other traders profit from contracts. You do not have to wait until the expiration date to sell a contract. This type of trader profits (or loses) from contract prices.

Either way, every commodity trader watches prices daily. A trader also keeps up with the economic news, climate change, and natural disasters. Commodities are not something you buy and hold indefinitely.