July 26, 2022 Updated 12:00 am

319

1 votes

Reading time: 13 minutes

Your best buy-point for an investment is when it starts to go up after it has been in a downtrend. Learn how to spot “bottoms” in a price pattern so you can buy at the lowest point and make greater profits as prices rise. Understanding the Bullish Engulfing Candle pattern empowers you to buy at the lowest price and reap the rewards.

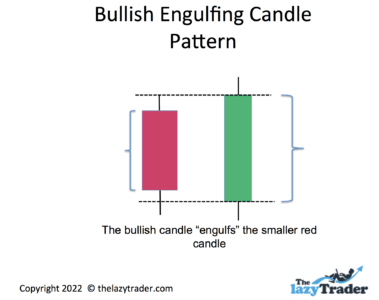

This pattern involves only one day’s trading, as shown in a single candle. You could say it involves two candles since you have to compare it to the previous day’s price action, but the idea is that you can spot a trend reversal in one candle. The body of the bullish candle extends above and below the body of the previous candle. You can buy in, and if the market follows through in the coming days, you will have bought at the beginning of an uptrend. The old saying goes, “buy low and sell high.” This is the “buy low” part.

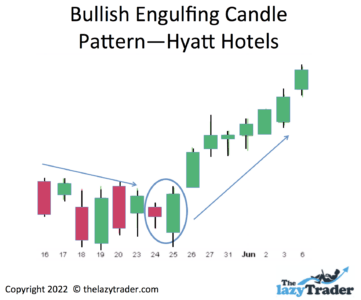

Here you can see a Bullish Engulfing Candle pattern that formed in Hyatt Hotels stock on May 25, 2022. Notice that the trend was up after the bullish engulfing candle.

This pattern can and does work, but no pattern works all the time. The Bullish Engulfing Candle pattern is accurate 48% of the time. That means that when you find a Bullish Engulfing pattern, you should pay attention but also take measures to reduce risk if the pattern fails.

This type of trading is known as technical trading, meaning you study chart patterns to make your investing decisions. This is as opposed to fundamental trading, where investors analyze a company’s profitability, debt, and so forth.

| Technical Analysis | Fundamental Analysis |

|---|---|

| Focuses on chart patterns and technical indicators | Focuses on company financial health, economic trends, and analyst forecasts. |

| Looks for trends. | Looks for company announcements and news. |

| May signal that it’s time to buy based on what other traders are doing. | Signals that a trader should stay in positions if the underlying fundamentals are still good. |

| Signals that it’s time to sell when other traders begin selling more than buying. | A sell signal will consist of dropping company profits or sales, as well as bad economic news. |

| Uses candlesticks to evaluate the price action in a day, week, or longer. | Evaluates profitability and company projections. |

Many traders are adamant about using either technical or fundamental trading. Some fundamental traders frown on technical trading. It can be useful to look at the pros and cons.

Technical traders swear by technical indicators in general and candlesticks in particular. The Bullish Engulfing Candle is one of the most popular patterns.

The Bullish Engulfing Candle lets you see the price action instead of merely imagining it. You can see the open and close of the day and see how those two levels extend above and below the body of the previous day’s candle.

While the Bullish Engulfing Candle is not always effective, many technical traders consider it reliable enough to be worth a look when one forms. This pattern has been in use for a long time.

Most charting services provide candlestick charts where you can spot a Bullish Engulfing Candle pattern. Once you find one, it is relatively simple to understand it. You see that the price reached lower than the previous day and extended higher. Basically, this means traders battled over prices and caused the trading price range to exceed the previous day’s.

Because you can see the price action for the day, you do not have the kind of confusion you would have if you just tracked the numbers on a spreadsheet. The visual aspect of using the Bullish Engulfing Candle pattern makes it simple for even beginners to see through the clutter of all the different prices.

The Bullish Engulfing Candle pattern is not merely about seeing the prices; it is about understanding what people are thinking. It is helpful to tell yourself a story about what you see, such as, “sellers drove the price down, but buyers came in and drove the price back up. There was increased interest in buying.”

Not all is rosy with the Bullish Engulfing Candle pattern. There are some pitfalls to watch out for.

As said above, this pattern is only right about half the time. That is because it is a one-day candle. Some traders like to wait and see if buyers follow through for two or three days. This increases the chances that the new trend will hold.

Because the Bullish Engulfing Candle pattern only lasts a day, you have to be watching that day in order to catch it. The price could zoom up and you would have missed the opportunity.

One reason this pattern can fail is that bad news can cause buyers to change their minds. After all, a single candle is not a trend. If the next day’s news is bad–or even the next week’s–buyers may throw in the towel. The risk of bad news during such a new trend may scare them away.

Some prominent traders “trade what they see, not what they think.” In other words, they are technical traders who follow chart patterns, including the Bullish Engulfing Candle pattern.

Jim Rogers

Rogers was the head of Rogers Holdings, and he had gains of 4200% when technical indicators helped him predict a bull market for commodities in the 1990s.

Steve Nison

Nison introduced candlestick trading to the West. He began focusing on technical analysis some 30 years ago at E.F. Hutton. He has used candlesticks-including the Bullish Engulfing Candle pattern–to decide when to buy into the market.

Jack Schwager

Currently, Jack Schwager is considered a successful technical analyst. HIs book Market Wizards provides guidance on using the Bullish Engulfing Candle pattern.

Sudarshan Sukhani

He has demonstrated expertise in technical trading, which includes the Bullish Engulfing Candle pattern. He’s president of the Association of Technical Analysts.

Munehisa Homma

The most famous candlestick trader Munehisa Homma actually invented them. In today’s U.S. dollars, he made $10 billion in profit. In 1775, he published The Fountain of Gold — The Three Monkey Record of Money. This was a guide to candlestick trading

There is only one type of bullish engulfing candle pattern. It varies in size–how high the highs are and how low the lows are, but this doesn’t make a large one better than a small one.

There is a bearish engulfing candle pattern, which you can learn about here.

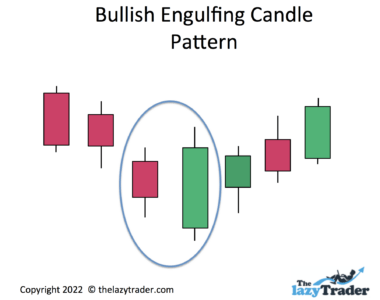

The key to reading a Bullish Engulfing Candle is to watch for a downtrend. At some point, that downtrend may display this candle.

Look for a green (up) candle whose body is larger than the body of the previous day’s candle. This is what is meant by engulfing.

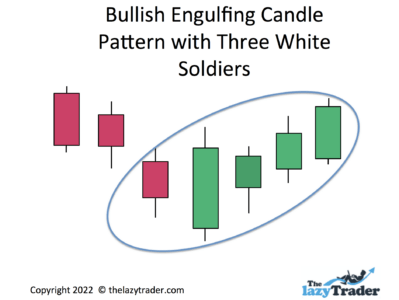

There is a pattern called the Three White Soldiers that can accompany a Bullish Engulfing Candle pattern. Watch the following days to see if the uptrend develops.

ARTWORK HERE

ARTWORK HERE

The Three White Soldiers are three more up days in a row. This increases the likelihood that the uptrend will hold.

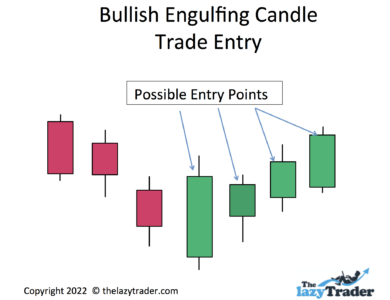

So once you see a Bullish Engulfing pattern, then what? Do you jump right in? There are several ways to buy and sell once you see this candle.

The candle is telling you that buyers won the “wrestling match” or the day, and that may mean they have taken over for good. Make sure you have a strategy in place.

Trade entry

Trade exit

Always plan when you will exit. Choices include:

Trading strategy

It is best to decide on a strategy in advance. Will you always buy on the first day? Will you always wait for confirmation?

However, there can be mitigating circumstances, such as when markets are exceptionally choppy. Remember, you don’t have to buy at all.

Likewise, adopt a selling strategy and stick to it. This will help you avoid emotional selling.

Trade management

In addition to placing stop-loss orders, some traders like to sell part of their position at various levels so they can guarantee some profit while remaining in the position. For example, after a 20% profit, a trader may sell a third of the position. The trader may sell a portion again at a 30% profit, and so on.

There is no such thing as too much education in trading. Here are some suggestions that will help you understand the Bearish Engulfing Candle pattern.

Trade What You See How to Profit from Pattern Recognition by Larry Pesavento

Recognizing patterns is the heart of technical trading, and this includes the Bullish Engulfing Candle pattern. This book helps you identify patterns as they develop and explains how to trade them.

Trading In The Zone by Mark Douglas)

A good source for eliminating bad habits and remaining consistent in your strategy. You learn to trade probabilities and ignore anomalies.

Thomas Bulkowski’s Encyclopedia of Candlestick Charts.

This is a good reference work, so you can look up patterns s needed.

The Complete Guide to Candlestick Charting by Alan Northcott

The book offers strategies that go with candlestick chart reading.

Courses on technical trading almost always include sections on the Bullish Engulfing Candle pattern. Avoid courses that promise outlandish returns.

Udemy Technical Trading

Udemy is a reliable source for quality courses. This is a good place to learn not only about candlestick patterns, but also broader aspects of technical trading, such as moving averages, trends, and how to use daily volume in your considerations.

Travis Rose

Recommended for beginners. Learn the basics of analyzing patterns.

Bullish Bears

Bullish Bears offers learn-as-you-trade skill building. You do not have to trade actual money because you can make paper trades.

Use blogs to stay abreast of current techniques, but also use their archives to learn. Follow the trades a blogger recommends to see how they work out.

Adam H. Grimes

The appeal here is that you can spot patterns in the current marketplace. Grimes walks you through trades.

Top-Down Charts

Learn the relationship between microtrends and macrotrends. The bearish engulfing candle pattern is a microtrend because it occurs on one day. See how it relates to larger trends and market dynamics.

Marc to Market

This is a Forex blog. Technical trading principles apply to Forex just like any other asset.

Forums can be a source for learning from others, but remember that not every trader giving advice is successful.

Elite Trader

Elite Trader provides forums on every trading style, including candlestick trading. Look at the general technical forums, and then explore niches that appeal to you.

Morningstar

You get high-quality input from traders here. Still, remember that not every opinion is reliable.

Look for newsletters from seasoned pros. A good newsletter will give you tips and specific recommendations.

The Technical Indicator–Marketwatch

This newsletter will get you right to the heart of technical chart analysis. You will use current-market setups and follow how they play out.

Trade-Ideas Strength Alerts

Learn about the Relative Strength Index. This vital indicator can help you assess patterns such as the bearish engulfing candle pattern.

Morningstar Investor Newsletters

There is such a wide variety of newsletters here that it is recommended that you focus on your narrow interests before branching out.

Choose a podcast based on the podcasters’ credentials and track record. Make sure the podcast is not merely a sales tool.

Allstarcharts Podcast on Technical Analysis Radio

Here you learn about current patterns that are developing in the marketplace.

Charting Wealth’s Daily Stock Trading Review

This podcast follows the live markets and provides an analysis of what trends are developing and are likely to develop in the following week.

YouTube can be a free-for-all, with many untrustworthy opinions. Choose carefully and ensure that the advice makes sense to you.

Using the Engulfing Candlestick Pattern to Find High Probability Trade Entries–ukspreadbetting

This video walks you through reading and trading the bearish engulfing candle pattern.

The Only Technical Analysis Video You Will Ever Need

This 45-minute video does take you through actual examples of technical analysis.

Webinars can be thinly disguised sales pitches. Make sure you learn nuts-and-bolts information.

Online Trading Academy

A reliable source and a thorough walk-through of technical trading.

Technical Analysis–Fidelity

Fidelity’s webinars are high-quality. Choose the series that explains candlestick patterns.

Cut through all the big promises and contemplate whether technical analysis in general and candlestick trading, in particular, are for you. If you are a fundamental trader, consider using technical analysis in conjunction with your growing skills as a technical trader.

Because the bullish engulfing candle pattern occurs in a single day, you must be prepared to check charts every day.

You must also be willing to take on the risk of a trend reversal. That is, this pattern suggests a new trend, and that is always a risky time.

In addition, be prepared to study complementary patterns that may work well with the bullish engulfing candle pattern.

Do not treat the Bearish Engulfing Candle pattern or any other candlestick pattern as a “get rich quick” gimmick. This pattern is used by level-headed traders who understand that trading is not gambling. Don’t try to “beat the market” or earn bragging rights to boast at parties. Slow and steady wins the race.

Never place more than 1-2% of your trading account value into any single trade. Though you don’t plan to lose, it does happen. So make sure you could only lose a little instead of your entire investing funds.

Start with the strategies and rules in this guide and experience the benefits. Only change your strategy when you have learned more through both study and real-world trades.

We all tend to remember our wins and ignore our losses. Keep a journal. Track how you are doing. Why were you wrong when you were wrong? What percentage of the time are you right?

These platforms will enable you to use candlesticks, including the Bullish Engulfing Candle pattern.

This platform allows traders to communicate like you do on Twitter and Facebook. You can share trading ideas and experiences with other traders. For example through social trading.

Ava offers platforms for multiple experience levels. You can automate your trades and follow expert traders to learn from their insights.

This platform is not available in the U.S. naga allows you to copy the best traders on The platform. You can trade stocks, cryptocurrencies, and Forex across the world.

This forex and CFD broker makes it easy for traders to get started quickly.

FP uses the Autotrade tool, which allows traders to copy trade. It offers live statistics, along with risk-management systems. You can see the entire trading history of the most successful traders and mimic their methods.

The platform allows a low minimum deposit. Those trading for the first time can get started here. A free demo is available.

Candlestick, or Candle – This is a graphic representation of the high, low, open, and close of the day.

Engulfing Candle – A candle “engulfs” another when the body reaches both lower and higher than the previous day’s candle.

Downtrend – Prices slope downward on a chart. This can be interrupted by some up days, but the overall trend should be lower. The longer a trend, the more reliable it is.

Uptrend – Prices generally move upward. This can be interrupted by down days, but you should be able to clearly see a series of rising prices.

Stop-loss – A stop-loss order sells your position automatically if the price drops to a level you have designated. You can choose either an exact price or a percentage loss.

Trend line – This is an imaginary line you draw the line access the lows for an upward trend and across the highs for a downward trend.

Moving average – This is an indicator showing the average price direction over a specified period. Most charts have moving averages.

Gapping Up – This is a sudden surge in a price with no gradual rise. Instead, the asset will open higher with no intervening trades.

Volume – This is the number of shares exchanged each day. Most charts display a graphic representation of each day’s volume. A Bullish Engulfing Candle that has high volume has a better chance of being successful.

Dead-cat bounce – The saying goes, “Even a dead cat will bounce if you drop it from high enough.” What is meant is that an upward reversal of the trend can be fake. Buyers may have come in too soon. The bounce does not sustain itself, and prices continue to drop.

The Bearish Engulfing Candle pattern is easy to spot but harder to trade. There is nothing wrong with waiting a few days to see if prices follow through and keep rising. Do not rely on a single pattern for all your trading decisions. Learn candlesticks and expand your knowledge constantly.

It can be good if you are looking to get into the “ground floor” of a new trend.

What you want to see is a continued uptrend, otherwise called “confirmation.”

They work 48% of the time.

The pattern is powerful in that it can be a sharp change in direction for prices.

Failure is always a risk. Since it is a one-day pattern, traders can change their sentiment the next day and drive prices lower.