May 9, 2022 Updated October 22, 2023

445

1 votes

Reading time: 1 minutes

As a consumer, you’re keenly aware of how interest rates impact your daily life. You see how rate fluctuations affect everything from credit cards to auto loans to returns on a savings account. A mere half-percent mortgage increase can mean the difference between buying the home of your dreams to settling on a small cottage in a less desirable neighborhood.

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also. At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

An interest rate is the cost you will pay to borrow money from a lender. The interest rate on a loan is a percentage of the loan amount. Lenders require borrowers to pay back the amount loaned (known as the principal). They also require borrowers to pay an additional charge (interest) for the use of the money.

Banks, credit unions, financial institutions, and other lenders take on risk when they lend money. The interest the borrower pays on the loan compensates the lender for this risk and provides them with a profit for making loans. Interest rates can apply to all kinds of loans. These include mortgages, student loans, car loans, and credit card debt.

An interest rate is also the reward you can earn for saving money. A bank or credit union will pay you interest on the money you deposit in a savings account or certificate of deposit (CD). They will in turn use this deposit money to fund loans to other customers.

Governments have long had an impact on interest rates. That’s because interest rates are often associated with government borrowing. Governments will borrow money using bonds to finance wars, fund projects, and help develop their economies. Investors who purchase government bonds will earn a set rate of interest.

For example, the economic success of the Renaissance was spurred by the development of new financial instruments that helped governments raise money. In the 1350s, the Dutch issued “perpetual bonds.” These bonds had no maturity date and paid investors a yield (called a “coupon”) on the bonds forever.

Starting in the 1500s, bankers from the Republic of Genoa set interest rates in 4-to-5-year intervals. The Spanish crown financed their foreign endeavors and empire building with loans from Genovese bankers. In 1694, the Bank of England was founded and began issuing bonds to fund the war against France. The United States issued its first bonds (called “loan certificates”) to raise money during the Revolutionary War.

According to Visual Capitalist, global interest rates have declined significantly over the last 700 years. During the 14th century, nominal interest rates were around 35%. Compare that to the mid-1800s when rates declined to 6% and 2020 when many sovereign rates dipped into negative territory.

You will see interest rates expressed as a percentage for both loans and investments. A lender will designate a loan’s interest rate as a percentage of the principal. For the lender, the interest rate represents their rate of return for lending money. For the borrower, the interest rate represents the cost of debt for borrowing money.

Let’s suppose a loan has an interest rate of 4.75%. This means the borrower will pay the lender the principal (the original amount borrowed) plus an additional 4.75% of the principal. The lender’s rate of return is 4.75%, while the borrower’s cost to borrow money is 4.75%.

Two important types of interest rates a borrower should understand are simple interest rates and compound interest rates. A simple interest rate means the lender charges the borrower interest only on the principal amount.

With a compound interest rate, the lender charges interest on the principal PLUS the accrued interest. Accrued interest is the amount of interest incurred on a debt but not yet paid out. A compound interest rate is referred to as charging “interest on interest.” When interest on a loan compounds, this means the borrower will pay more in interest compared to a loan with a simple interest rate.

A nation’s central bank determines short-term interest rates. A country’s central bank issues currency, conducts the government’s monetary policy, and provides services for the commercial banking system. By adjusting interest rates, a central bank can influence a nation’s economy. Central banks can use interest rates as a tool to encourage spending and growth or combat inflation.

In the United States, the central bank is the Federal Reserve. The Federal Open Market Committee (FOMC) is the Federal Reserve’s policymaking branch. It meets eight times a year to determine the country’s monetary policy and interest rates.

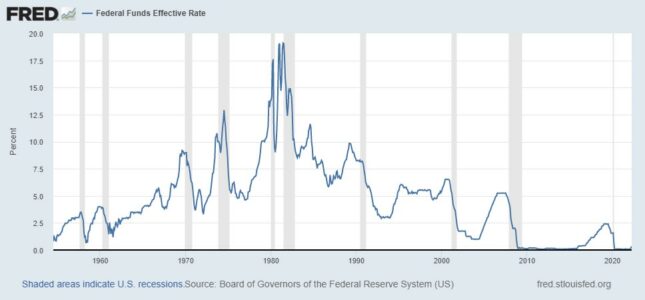

The below chart shows the Federal Funds effective interest rates from July 1954 to April 2022. The shaded areas represent U.S. recessions:

Image from St. Louis Federal Reserve.

In the UK, the Bank of England is responsible for setting interest rates. The Monetary Policy Committee sets the bank rate, which is the interest rate commercial banks receive that hold money with the Bank of England. This rate is important because it influences the interest rate that commercial banks will in turn charge its borrowers and pay its savers.

Interest rates impact consumers and businesses that are looking to access credit. When interest rates are low, consumers are more likely to borrow money as the amount they will need to repay for loans will be lower. Businesses will use access to “cheap money” to fund new projects and expand operations. A nation’s central bank may keep interest rates low to spur economic growth. This frequently happens during recessionary times or when unemployment is high.

High interest rates, on the other hand, have a cooling effect on an economy. A central bank may raise interest rates as a way of curtailing spending and slowing down an overheated economy. When an economy expands at an unstainable rate, the prices of goods and services will rapidly increase. To fight this high inflation, the central bank will often increase interest rates. As the cost of borrowing increases, consumers and businesses will borrow less and spend less, thereby reducing inflation.

As a consumer, you have probably noticed that interest rates are always changing. It’s common to hear about an increase or decrease as a top story in the day’s financial news. Interest rates can also vary depending on the financial institution and the type of loan.

Here are three main factors that impact interest rates:

Make it a habit to read reputable news sources that focus on business, economic, and financial news. These include the Financial Times, Wall Street Journal, and Forbes.

For the beginning investor, it’s not necessary to spend hours studying university-level course books to understand the basics of interest rates. By going overboard, you may end up frustrated and remembering little. The goal is to understand enough so that you can make prudent decisions regarding your investing and personal finances.

A good idea is to remain patient as you learn more about the connection between interest rates, the economy, and investing. While it won’t happen overnight, over time you will be able to react quickly and proactively to protect your portfolio as rate adjustments occur.

Central banks must weigh many risks when deciding on the direction of a nation’s interest rates. Even a slight adjustment can have a widespread impact on the overall economy.

There have been times when interest rates have risen so quickly that it’s triggered an economic downturn. An example of this is the U.S. recession that started in July 1981 and ended in November 1982. The catalyst for this was the Federal Reserve’s aggressive increase of interest rates to combat mounting inflation. Between July 1980 and June 1981, the Federal funds rate doubled from 9% to 19%.

This tight monetary policy put pressure on economic sectors dependent on borrowing. As the recession worsened, unemployment increased. Particularly hard hit were the construction, manufacturing, and automobile industries.

Federal Reserve Chairman Paul Volcker faced considerable pressure to loosen the country’s monetary policy. However, Volcker believed that high inflation was the more serious threat to the nation over the long-term. The impact of his policies began to take effect in October 1982. Inflation fell to 5% and the Fed pulled back interest rates to 9%. Unemployment also began to decline, signaling the end of the recession.

Consumers and businesses that incur debt bear the brunt of interest rate hikes. The cost to pay back the debt will increase. As we’ve discussed, if rate increases are too quick and drastic, the economy can plunge into a recession. This combination of factors can push struggling households and businesses into arrears and bankruptcy.

Interest rate risk is a key risk for holders of existing bonds. If new bonds enter the market with higher rates, the older bonds with lower rates will lose market value. Bond buyers will obviously prefer the newer bonds and the demand for the old bonds will decrease. Holders of these older bonds will receive less than face value if they sell them before the maturity date in the secondary market.

News of a change in interest rates can trigger a strong reaction in the markets. Critics point that this reaction can be outsized, causing investors to make rash decisions regarding their holdings.

For example, investors may rush to sell if they believe a rate increase is a harbinger of a coming recession. Investors who normally believe in a long-term approach can be swayed to dump their investments. This “herd behavior” can cause them to exit a stock even if the fundamentals are sound.

On the other hand, investors could see a rate decrease as a sign of a loosening monetary policy and opportunity for company growth. This may cause them to load up on stocks and other investments without performing due diligence.

Many investors wonder about how to invest with rising interest rates. Here are a few strategies you can employ to take full advantage of rate increases.

While it’s true that compound interest rates mean borrowers will pay more interest, it’s also true that compound interest rates are a boon for savers. If you have an investment that pays compound interest, you can create additional wealth by reinvesting the interest you earn. You will be earning “interest on interest,” allowing you to earn more money over the long term.

Look for opportunities to earn compound interest on your cash. You can generate compound interest through savings accounts, money market accounts, high yield savings accounts, and certificates of deposit (CDs).

Lenders base the interest rate they charge a borrower on several factors. One of the most important is the borrower’s credit score. Borrowers with higher credit scores generally qualify for loans with lower interest rates.

You can do several things to improve your credit score. For example, be certain to pay your credit cards and other bills on time. Additionally, you could lower your credit utilization (the percentage of available credit you use) and dispute any errors you find on your credit report.

It’s easy to become complacent and just accept the interest rate your credit card company charges. That’s a mistake because over the long run you could be paying way more in interest than you need to. By locking-in a lower interest rate, you will benefit from cheaper borrowing costs.

If you are carrying credit card or other types of debt, review the interest rates for each. For credit cards, you can call the company and ask for a lower rate. If you have a good credit record and a history of paying on time, they will often offer you a lower rate to keep you as a customer.

If you are a homeowner, investigate refinancing your mortgage to a lower rate. Depending on your current rate, this could save you thousands of dollars each year. If you have an adjustable-rate mortgage, research the pros and cons of converting it to a fixed-rate mortgage. And if you’re in the process of buying a home and anticipate rising rates, lock-in your rate as soon as possible.

The below chart shows the 30-year fixed rate mortgage average in the U.S. from April 2, 1971 to May 5, 2022. The shaded areas represent recessions:

Image from St. Louis Federal Reserve.

Banks, credit unions, and other financial institutions are all competing for your business. They offer new credit card customers deals—including 0% interest for a set time. They make it easy to do balance transfers from higher interest cards to theirs. You’ll generally need to pay a fee for this and make a minimum monthly payment.

Do the math to make sure it really is a good deal for your situation. And keep track of when the introductory period expires. Once it does, your interest rate will increase, sometimes significantly.

The best advice is to not carry credit card debt. But if you do, your goal should be to pay it off as soon as possible. One way to do this is to pay off your high-interest rate debt using a personal loan with a lower interest rate.

Personal loans differ from credit cards in several ways. Unlike credit cards, they don’t allow the borrower ongoing access to credit. Instead, you receive a lump sum and have a set time to repay the debt through scheduled payments. If you have a good credit score, you can usually get a much lower interest rate with a personal loan than a credit card.

IMPORTANT: Do not confuse a personal loan with a payday loan. Payday loan companies offer borrowers immediate cash advances on their paychecks. These are short-term loans (often known as “predatory loans”) with very high interest rates and fees. You should avoid payday loan companies. Instead, use a financial institution with a good reputation to secure a personal loan.

Simple interest rate: The simple interest rate is one way to calculate interest charged on a loan. To calculate the simple interest rate, multiply the interest rate by the principal by the number of time periods.

Compound interest rate: A compound interest rate is one method lenders use to calculate interest charged on a loan. This method is also known as “interest on interest.” The lender earns interest both on the principal and on the accumulated interest from prior time periods.

Prime rate: The interest rate commercial banks charge their preferred corporate customers is called the “prime rate.” In the U.S., the Federal Reserve Bank establishes the overnight interest rate that is the basis for the prime rate. The prime rate is important because banks use it to determine other rates such as mortgages.

APR: APR stands for “annual percentage rate.” APR refers to the interest rate expressed as a percentage that a lender charges a borrower each year on a loan. This amount includes fees and additional costs the borrower must pay for the loan. APR only accounts for simple interest, not compound interest.

APY (UK: AER): APY stands for “annual percentage yield.” APY refers to the real rate of return for an investment or loan. While the APR (annual percentage rate) only accounts for simple interest, the APY accounts for compound interest. Because of this, the APY on a loan will be a higher number than the APR.

Fixed interest rate: A fixed interest rate is a type of interest rate a bank or other financial institution will charge borrowers. A fixed-rate loan means the interest rate the bank charges will stay the same for the life of the loan.

Variable interest rate: A variable interest rate is a type of interest rate a bank or other financial institution will charge borrowers. The interest charged on a variable-rate loan will change as the prime rate changes.

The importance of interest rates goes beyond what you pay on your credit card bill or home mortgage. The rise and fall of rates will impact companies, the markets, domestic and global economies. Central banks set monetary policies that attempt to strike a balance that keeps growth stable and inflation in check. This balance is akin to a tightrope act—one false move can send the economy into a tailspin.

For these reasons, it’s critical investors never underestimate the impact rates have on their stock portfolios. A basic understanding of interest rate concepts can ensure you react quickly (but not recklessly) as rates inevitably change.

According to the Bank of England’s bank rate database, the highest interest rate on record in the UK was 17 percent recorded in November of 1979.

In some situations, interest rates can increase very quickly—in as little as a few months. This is especially true during times of high inflation. For example, inflation increased in the U.S. from 6.2% in 1973 to 11.1% in 1974. The Federal Reserve responded by hiking the federal funds effective rate from about 9% in February 1974 to almost 13% in July.

Many experts believe interest rates are too high if they push the economy into an economic downturn. For example, the U.S. Federal Reserve has a history of increasing rates to fight inflation. The aim is to reduce inflation by making borrowing more expensive. Businesses and consumers then slow down on making purchases. This decrease in demand keeps prices lower.

However, this strategy can spiral out of control if demand decreases to the point that business profits go down. Companies may respond by cutting back production and laying off employees. Thus, a pervasive drop in spending can lead to a full-blown recession.

Interest rates affect your daily life in several ways. As a borrower, a lower interest rate means you will pay less to borrow money. Borrowing for expensive items—such as a home, car, or college education—becomes easier and less expensive. Consumers often rack up more debt when interest rates are low. Businesses will also increase their borrowing. They might use this access to cheap money to expand their operations, hire more workers, or launch a new product line.

Conversely, when interest rates are high, people borrow less as the cost of borrowing increases. People tend to spend less and save more. A hot real estate market can cool down as mortgage rates increase. Home buyers may find it difficult to qualify for loans as lenders tighten their requirements and loans become more expensive. Home sellers may find the value of their homes decline and may have difficulty selling their properties.

One bright spot for consumers, however, is the dampening effect high interest rates have on inflation. High interest rates put the brakes on inflation. As people reduce their spending and demand decreases, the price of everyday goods also decreases. Consequently, everything from the cost of food, gasoline, housing, and utilities can all go down.

Low interest rates mean people who save cash in a traditional bank will earn very little on their money. Some banks have paid as little as 0.1% interest on their savings accounts.

On the other hand, when interest rates increase, savers will see a higher yield on their accounts. It may take some time before they see this increase once the Federal Reserve announces a rate hike. Eventually, banks increase the interest rates they offer customers on their savings accounts and certificates of deposit (CDs). However, this rate increase for cash savings may not be enough to offset the impact of high inflation.