by Glen Goodman

May 25, 2021 Updated September 16, 2023

954

1 votes

Reading time: 16 minutes

In this guide, you’ll learn the basics of blockchain and cryptocurrency trading. You’ll get detailed step-by-step instructions on how you can start trading crypto, and learn what you should beware of in this highly innovative, potentially profitable, yet volatile market.

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also. At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

Cryptocurrencies are digital assets that work as a medium of exchange using blockchain technology that controls the creation of new coins and secures all operations.

It serves as a public ledger, a computerized database in which transactions are verified and recorded by a system of computers. The information about transactions is collected in the interconnected blocks with a certain storage capacity.

An anonymous group of developers named Satoshi Nakamoto is famous for the creation and implementation of the first blockchain and the first decentralized digital currency Bitcoin BTC.

In October 2008, they published the original Bitcoin whitepaper, and on January 3, 2009 block 0 known as “genesis block” was created.

According to its whitepaper, the first cryptocurrency Bitcoin was invented as a peer-to-peer (P2P) electronic cash system, an alternative to traditional means of payment aiming to exclude any third parties like centralized authorities or payment systems from the process.

Thanks to Bitcoin’s open code, its release initiated the creation of thousands of other cryptocurrencies, each one either solving specific issues.

Users purchase products and services online, they store and transfer value, and generate profits by depositing, trading, or staking just like any fiat currency. However, there are some distinctive features that set them apart from traditional finance and derivatives:

It’s worth adding to everything mentioned above that cryptocurrency trading transaction commissions are lower and while their technical background allows them to function 24/7. The underlying blockchain technology makes it possible thanks to such features as decentralization, transparency, and immutability.

Blockchain is supported by hundreds of nodes in different parts of the planet that keep the network in a decentralized form.

This has a beneficial effect on its security, prevents fraud and double-spending, increases transaction time, and eliminates the need for financial intermediaries.

Instead of relying on a centralized institution, blockchain enables users to deal directly with each other so they have full control over their funds.

It also cuts out costs associated with banks making transactions less expensive. Such an approach has its disadvantages as well. Thus, there is no way to reverse transactions or restore the account if the private keys are lost.

Blockchain represents a public ledger that provides transparency of all information stored in its registry. Each node that verifies transactions has its own copy of the constantly updated data chain enabling anyone to look through the history of all transactions via online explorers.

This information can be used to trace coins, define their location, and find out where stolen coins are sent.

Unlike centralized banks with their totally opaque structure, blockchain allows its participants to conduct transactions in a fully transparent manner which removes the necessity of trust.

Another key feature of blockchain technology is immutability or unchangeability, which means that the data registered in the blocks is irreversible.

Once the transaction is completed it is impossible to alter the data stored in the blockchain. In order to do that, an attacker would have to gain access over the majority of nodes which is possible in theory, but economically inefficient in practice. Along with decentralization, this characteristic contributes to blockchain security.

The lack of centralized governance results in one more key aspect of blockchain-based assets. Cryptocurrencies refer to highly volatile types of investments, as their prices may move up and down quickly on a daily basis.

Price fluctuations are driven by such factors as a lack of liquidity, news and rumors, geopolitical events, large transactions, and security breaches.

Extreme volatility prevents crypto assets from mass adoption. On the other hand, this aspect gives users an opportunity to make good profits by trading the right coins at the right time.

The high volatility experienced when cryptocurrency trading can enable high profits, especially compared to traditional stocks and bonds.

By analyzing the market movements and making correct predictions, one can make profits by exchanging cryptocurrencies.

However, crypto trading is a business of high risks as well, and before diving into it, ensure you have done your own market research and studied all opportunities and possible obstacles.

Unlike traditional stock markets, cryptocurrencies operate 24/7 so users from all over the world can take part in the process independently. To be able to trade you will need some basic tools, such as:

In this chapter, we are going to give a step-by-step guide on cryptocurrency trading for beginners:

As a newbie you probably don’t have crypto to trade, so you will need to buy some coins first. Most trading platforms provide exchange services as well, however, not all tokens can be bought for regular fiat currencies.

You’ll need to start by using your debit card to purchase entry coins, most commonly Bitcoin or Ethereum (ETH), that you can later exchange for your preferred asset.

Cryptocurrency trading can be really frightening at first as there is a constant flow of news about cryptocurrency scams and people losing money in this market.

Moreover, when some of the big exchanges get hacked, the attention-grabbing headings can make the whole market plummet and lead to big money losses. E.g. when an ill-fortune DAO was hacked in June 2016, Bitcoin price dropped by 18% in a matter of a few days.

Therefore, choosing the right platform is one of the most important decisions you’ll make. When you know what aspects to pay attention to and do some research you’ll be able to choose the exchange according to your needs.

Having studied all these aspects, you will be able to find the platform to fit your requirements best (scroll through to the next section “Best Cryptocurrency Trading Exchanges” to see our recommends exchanges). .

After choosing the exchange, you need to sign up and go through the verification process. Registering is typically a very simple process: just input your first name, last name, password, and email, and agree to their Terms and Conditions.

You may also have to choose between an individual or a business account. After that, you’ll get an email with a one-time password to confirm your registration.

Due to regulations, to be able to deposit and withdraw funds traders need to verify their accounts with different levels of verification for different types of accounts.

Usually, it is necessary to submit your identity proof as registered platforms are subject to Know Your Customer (KYC) identity checks. Therefore, you’ll need to provide your ID and a photo of the required quality.

Additional verification details may include your address, phone number, and your selfie with the ID in your hand. To create a business account, you must apply with your corporate documents.

The next important thing to do is increase your account security by taking these simple precautions:

Also, remember that exchanges are susceptible to hacking attacks, therefore, it’s recommended to store just a tiny portion of your coins there which should be sufficient for trading activities.

Once you’ve registered on an exchange and purchased some crypto, you must think of secure storage for your crypto assets.

Coins can be stored in a cryptocurrency wallet, a tool for interacting with the blockchain network, which keeps your private key and public address. Wallets can be classified as hot and cold ones depending on their working mechanisms.

A hot wallet represents a piece of software that helps you manage your investments. It is connected to the internet and provides you with access to your funds regardless of your location.

The most common options include exchange, desktop, and mobile wallets. Desktop wallets are quite easy to acquire as the only thing you need to do is download and install the client.

Web wallets and those provided by exchange platforms let you access your cryptocurrencies online. MultiBit and MyCelium are popular mobile wallets while Metamask, Exodus, and Coinbase are some examples of hot wallet providers.

However, the convenience comes at its own cost as it is not recommended to keep all your funds in hot wallets for security reasons. Since funds are stored online, they can become an easy target to hackers.

If you look for higher security and are still inclined on using hot storage, Multisignature wallets like BitGo would be a better option.

They issue 3 private keys: one for the company, the other for the user, and the last one as a backup. Every transaction must be signed by at least 2 keys out of 3 which makes it more difficult to hack.

With all said above, hot wallets come with the following pros and cons.

All-in-all, hot wallets are a good option for daily usage of crypto and not the best solution for long-term investment, especially when it comes to big amounts of money. If you are planning to get involved in day-trading, hot wallets would be your best choice.

Cold wallets represent a much more secure option compared to their hot alternatives as they have no access to the internet and store the keys offline. Thanks to the high-security standards, they are regarded as most suitable for long-term investors. Examples of cold storage are hardware and paper wallets.

Wallets printed on paper are rarely used today as they are outdated. Hardware wallets are a better alternative as they come in a form of physical devices which can be bought online from their producers. They also have their pros and cons, which we are indicating below.

To summarize all the information above we recommend acquiring a cold wallet as soon as you have medium or long-term investments in your portfolio to keep most of your funds in it. The most popular options include Ledger and Trezor.

A cold crypto wallet allows you not only to store digital currencies. Once you’ve chosen an exchange, you can trade digital assets directly from your wallet as well, though the procedure would not be as convenient as with the hot option. To complete a transaction you need to plug in the wallet and follow the instructions.

Now that you have a trading platform account and a wallet, it’s time to make a decision upon your strategy. You have to choose if you want to become a short-term trader or a long-term investor.

Investment is simple as all you need to do is to make a thorough analysis, buy the selected coins and hold them until their price grows. As for day-trading, this type of activity is considered to be much more complex and risky. More detail about associated risks will be given below.

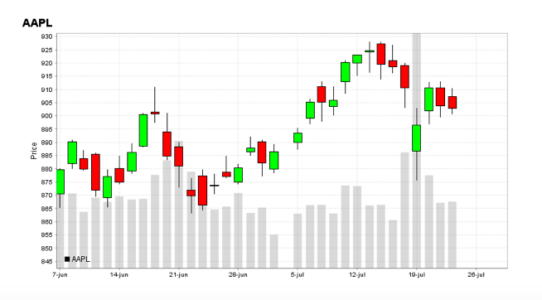

The graphs of price movements contain all the information you need to make the right decision. Learn how to read candlestick charts and to spot signals and trends so as to predict the price movements. Since the signals are aplenty, it worth devoting a separate guide.

You may follow the prices of cryptocurrencies via candlestick graphs provided by the cryptocurrency trading platforms.

While the distribution of cryptocurrencies has grown, many people still consider them too technologically advanced. Trading platforms are changing this perception making buying, holding, and exchanging cryptocurrencies easier. Below we have listed some of the top cryptocurrency trading exchanges and their key peculiarities:

. This is one of the most trusted platforms providing such services as an exchange interface, a wallet, a Coinbase Card, margin trading, and many others. It allows the purchase and storage of Bitcoin, Ethereum, Litecoin, and 30+ other assets without leaving the platform. The exchange secures 98% of digital assets offline, and fiat funds are covered by FDIC insurance. Although it serves 100+ countries, buying and selling are available only in 41 of them including the US. Be aware of the fact that trading on Coinbaise is not anonymous as a user’s name is attached to the account.

. This is one of the top cryptocurrency exchanges with the highest trading volumes supporting 150+ different coins and being the best for altcoin lovers. Verified users can buy crypto for USD, EUR, GBP, and a number of local fiat currencies such as the Japanese Yen and Turkish Lira. Among its payment methods are PayPal and Western Union. The company works across the world including the US. Binance offers a wide range of services: Binance Pool, interest on deposited funds, Binance Visa Card, Crypto Loans, Ethereum 2.0 staking, and yield farming. However, demo trading is not possible. It is worth noting that the company was hacked in 2019 but no successful attack has been conducted since then.

. Coinmama is considered to be a medium-size exchange catering more to big spenders and offering a limited number of assets. In addition to Bitcoin and Ethereum, users can purchase Bitcoin Cash, Cardano, Litecoin, Ethereum Classic, Ripple, and Tezos. All of these coins can be exchanged for US dollars, Euros, GBP, AUD, and Japanese Yen. The fees may not be the best, though. Coins can be bought using bank cards, a bank transfer, or Apple Pay. Coinmama accepts traders from many countries including the United States, Australia, Canada, and United Kingdom. Users mostly complain about the Coinmama identity verification, which is slow and can be rejected without explanations.

. This is a top-rated cryptocurrency trading platform suitable for beginners as well as experienced traders. It offers a choice of 50+ cryptocurrencies, fiat currency trading, and competitive fees. The payment methods include bank cards, Google Pay, and wire transfers. Probably the best thing about Kraken is that it has never been hacked and follows all safety measures. Kraken works with traders from Australia, Canada, United States, United Kingdom, and many other regions. Among its disadvantages are high minimum deposits on some cryptos and slow Pro verification.

. The platform is more suitable for beginner traders. Initially targeting the UK and Europe, it is now allowing traders from the US as well. It offers 50+ assets to buy and sell, a practice trading account, a copy trades feature, investor competitions, and a multi-crypto on-chain wallet. Users can fund their accounts through multiple payment methods which include credit cards, PayPal, China UnionPay, Scrill, Neteller, WebMoney, Yandex, and a bank wire transfer. The platform operates 24/7 but markets are only available when the main markets for that asset are open.

. This platform for margin trading is suitable for both beginners and experienced traders. It supports only five cryptocurrencies, though, which are Bitcoin, Ethereum, Litecoin, Ripple, and EOS, but gives the opportunity to trade major commodities like oil, gold, or natural gas. It is legit but not regulated for now.

The exchange does not provide an option of a demo account, however, it allows opening a live trading account and practice on the platform itself. It offers direct crypto deposits as well as alternative deposits via credit card, bank, and SEPA transfers. All withdrawals are in Bitcoin.

The list of cryptocurrency trading exchanges goes far beyond those that we have listed in this section. You may choose one of the offered options or make your own research based on the aspects discussed in the previous part.

For investors and traders, understanding risk is an integral part of their activities. Below we set out the most important issues that investors should be cognisant of.

The Bitcoin market is constantly fluctuating. Altcoins and some other assets copy its trend so it is not unusual for the token price to jump and fall by 30% in a single day. Under such circumstances, the potential for profit equals the risk of loss. Volatility swings lead to unpredictable prices so traders must be sure that their strategies take into account the uncertainty.

TradingView: Bitcoin price can skyrocket as well as plummet within a single day

Governments or central banks don’t regulate cryptocurrencies, which results in more risk scammers and bad actors. Fake exchanges, wallets, and phishing links pop up like mushrooms in this boisterous industry. Multiple Ponzi schemes offer increased returns for investors but sooner or later they disappear with the invested funds.

The tech-based nature of crypto wallets, exchanges, and trading platforms means they are subject to hacking, cyber thefts, and other malicious activities. Hacking is a serious risk since there is no way to return the stolen coins. Additionally, if you own a wallet and lose your private key or somebody steals it, there is hardly a way to get your coins back.

There are some more sophisticated risks that cryptocurrency traders must familiarise themselves with. They include cryptocurrency hard forks which may cause price volatility, leveraged trading which may lead to great losses, and the absence of physical collateral to back coins up if the system shuts down.

Summing up, it’s worth adding that cryptocurrencies are part of a new industry, which itself is subject to a high degree of uncertainty. The tips below can help you navigate the cryptocurrency market and minimize risks. It is also useful to find out about Crypto geniuses, as you can learn from them.

As cryptocurrencies are gaining more and more exposure, governments and central authorities have started discussing the need to regulate the cryptocurrencies’ taxation. Bitcoin as the cryptocurrency with the highest level of capitalization became the first one taxed in many countries and other assets followed it.

According to the European ISR authority, cryptocurrency is a definitive property that should be taxed. In the US, crypto taxes are based on a 2014 IRS ruling, which determines cryptocurrency as a capital asset like stocks. Each country has its own cryptocurrency taxation rules but some of the requirements are similar. Before you start trading, do research and find out how much tax you’ll have to pay.

Here is a number of common rules about cryptocurrency taxes:

Some aspects may differ for different regions. Make sure you study the rules beforehand so as not to become subject to penalties.

Despite regulatory uncertainty, cryptos have a huge potential and may become an integral part of our daily lives in the nearest decade. Their adoption grows as people use Bitcoin more for purposes other than speculation (e.g. to buy a cup of coffee). Also, many consider Bitcoin a safe haven for long-term storing of value and as a potential shield against inflation.

In this guide, we have provided some basic advice that can serve as the starting point. For more sophisticated trading activities, your experience would be the only advisor.

Crypto trading can be a good idea for some investors due to the potential for high returns and diversification benefits. However, it also comes with significant risks, including high volatility and regulatory uncertainty.

Yes, it’s possible to make money with crypto trading due to the potential for high returns. However, there is also a significant risk of losing money due to the high volatility and unpredictability of the cryptocurrency markets.