by admin

December 12, 2017 Updated February 8, 2024

501

130 votes

Reading time: 14 minutes

It’s estimated that only 10% of traders are profitable (as shown in Larry Pesavento’s book, Trade What You See: How To Profit from Pattern Recognition). The ability to see these winning trades on a social trading platform, and copy these trades, is a complete game changer. In this article, we discuss how social trading allows you to become a profitable trader by replicating the positions of professional traders.

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also. At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. “the platform offers some impressive features but withdrawing money can be difficult.” OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading. Offers multiple asset classes, platforms, and regulated in a variety of regions. Caters for a global audience. Awarded with the Highest Overall Customer Satisfaction Award for 5 years running - Investment Trends CFD Report 2015. XTB is an international online broker helping its users trade a big variety of different assets in one place. This article aims to review this platform in detail, discover its features, pros, and cons in order to help investors make a weighted decision. A standalone copy-trading ecosystem, providing equities, foreign exchange, commodities and cryptocurrencies markets. Provides a global selection of brokerages. Pepperstone is a global regulated broker that provides its clients with the latest technologies for trading multiple assets such as Forex, indices, cryptocurrencies, stocks, ETFs, and commodities. This article provides an overview of its trading platforms, tools, fees, protection measures, and other aspects to help traders make a more informed decision.![]() Best Social Trading Brokers

Best Social Trading Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

Social trading is a trading strategy in which a trader replicates a more experienced trader’s decisions.

The concept of social trading is simple:

Find a profitable trader, copy their trades, and become profitable yourself.

This is particularly helpful for people new to trading – as the ability to make investment decisions based on the investment strategies of more established traders can reduce the risks which are inherent to financial trading.

Essentially, social trading platforms let individuals see the past performance of a particular person, which they can use to try and predict that person’s future results.

Similar to social media, social trading platforms connect like-minded people to share their experiences. This social element to trading also helps traders handle the up swings and down swings which come with trading.

Getting started in the world of social trading is actually quite simple. In fact, there are just three main steps to follow if you want to replicate trade ideas:

Profiting from the financial markets requires a certain amount of expertise. It’s not easy for beginners. In fact, 80% of traders quit within two years of starting.

You need to understand how that specific market works, develop your own winning strategy, and be aware of current events in the financial world – or do you?

This is where social trading comes in. The new phenomenon is perfect for beginners and intermediate traders who want to profit from the endeavours of successful, verified traders.

That said, social trading platforms aren’t only for beginners who want to replicate trade ideas. – professional traders can benefit too, as high-performing accounts can charge a fee for traders to view their trades, or earn commission on profitable trades.

Yes, social trading can be profitable.

Following successful traders high on a social leaderboard means you’ll learn from those who “walk the walk” – and when they profit… so do you.

DISCLAIMER! – and please read this carefully – social trading is not a guaranteed way to make money.

Even professional traders experience losses. Don’t let anyone tell you otherwise – the stock market is volatile and no one can actually predict the future – investment advice is only making the best decision based on the information at hand.

Social trading seems remarkably simple – find the best traders, and then just copy them, right?! The truth is that making money with social trading depends on a number of factors:

Even if you do find the world’s best trader, not using risk-management techniques can result in a loss of money and even blow your account.

You see, the wins come quick, but the losses can build even quicker. It’s a fact of life that all traders encounter drawdowns in their trading career.

As such, there is a realistic chance that a market newcomer copies a successful trader who is just about to suffer a drawdown, which means the market newcomer will experience a losing trade from the very start.

An example of a poor risk-management technique is assigning 90% of your capital to just one trade. In such a case, imagine the market then moving against your trade position – 90% of your total capital is exposed and at risk of being gone forever. To avoid this, diversify your capital among a range of different trade ideas and risk NO MORE than 1-2% of your trading account’s value per trade.

Traditional trading demands technical analysis, fundamental analysis, following a strict methodology and trading discipline, expecting volatility, and a time commitment to learning.

In fact, it’s thought that one needs to practise for 10,000 hours to “master” a skill. This was famously discussed in Malcolm Gladwell’s book, Outliers: The Story of Success. As such, we can’t be surprised that many new traders are searching for a new way to trade.

But is social trading really the answer we’ve all been looking for? Let’s jump into the pros and cons of social trading vs traditional trading.

You know the score… Successful trading strategies are usually kept secret within small groups of wealthy individuals. However, social trading has allowed these strategies to be distributed among a wider pool of traders who work as a collective. Everyone wins. The marker newcomer profits from copying winning trade ideas, whereas the “master trader” diversifies his income through performance-based bonuses.

Traditional trading requires in-depth knowledge that takes years to build. With social trading, you can sit back and profit from professional traders who have already put in the time and effort.

Social trading also serves as a useful reminder that even professional traders experience losses and go into account drawdown. It allows new traders to know what they’re getting into and that losses can be normal.

It feels great to know that you’re not alone on your journey. The social trading community is packed with like-minded individuals that want to see each other succeed. If you scratch my back, I’ll scratch yours…

Analysing the market takes a long, long time. Social trading has birthed a range of apps and tools that can be browsed whenever you have a spare five minutes, even if that’s on the toilet (hey, we won’t judge). These platforms allow any user to access trade ideas from talented professionals that trawl the markets for ten hours a day.

Professional traders don’t lose money, right?! Of course they do. And so do the traders who copy trade them. Copy trading encourages a false sense of security, as the inexperienced trader believes that their money is in safe hands and can’t be lost.

When seeing how much money a professional trader has recently made, it can be easy to assume that free money is on the cards. And who can blame them?! However, this leads to inexperienced traders becoming over-leveraged and taking higher risks.

While social trading allows for less time management, you still have to monitor the traders that you’re following. After all, you’re only as good as the traders you follow.

It’s important to recognise the trading style of the trader you’re following. Is the trader building a long-term portfolio or taking high-risk strategies for quick gains? Finding the answer to this question will allow you to build your own risk-management strategy.

Social trading allows anyone to view and analyse the trade ideas from other traders in the social network, whereas copy trading executes the trades from another trader in real-time.

As you can see, copy trading is just one form of social trading. In fact, you can be a social trader, but not a copy trader.

The real difference lies in who executes the trade. Copy trades are exact copies of other trading decisions, with trades executed in an automated manner. Conversely, social traders view the ideas from other traders, but they make their own decision on whether to execute a trade or not.

Once you’re familiar with how it works, it’s time to start social trading. Simply find a suitable platform, search for traders to follow, and then view their trading performance and ideas. You can then decide whether to use this information for your own trades or instantly replicate their trades with one click.

But wait… read the following rules before using your next paycheck to copy any trader:

When using real money it’s essential to keep the risk small – typically go no higher than 1-2% of your trading account’s value per trade.

Following the above rules will put you in the best position for success. Picking the correct trader is the most important step, so be sure to track their long-term performance by looking at their wins and losses, while also considering the level of risk they’re taking.

The most important factor when choosing a social trading platform is to ensure your money is stored safely. The exact regulation and protection will vary from country to country, but look for platforms that are held to account for their actions.

Once you’ve determined the platform is regulated within the country you live in, make sure it has the features you need, such as:

Many platforms allow traders to copy another trader with just one click. This feature will copy the actions of any trader you choose to follow. When they buy, you buy.

Although similar to copy trading it is slightly different. Mirror trading copies automatic trading software and not humans. An example would be an algorithmic trading program.

You want to know how well the trader is performing in the short, medium, and long term. Not just last year, but you know… in the last few days or weeks. This feature allows you to select traders with the best consistency while avoiding those who may have had a good trading week but a disastrous trading year.

Copy trading is not the only benefit of social trading. In fact, a community is one of the most overlooked features. A vibrant community allows users to discuss trading signals, fundamental news, and risk management – alongside having fun with virtual friends.

Lastly, a super-advanced platform is no good if it’s a struggle to use.

The trading app interface should be user-friendly and not look like the control panel of a spaceship. The market moves quickly, so it should be easy to execute or manage a trade with just one click.

After scouring the seven continents for the best social trading platforms, we have compiled a list of six that get our approval (provided you’re not a US citizen). Read through each bio to find which is the best social trading platform to suits your needs.

Founded in 2006, eToro is an industry-leading company that has social trading at the core of their focus.

As a platform built primarily for social trading, eToro offers an immersive trading experience that promotes connection with like-minded traders. These traders appreciate the user-friendly interface, which makes eToro one of the easiest platforms to use.

In addition, eToro features a range of social features that are unique to the platform. For example, the “feeds” area of the platform allows you to engage with any trader, just like you would on Twitter or Facebook. It goes far beyond standard messaging too, as users can share videos and charts as they go about their daily business.

It’s great that eToro offers their copy trading service to US customers. However, it currently only applies to cryptocurrency assets, such as: BTC, ETH, XRP, ZEC, and ADA – amongst others.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. The Lazy Trader is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. 76% of retail investor accounts lose money when trading CFDs with this provider.

From the AVA Group of companies, AvaTrade is an international forex broker that has been around since 2006.

One of the main reasons why individuals love AvaTrade is due to the number of compatible trading platforms for every experience level. This includes MetaTrader 4, MetaTrader 5, MetaTrader for Mac, and the MetaTrader mobile app.

AvaTrade also offers a range of automated trading tools, such as RoboX, Mirror Trader, MQL5 Signal Service, API Trading, and Duplitrade.

Founded in 2015, NAGA is a Fintech company that offers access to traditional financial markets, along with cryptocurrencies and virtual goods.

Users are attracted to the NAGA Wallet, which offers safe storage of fiat and cryptocurrency assets with a built-in exchange and a gateway to NAGA Messenger for direct trader-to-trader discussion.

Users also have access to the NAGA card, which is a Mastercard that offers 24/7 free and instant withdrawals.

Their social trading capability is built with a proprietary algorithm for finding the top traders to copy on the platform. But perhaps the biggest benefit of the NAGA exchange is the unlimited and commission-free crypto and fiat trading.

Founded in 2005 and regulated by ASIC, MultiBank is a global forex and CFD broker.

Their platform allows users to start trading with just a few simple steps. Benefits include no cap on the number of signal traders that can be copied at the same time.

Users can customise their copy trading strategy by assigning ratios to each signal provider they subscribe to. It also allows for trades to be executed in proportion to the equity of the account that is being replicated.

FP Markets is a global online financial trading platform that offers forex and CFDs trading.

Regulated by ASIC and storing all client’s funds in segregated bank accounts, this is a platform built on trust.

The platform offers an Autotrade tool, which is provided through Myfxbook (considered by many as the “gold standard” for keeping traders fully-transparent when reporting their performance). This allows traders to copy trade via any system in their FP Markets MT4 trading account. This tool also provides real-time statistics, risk-management systems, and the ability to remove and add trading systems at any moment.

With headquarters in Greece, ZuluTrade is a financial company that offers social and copy trading to users from 192 countries.

Users appreciate ZuluTrade’s low minimum deposit requirement, especially those who want to give trading a try for the first time. You can even sign up for their free demo simulation account.

In addition, ZuluTrade makes it easy to choose a signal provider. Simply use their algorithm to rank traders by the factors most important to you, such as:

Overall, users have access to over 10,000 traders from around the world. Simply rank the traders by performance, and then start following the best of the best.

US customers can take advantage of these features too, but on a slightly more limited basis. For example, those using the US platform will only be able to trade one pair at a time, which makes it vital to look for a provider that doesn’t open multiple trades at once, otherwise you will experience different results from what you expected.

Collective2 is a US-based automated trading system with over 78,000 members in their community. It doesn’t require any technical or financial background, and the service has been verified as US-friendly by FINRA.

Collective2 offers two main services: Automatic Trades (ATS) and Social Trading (ST), which are both accessible to members. ATS is a fully automated trading service, while ST allows you to follow and copy trades from other traders in the community. The platform has a built-in chat room where users can discuss their individual strategies or ask for feedback on live trade performances.

Collective2 have a unique subscription structure with three service tiers that are priced according to the amount of strategies you wish to follow. Most users are lured by the Portfolio Plus plan, which doesn’t limit the amount of trade equities, Fixed Income securities and derivatives they can trade on.

The MQL Company is a provider of trading terminals for online forex and cryptocurrency trading. It provides the MetaTrader platform, which has been designed to trade on any regulated market.

As a US-friendly social trading platform, MQL5 is known for its advanced features and great affordability. You can subscribe to automated signals and trading systems through MetaTrader4 or MetaTrader5. It’s easy to set-up a trade system for any of these platforms.

There are many different ways to benefit from having a social trading strategy:

This type of social trading strategy acts as guidance for new traders who want to be nudged in the right direction. The trader can look deeper into the trade tip, where they can decide whether to execute a trade or move onto the next tip.

Copy trading is the act of replicating the trades from another trader in real-time. In essence, your account is tied to the account that you’re copying. You win when they win, but you also lose when they lose.

Copy trading is suitable for those who lack the time or experience needed to research and make decisions of their own. The only requirement is to find a trader that has a strong trading history and one that aligns with what you want to achieve.

The top social trading platforms have communities of like-minded individuals. Not only does this democratise knowledge, but it’s also incredibly enjoyable and becomes a hobby for many.

These platforms give full details on the trader, which allows anyone to see a trader’s basic information, their trading strategy, and their complete trading history.

This involves robots that execute a trade every time the market follows a specific pattern. Unlike other forms of social trading that rely on social interaction with peers, automated trading systems simply execute trades based on a range of previously-set parameters and market conditions.

Automated trading systems are a double-edged sword that carries both pros and cons. They are great for removing the chance of human error, but the lack of human monitoring means there is a higher risk during black swan events.

The World Economic Forum described social trading as a low-cost, sophisticated alternative that allows for maximum control.

Unlike just a decade ago, anyone can now enter and profit from the financial markets using social trading tools. But how can you really take advantage of this new alternative?

Let’s take a look at how to maximise success with social trading:

It’s important to find the most suitable network for your needs. For example, do you want to follow day traders or those building a long-term portfolio?

Those new to social trading should open a demo account before depositing their hard-earned cash.

The first few weeks of your trading adventure will be spent experimenting with different systems and traders. As such, start small to avoid blowing your account.

Going all-in on just one trader or trade idea is a recipe for disaster. Follow traditional trading strategies by diversifying between multiple traders and staying low risk on each trade (1-2% of your trading account value).

The best platforms allow you to keep a close eye on traders, while not executing any trades. Benefits of this include: learning their trading style, their risk appetite, how they handle losses, how transparent the platform is, and ultimately whether they are someone you want to follow.

Some traders love taking big risks, whereas others prefer to play things safe. It’s important to recognise which one you are.

Is the trader using a consistent strategy or are their actions all over the place? Sudden big wins could be a result of a lucky trade.

Does the trader win time and time again? This gives an insight into the likelihood of a trader’s success. A win/loss ratio win-rate above 50% is usually desired.

You can learn about a trader’s consistency by viewing their equity curve, which is generally found on their trading profile. This will show their trading performance over a set amount of time (weeks, months, or years). It’s recommended to follow traders who have been successful over longer periods of time. For example, following a trader with a 25% return over twelve months is a far safer option than following a trader with a 25% return over seven days and only a month’s worth of verifiable data.

Every trader loses, but how a trader handles a loss is what separates the successful from the failure. It’s recommended to see whether the “master trader” experiences drawdowns frequently, how long the drawdown lasts for, how long it takes them to “bounce back” from a loss, and whether they are prepared to stick to their trading strategy.

Getting started with social trading doesn’t have to be a difficult task. You just need to sign up with a good trading platform, find professional traders that represent your trading style, and then use that knowledge to replicate their trades.

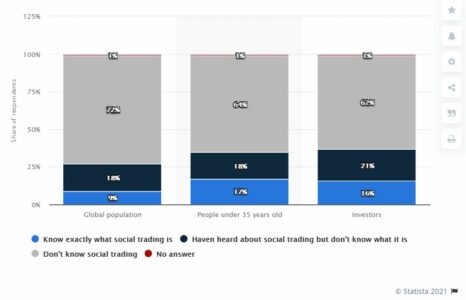

The social trading market is still remarkably young and ready to explode even further. In fact, a 2019 study found that 62% of investors had never heard of social trading.

We need to emphasise that social trading carries the same risks as traditional trading. Losses are waiting for you at every moment. Learning money management is crucial for minimising loss, regardless of whether you’re following the top-performing traders or going it alone. Fortunately, you can turn to the trading community. Oh, or your friends at The Lazy Trader, of course.

An example of a social trade could be a trader who shares their investment strategy or insights on a social media platform like Twitter, LinkedIn, or StockTwits, and other traders follow their lead and invest accordingly.

It is possible to become a millionaire by trading, but it’s essential to understand that trading is not a guaranteed way to become wealthy. Trading involves risk, with zero guarantee that any particular trade will be profitable. In fact, the vast majority of traders lose money – but with the right mindset and practice, yes – people can become millionaires trading.

A social trading broker is a type of brokerage firm that offers social trading as a service to its clients. Social trading brokers provide a platform that allows traders to connect with each other, share information and insights, and even copy the trades of more experienced traders in real-time.