January 24, 2022 Updated September 22, 2023

1086

1 votes

Reading time: 1 minutes

Yes, you will not have all your money invested to take advantage of steep rises in a bull run, but consider it insurance. You earn a little less because you protected yourself. Do you regret buying fire insurance if your house does not burn down? Not really. You congratulate yourself for being smart and protecting yourself and your family. In the same way, protecting yourself from losses may lower your profits, but it also lowers your risk.

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also. At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

A bull market is part of a financial and economic cycle. The technical definition of a bull market is when stocks rise 20% after they previously dropped 20%. This is not something that happens in a day. It can take years for a bull market to develop, but the one-year mark is considered the minimum.

If stocks rise and fall 20% within days, this is neither a bull nor a bear market. It is simply high volatility. Do not try to invest during such periods.

Charles Dow created the Dow Jones Industrial average in 1896. When you hear that “the Dow is up,” you are hearing about the index he created.

Every investor should be familiar with Dow Theory, but there is one tenet you should understand for now. There are two types of trends in the market. An uptrend or downtrend is a primary trend. In other words, it is expected to continue for a long time. A secondary trend is a pullback or uptick that temporarily goes against the primary trend.

Investors say, “the trend is your friend,” meaning go with the primary trend and do not get too excited about slight resistance that goes in the other direction. Knowing this can help you stay calm if you see your investments dropping a few percentage points.

A bull market occurs when most investors are optimistic about prices going up. There are more buyers than sellers. Since so many buyers are completing, sellers can keep raising their ask prices. So prices go up.

A bear market occurs when the pessimists take over, when it seems like a financial crisis is coming. They think prices will go down. They sell their shares, and soon there are more sellers than buyers. So sellers have to keep lowering their ask price to attract the few buyers in the market. Prices go down.

The longer a trend, the more likely it is to be called a bull or bear market. A day or even a week of a downtrend or uptrend does not create a bull or bear market. Look for a sustained direction.

Bull markets have shared the same characteristics throughout history. We have seen enough of them to know what elements indicate a bull market has begun. That does not mean it is easy to predict a bull market, but you can confirm that you are in one as the trend moves forward. Here are three signals to look for.

When the gross domestic product (GDP) is increasing, we’re bullish: financial markets are ripe for a bull market. Caution: this is not a guarantee. A bull market can fail, so always use risk mitigation strategies. Still, a bull market does not develop when the economy is weak, so consider a strong economy as a signal that a bull market has either developed or could develop. It means investor confidence is strong over that particular period of time.

When company profits meet or exceed analyst expectations, this can indicate that the business environment is getting stronger. When many companies report better earnings, investors find those companies’ stocks attractive. That can drive prices up as more buyers come in.

When fewer people are filing for unemployment benefits, that is a sign that more people have jobs. Since the consumer is the backbone of the economy, the reasoning goes that employed people tend to buy more goods and services. So low unemployment bodes well for the economy, suggesting businesses will make more money.

So, if the trend is your friend, can you expect a bull market to continue forever? No. Trends give out. A bull market can reach a peak, and stocks can decline in price. There are some significant indicators that suggest a bull market is over.

Inflation hampers stocks because higher prices mean consumers cannot buy as much as they used to. This cuts into a company’s profits and makes its stock decline in value as inflation continues.

Rising Interest rates on loans, which means people and businesses are less likely to make big purchases. This means the economy can be hurt.

Also, when bond interest rates rise, that means investors can get better bond returns. Bonds start competing with stocks and attract investors. With fewer buyers in the stock market, prices can decline.

A bull market can level off. For six to nine months, stock prices will move sideways. It is as if buyers think the market has gone as far as it can for a while, and fewer people buy. As fewer and fewer buyers are left, sellers may take over and start getting rid of stocks. When sellers dominate, stock prices go down.

Some news is so bad it can reverse the market. Geopolitical risk, an explosion at an oil refinery, a pandemic, and other big events can scare investors and set off a sustained downtrend. So what do you do? You do not have a crystal ball.

Always set stop-loss orders so your stock will automatically sell if the price drops a set percentage amount or a set dollar-loss amount. You choose the level of the stop-loss according to your own risk tolerance. They have to allow for general fluctuations in the price but become active when the drop is too far for you.

NOTE: One sign a bull market has gone too far is when young investors start saying seasoned investors “just don’t get it.” The claim is that the rules of investing have changed because the times have changed. Fed Chair Alan Greenspan called this “irrational exuberance.” Of course, the high-flying market came back down. The rules had not changed.

What complicates matters is that these indicators are not 100% accurate. The market can continue upward despite the economic signals. So the indicators are not a reason to sell, but they are a reason to place stop-loss orders-an automatic sell order that triggers when your stock price drops to a level you designate.

You do not have to look far back into history to find some historic bull markets. Let’s look at a couple of the more well-known ones.

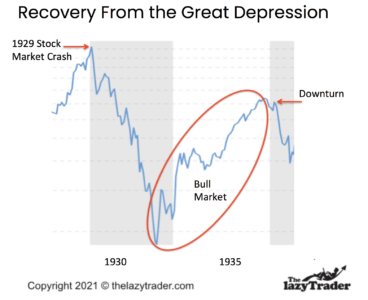

It took some time for this bull market to develop after the 1929 crash, but by 1932, stocks began to rise. The bull market increased stock values by more than 300% in five years. It was driven by President Franklin’s New Deal, which created government spending programs that stimulated the economy.

The stock market crash of 1929 was followed by a recovery. The gray columns indicate declines in the market. You can see that bull markets are sandwiched between downturns.

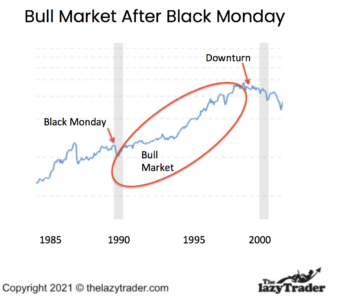

This bull market emerged just after “Black Monday.” That was when the market crashed in October of 1987, losing 22% of its value in one day. The loss amounted to $500 billion. People panicked and could not contact their brokers to give sell orders because phone lines were jammed.

What many considered a disaster turned out to be a speed bump. By September of the following year, the market recovered its losses.

Much of the recovery was driven by the Federal Reserve, which cut interest rates and allowed banks to loan money without worrying about defaults.

The panic that caused investors to scramble to get their money out of the market, turned out to be a small blip.

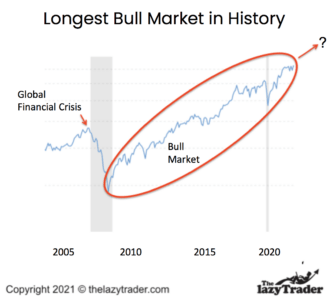

This bull market lasted from 2009 to 2020. It came on the heels of a stock market plunge due to the financial/banking crisis of 2008.

The rise in stock prices resulted from consistent economic growth, increased company profits, and extremely low interest rates. One of the biggest drivers was quantitative easing by the Federal Reserve. “Quantitative easing” means they lowered interest rates on bonds and loans, and issued more currency to provide banks with cash to lend.

COVID interrupted the bull market that began in 2009.

A bull market can provide profits for investors. Here are some of the benefits:

During a bull market, stocks may go up because people think they will, meaning they continue to buy. At some point, this enthusiasm can lift even mediocre or bad stocks.

This is short-term trading where speculators buy stocks that seem to be poised to rise. This increases the buying activity, which raises stock prices. Yet hot stocks can also lose value quickly.

Those who do not want to make frequent trading decisions can make money by purchasing the stocks of stable companies. During a bull market, these stocks tend to rise. Watch for “market leaders,” which are published in financial news outlets. These are stocks that are advancing the most and maintaining that rise consistently.

As you look back on a bull market chart, it is easy to see the steady climb. You might say, “I wish I had put all my money in and just let it ride.” But of course, that is the benefit of hindsight. At the time you are making investment decisions, you do not know where the chart is headed. You may think you know, but you could be wrong. This strategy is only for the big boys who can afford to lose a lot of money.

It is never a good idea to put more than 1-2% of your money into any trade. Remember, the pundits can be wrong in their predictions, and unexpected events may happen.

One way to profit without risking anything is to buy shares every time prices drop. This way, you get a better price but still participate in the bull market’s general uptrend. So how do you know whether a dip is temporary or is an indicator of a major decline? Study turnaround patterns. You can usually see that a pullback that is temporary by watching the patterns that form.

You do not have to guess the bottom of the pullback. Just make a purchase after the drop. Only put in 1-2% of your investment money.

With this approach, you purchase on the same day every week or month. You do not judge the chart’s potential. Instead, you buy the same dollar amount of stock each time. The idea is that if you invest, say, $1000 and the stock costs $100 per share, you will get ten shares on the first purchase.

The next time, the shares may be worth $110. So you would get fewer shares for your 1,000. Then on the next purchase, let’s say shares have gone down to $90 per share. You get more shares for your $1,000. In this way, you are always getting more shares when the price is low and fewer shares when the price is high. The average of your purchased amounts is lower than the current share price on any given day.

Yes, you will not have all your money invested to take advantage of steep rises in a bull market, but consider it insurance. You earn a little less because you protected yourself. Do you regret buying fire insurance if your house does not burn down? Not really. You congratulate yourself for being smart and protecting yourself and your family. In the same way, protecting yourself from losses may lower your profits, but it also lowers your risk.

One of the most significant risks of a bull market is that investors believe there are none. Every asset class is going up, so what is the risk? Well, there are some. Let’s take a look.

As continuing profits make investors fearless, they may begin buying stocks without knowing the companies past performance. And they may put more in the market than they can afford to risk. They forget that the trend can and will turn around at some point, and if they have been foolish, they can lose money with improper asset allocation.

When people start piling into the market because they are afraid they will miss a “sure thing,” they are not buying because the stocks are worth the price, but because market sentiment is making them reckless.

The saying goes, “a rising tide lifts all boats,” meaning that even bad stocks may increase in value when the trend is up. At first, the influx of new buyers drives prices up, but at some point, stocks get overpriced. When the day of reckoning arrives, the bad stocks will be the first to tumble.

Next, even stocks of good companies will fall as everybody gets over the euphoria and realizes stocks are priced too high. High-flying markets always adjust back to more reasonable prices, so wild gambles will go badly.

Leverage means borrowing money to buy stocks, options, and futures. The idea is that you will pay back the money out of profits. But the catch is if the stock goes down in price, your broker will ask you to deposit more money to make up for it. If you don’t, the broker will sell your stock, and you will be stuck with the loss.

Momentum traders buy a stock in a short uptrend and sell at the first sign of trouble. This is the opposite of the buy and hold approach. You can trick yourself into thinking you are quite good at it because you are making profits. But this may be because all stocks are rising. Momentum traders need special expertise and monitor their stocks by the hour or by the day.

At some point, the market will turn, and you may find yourself making some guesses that do not pan out. A string of losses can eat away all your profits and even part of your capital.

None of these warnings mean you should stay out of a bull market, but they do mean you should have an exit strategy for getting out if things turn against you. You can place a stop-loss order or simply keep up with what the market is doing and sell if prices reverse into a bear market.

In any bull market, some stocks fail because the company is failing, it lost market share, took on too much debt or is a fraud. You have to perform due diligence on any stock, no matter how good the market is.

Do your due diligence and only invest in leading stocks of solid companies. If a rising tide lifts all boats, it will also lift your ship. Why buy a leaky raft, hoping it won’t sink?

A bull market can be a heady time. It may seem like every stock you buy is a winner and you can do no wrong. But do no’t let that make you reckless. Always have an exit strategy and invest with a margin of safety. This can be a stop-loss order that automatically sells your position if it drops to a certain point, or it can mean taking your profits when you have reached a goal of some percentage gain.

But also enjoy the run. Some fortunes have been made during bull markets. Keep one eye on contrary signals but stick with the trend until it tells you not to. Get in the habit of staying away from predicting what the market may do, and invest based on what it is doing. High-risk traders try to catch every little signal that indicates an up or down movement, but your job is to find trends, not glitches.

Bull markets, on average, tend to last between four to five years, though this can vary significantly. For example, the bull market spurred by the growth of tech companies like Amazon on the NASDAQ and S&P 500 index lasted over a decade, from 2009 till 2020.

Predicting a bull market with certainty is challenging due to numerous variables, including corporate profits, fundamentals, and geopolitical events. However, a financial advisor or brokerage can analyze market trends, valuations, and economic indicators to provide educated predictions.

A ‘bubble’ is a term used on Wall Street to describe a situation where the prices of securities or other assets inflate rapidly, exceeding their underlying value. This often happens due to exuberant market behavior, as seen in some sectors of the crypto market, and is usually followed by a sudden drop or ‘burst’ when the bubble collapses.

A correction is a decline of 10% or more in the price of a security, ETF, or index from its most recent peak. Corrections are usually short-lived and are considered a natural part of the market cycle that brings overvalued securities back to a more sustainable level.

A bull represents a bull market because the behavior of a bull is seen as aggressive and forward-charging, mirroring the market’s upward trend in a bull market. The terms ‘bull vs. bear’ originated in New York, where traders observed that a bull attacks by thrusting its horns upward, whereas a bear swipes its paws downward.