April 20, 2022 Updated October 19, 2023

499

1 votes

Reading time: 1 minutes

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also.

Real estate investing led Scottish-American industrialist and philanthropist Andrew Carnegie to have famously claimed: “Ninety percent of all millionaires become so through owing real estate.”

While the exact percentage is up for debate, Carnegie’s assertion about the wealth-creating potential of real estate is not. Legions of fortunes have been made through real estate investing.

At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

In fact, there’s a well-established connection between the health of a nation’s real estate market and its overall prosperity. In the United States, spending within the housing market alone accounted for 17.5 percent of the nation’s total gross domestic product in 2020. All spending on housing services (which includes rents) came in at a staggering $2.8 trillion dollars for the year.

According to British real estate company Savills, real estate is the world’s most significant store of wealth. In 2020, the worldwide value of real estate soared to a record-high $326.5 trillion. The value of real estate is greater than the combined value of all global debt securities and equities.

Real estate investing is an investment strategy involving the purchase of physical real estate and/or real estate assets. The goal of the real estate investor is to make a profit through the management, ownership, rental, or sale of their investments.

Real estate investing can be direct or indirect. A direct investment involves the investor’s ownership and management of a physical property. An example of this would be the purchase of a residential or commercial property that earns rental income.

An indirect investment, on the other hand, does not require the investor to be actively involved in the ownership or management of a property. An example of an indirect investment would be the purchase of shares in a company that manages or owns real estate.

Some popular types of real estate investments include:

Many expert investors say that an investment in real estate is one of the safest and best investments you can make. They tout the ability to own a tangible asset that provides rental income along with the opportunity for appreciation. Real estate is secured by the real estate itself, whether it be an apartment, retail complex, warehouse, or other building.

Granted, there is no guarantee you will make money as a real estate investor. Values can go up and down rapidly. Case in point is the 2007-2008 financial crisis. This wiped out many investors who did not have the reserves to ride out the crash of the housing market.

Still, those that did have cash reserves had the chance to buy more properties when the prices were low. Over the last decade, they’ve made significant gains as the market rebounded.

The recent overall positive numbers for real estate investing seem to prove enthusiasts right. The National Council of Real Estate Investment Fiduciaries (NCREIF) revealed in a 2021 report that the average 25-year return for commercial real estate investment properties in the U.S. was 10.3%. This slightly outpaced the S&P 500 Index’s average annualized return of 9.6%.

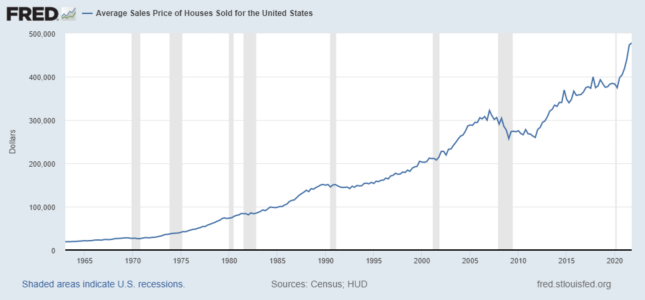

This chart from the United States Federal Reserve depicts the average sales price for houses sold in the U.S. between January 1963 and October 2021. The areas in grey indicate recessions. As you can see, the real estate market consistently rebounds to newer highs even after economic downturns.

Investors often use the equity they have in one property to purchase another. Equity is the property’s current market value minus any liens or mortgages. When an owner has a large amount of equity in a property, they can use that equity to help secure a loan to purchase another property.

This leveraged real estate strategy enables the investor to buy more investment properties with borrowed money. They may end up having very little of their own money in the property itself.

For example, a new investor may use a line of credit on their existing home to fund a down payment on an investment rental property. Of course, this strategy is risky. It puts the investor’s home in jeopardy should the investment property fail to make a profit.

Real estate has many advantages as an inflation hedge. The first is its overall historical long-term appreciation in value. This appreciation can help investors keep pace with high rates of inflation. In some hot markets, real estate appreciation is so great that it will outpace the rate of inflation and outperform other asset classes.

As property prices increase, property owners benefit because this will generally lead to higher rents. Rents are a recurring source of income that can keep investors afloat when other markets—such as stocks, bonds, and commodities—suffer downturns. While asset classes such as stocks can lose all their value and become worthless, it’s rare that this happens to real estate.

Additionally, as property prices increase, an investor’s equity in a property will frequently increase as well. As discussed earlier, many real estate investors tap into their property’s equity to finance other real estate purchases.

Portfolio diversification and hedge against risk – It is generally not closely correlated with other investments, such as stocks, bonds, or commodities. When these markets experience downturns, the real estate market can offer the investor a measure of protection. Because of this, real estate provides the investor with portfolio diversification and a hedge against risk.

Recurring income stream – Both residential and commercial real estate provide investors with a recurring income stream in the form of rents. Through periodic rent increases, the investor can increase their cash flow. If the investor hires a property portfolio manager, this form of income can be relatively passive.

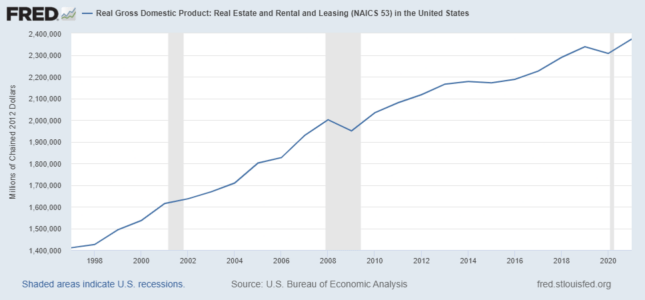

This chart shows the real gross domestic product for real estate (including rental and leasing income) went from about $1.4 trillion in 1997 to $2.4 trillion in 2021. The areas in grey represent recessions.

Opportunity for substantial appreciation – Real estate has a history of gaining value. Many real estate investors will make their decision to buy a property based on the expected cash flow the property will generate through rents. House flippers look for properties they can purchase cheaply. They renovate the property and then put it back on the market for a quick profit.

Tax benefits of owning real estate – In the U.S and UK., there are several tax advantages to owning real estate. These advantages come in various forms depending on which country you are in.

Ability to leverage – As we discussed earlier, investors can use leverage to expand the number of properties they own. This makes it possible to own multiple income-producing properties without having to pay the full price for them in cash.

Not as liquid as stocks – Compared to stocks, it can take a long time to cash out a property. You can buy and sell stocks online in minutes. In contrast, it might take you months or even years to sell your real estate. This can be a problem if you need money quickly.

Time consuming – Investors spend significant time researching a property, doing a cost analysis, and negotiating a contract. Unless you have a property manager, you will spend considerable time on maintenance, bookkeeping, and dealing with tenants.

Can require a large upfront investment – As a stock investor, you can start with a small amount of money. You can begin by buying a single share of an inexpensive stock. Real estate investing, however, is more expensive. Typically, if you invest directly in physical property, the very least you will need is funding for the down payment and financing for the balance.

High transaction fees – Compared to stocks, real estate transaction fees are quite high. Just to close a deal, you will need to pay a variety of fees. These range from agent fees, closing costs, taxes, title insurance, inspections, and appraisals.

Ongoing repair, maintenance, and ownership costs – Once you’ve purchased a stock and paid the share price along with any broker commissions, you can enjoy the benefits of ownership without additional fees.

That’s not the case with real estate. No matter how carefully you choose your property, you will over time have to spend money on repairs, improvements, and day-to-day maintenance. You will have additional ownership costs, such as property taxes, insurance, and accounting expenses.

One of the best ways to get started is by studying the different types of real estate investments. You will want to decide on an investment strategy that makes sense given your situation.

You will want to match your strategy with the amount of money and time you have available for your initial investment. As different investments have different risks, you will also want to consider the amount of risk you’re willing to undertake.

A direct real estate investment will take the most money and time commitment. These are investments that require the investor to own and manage physical properties. Examples are residential rental properties, commercial properties, and house flipping. While the potential for profit can be high, the risk of loss can be high as well.

If you have a small budget and/or limited time, an indirect investment might be a better option. These are ideal for beginners who want exposure to the real estate market without having to own or manage property.

Instead, the investor owns shares of a company that buys and operates properties. The purchase process is simple—like buying a stock. Examples include real estate mutual funds, real estate investment trusts (REITs), and REIT exchange traded funds.

Like all investments, real estate has its share of risks. Here we discuss some of the key risks of investing in real estate.

While leverage can be a real estate investor’s best friend, it has its dangers. One of the biggest risks is the possibility of losing everything if you become overleveraged. If the market declines, you might end up with high mortgage payments that your rental income doesn’t cover. An economic downturn and high vacancies can lead to losses that make it impossible to earn a profit from your multiple holdings.

An example is the financial crisis of 2007-2008 that culminated in the bursting of the housing bubble and a worldwide Great Recession. For years beforehand, banks reduced their mortgage lending standards. They routinely issued subprime mortgages to borrowers who didn’t have adequate income or assets. This availability of cheap money fueled a boom that caused home prices to skyrocket.

Banks repackaged these loans and sold them in bulk to other financial institutions in the form of mortgage-backed securities and collateralized debt obligations. Many borrowers used the availability of low-interest, adjustable-rate mortgages to finance the purchase of investment properties. Their intention was to sell the properties for a profit before the mortgage payments reset at a higher interest rate.

This was a risky bet that didn’t pay off when the housing bubble burst. Home values plummeted. Investors couldn’t sell their properties for what they owed. Nor could they afford to pay their mortgage debt.

They defaulted in droves. Meanwhile, financial institutions were left with trillions of dollars in almost worthless mortgages. During the resulting Great Recession, many people lost their homes, jobs, and savings.

This is one of the biggest risks of real estate investing. When a tenant fails to pay their rent or is late, the owner will still need to pay the property’s fixed expenses or risk losing the property. These expenses include mortgage payments, insurance, and property taxes.

For example, during the global pandemic, many property owners were hard hit by eviction moratoriums. Governments enacted regulations to protect tenants who had lost their jobs from also losing their rental homes.

Property owners were prohibited from evicting tenants who did not pay their rent. This meant huge financial losses, particularly for small “mom-and-pop” owners who relied on rents as their main source of income.

There are many ways rising interest rates can drive property prices and impact investors. For example, investors looking to buy property are keenly aware of interest rates. Unless they are an all-cash buyer, an investor will need to finance their property through a loan. The higher the interest rate, the higher the investor’s monthly mortgage payment.

Thus, a high interest rate can significantly decrease an investor’s purchasing power. An investor may need to reduce the amount they can spend on a property as interest rates increase. Also, as interest rates go up, lending standards will be stricter. It may be challenging for an investor to qualify for a loan.

Conversely, higher interest rates can also impact the investor looking to sell a property. High interest rates have a cooling effect on a hot real estate market. As the cost of borrowing goes up, demand for real estate goes down.

The investor looking to sell their property may be forced to reduce their price to entice a buyer to make an offer. Properties may sit longer on the market. During this time, the investor will still have to pay operating costs. All of this can negatively impact the investor’s profit margin.

One big criticism is that investors push up prices to the point where it becomes unaffordable for locals. That’s exactly what’s happened in Cornwall. Residents there complain they are priced out of home buying and rental markets by investors purchasing second homes.

Deep-pocketed investors outbid locals for the most coveted properties. Meanwhile, these second homes remain vacant most of the year. This only adds to the frustration of locals struggling to find affordable housing.

In an attempt to bring affordability back to their city, the Berlin government introduced rent caps in 2020. The goal was to curtail the activities of hedge funds and private equity firms.

These large investment companies were buying up rentals throughout the city and hiking up rents. The rent-cap measure was short-lived, however. Property investment lobbyists argued against the law. Germany’s highest court eventually overturned it as illegal.

To become an effective real estate investor, you will need to do ample research about your target area and property. Research average rents and vacancy rates for the property and neighborhood. Do an analysis to determine your potential profit margins and return on investment.

Study anything that might affect a property’s value. This includes market trends, crime rates, tax laws, and zoning regulations. Don’t ignore red flags just because a property seems like a great deal.

Buying investment property is a multi-step process. As a beginner, you can easily feel overwhelmed by the complexities of purchasing a property and setting it up as a profitable business. You can minimize your mistakes by leveraging the knowledge of experts in each phase of the project.

Start by finding a broker who specializes in properties in your target area. Over time, you will likely want to add a mortgage specialist, appraiser, building contractor, and property manager to your team.

A direct investment in physical properties is just one way to gain exposure to real estate. This strategy can be time consuming. It will require you to access significant amounts of capital either in the form of personal cash or through borrowing. You will now be a landlord. This has its own set of risks, responsibilities, and occasional headaches.

If you would like some of the benefits of real estate investing without the time and capital commitment, consider an alternative investment. Instead, you can purchase shares of a company that buys, sells, and manages real estate investments. Some of these securities offer the opportunity for dividends along with investment growth. Real estate investment trusts, ETFs, and mutual funds are examples of alternative investments.

You will need a cash reserve to cover those times when your rental income goes down due to vacancies or non-paying tenants. A rainy-day fund is also critical to cover unexpected repairs and other expenses that crop up.

Some experts recommend an investor have at least a three-to-six-month cash reserve to cover operating expenses for each property. However, expenses vary from property to property.

You might want to work with a real estate expert to calculate an ample cash cushion for each property you own. Most importantly, do not be tempted to dip into your cash reserves to fund the purchase of other properties.

Go into your property purchase with clear exit strategies and backup plans in mind. Know upfront whether you intend this to be a long-term or short-term investment. Decide what conditions need to occur for you to sell your property.

Have an investment goal in mind. This could be a target profit or a specific time frame you intend to hold the property. Also, develop backup plans in case the market tanks or for some reason you need to quickly liquidate your investment.

A real estate investment trust (REIT) is a company that invests in real estate assets that produce income. REITs finance, own, and operate office buildings, hotels, apartments, warehouses, storage facilities, hospitals, data centers, and other assets. Investors earn dividends from REITS. You can buy and sell shares of publicly traded REITs on major securities exchanges.

An exchange traded fund (ETF) that holds several real estate investment trusts (REITs) and other real estate investments is known as a REIT ETF. This diversification gives investors a broader exposure to the real estate sector. This helps reduce risk. REIT ETFs passively track real estate indexes. They generally have low expense ratios.

A real estate fund is a mutual fund that only invests in real estate. The fund may invest directly in real estate through the ownership of commercial properties. Additionally, the fund may invest indirectly through REITs and securities offered by public real estate companies.

Investors who have a bearish outlook on the real estate sector will sometimes buy an inverse REIT ETF. These ETFs use derivatives to provide investors with short exposure to a basket of real estate sector securities. The aim is to profit from the anticipated decline in the underlying benchmark’s value. These are highly leveraged and risky investments not recommended for a novice investor.

One of the biggest advantages of real estate investing is the many investment options available. There are opportunities for just about every budget, time commitment, and risk appetite.

Getting into the market can be as simple and inexpensive as purchasing shares of a mutual fund or ETF. Many investors start by buying a second home and renting it out. Some prefer commercial properties such as retail spaces, offices, data centers, and warehouses. Still others focus on crowdfunding or joint ventures. They pool their funds with other investors to acquire large residential and commercial properties.

Given all the options available, you may feel overwhelmed deciding which path (if any) you should take. It can be especially challenging when it appears everyone is making money in real estate.

However, do not let the fear of missing out drive your decision. Instead, be clear about why you want to invest and the resources you have available for your first investment. That way, when you do get started, you will have confidence that you have chosen a strategy that best serves you and your goals.

To determine the value of your investment, you will need to use a real estate valuation method. According to Investopedia, two common valuation methods are the discounted net operating income approach and the gross income multiplier approach. Both approaches help investors estimate how much money their property will generate.

To calculate your property’s discounted net operating income, you will need to subtract all operating expenses from the property’s earnings. Operating expenses are ongoing costs you will incur for running your business.

Some examples include utilities, insurance, management fees, and property maintenance. You will subtract these costs from the revenue you expect the property will generate. If you’re not certain how much income a property will generate, you can use an estimate based on rents of nearby comparable properties.

Alternatively, you could use the gross income multiplier (GIM) approach. This approach looks at the gross income your property generates compared to other properties in the area. Investors often use the GIM to value commercial real estate.

To calculate GIM, first start with your property’s gross annual rental income before the deduction of operating expenses. Be sure to take vacancies into account. For example, if you predict a 10% vacancy rate, deduct this to arrive at your gross annual rental income.

Divide your property’s sale price by its gross annual rental income. This will give you the GIM. This is a rough measure of your investment property’s value. Using historical sales data for your region, you can compare your property’s GIM to that of nearby properties.

It’s not mandatory to use an agent when buying a property. Some experienced investors are comfortable going it alone. However, many investors decide to collaborate with an agent because of the many advantages it brings.

First, as a buyer, you will typically not pay a fee to your agent. The property seller pays agent commissions upon sale closing.

Commercial real estate agents are knowledgeable about market trends for their region. They know which areas offer the best opportunities. They can offer guidance in finding properties that match your budget and investment goals. A buyer’s agent will also help you research potential properties, analyze the pros and cons, and negotiate an offer.

It can be a high-risk proposition to invest in areas away from your home. If you’re unfamiliar with the area, you will face many challenges.

For example, you will need to learn about the market trends in the area, government requirements, and tax regulations. Some lenders place additional restrictions on out-of-area buyers.

They consider them a higher risk and may require a bigger down payment and higher interest rates. You may find it impossible to manage a property long distance. In this case, you will have the added expense of hiring a property manager.

Despite this, some investors find the benefits of out-of-area investing outweigh the limitations. They locate real estate bargains that simply don’t exist in their local market. For them, the potential of a high return on investment makes the risk worth it.

According to legal publisher Nolo, a conservative forecast for real estate return on investment would be an increase of at least 1% per year in appreciation. Some economists say an annual 3% to 5% return is a reasonable expectation.

Of course, there are no guarantees you will ever make a return on your investment property. There are many factors that can help or hinder your investment’s return. These include:

There are many fees you will need to be aware of when purchasing investment real estate. While this list is not exhaustive, here are some typical fees you might incur when purchasing an investment property: