December 10, 2021 Updated October 22, 2023

451

1 votes

Reading time: 14 minutes

In this guide, we discuss how investors can use fundamental analysis to discover potentially profitable investment opportunities. Some of the world’s most successful investors—such as Warren Buffett and Charlie Munger—have used fundamental analysis to identify undervalued stocks. This they have achieved long before others recognize their true value. By accumulating buy and hold “hidden gems” when the price is low, Buffett and Munger have made a fortune. This has benefited shareholders of Berkshire Hathaway, their firm. Here we describe the key concepts and strategies that make fundamental analysis such a powerful tool for investors.

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also. At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

Fundamental analysis is an approach to analyzing investments that helps an investor pinpoint assets that might be undervalued. An undervalued asset is one that is selling at a price believed to be lower than its true intrinsic value. Recognizing an undervalued asset is important to investors. It represents an opportunity to buy an investment at a discount. If the price goes up, the investor then has the opportunity to sell their investment for a profit. Investors often use fundamental analysis to help determine if they should purchase a specific stock. There are three layers of fundamental analysis to consider when analyzing a stock as an investment. These are economic analysis, industry analysis, and company analysis.

An economic analysis reviews what is going on in the broader economy that might impact a stock’s value. An industry analysis evaluates the strengths and weaknesses of the industry in which a company operates. A company analysis digs into the nitty-gritty of a company (such as its revenue, profits, and leadership and if there is any creative accounting) to determine if the stock might make a good investment.

To do a fundamental analysis, you will need to review a variety of company metrics and other information. Fortunately, there are some relatively simple steps any investor can take to do this.

This type of company evaluation is called a quantitative analysis. All publicly traded companies have to make their annual and quarterly financial statements available to investors. You can usually find these documents on the “Investor Relations” page of their website.

Look to see if the company is profitable. Review several years’ worth of financial statements. Focus on sales growth, revenue, profits, assets, liabilities, and cash flow.

TIP: Quarterly and annual reports can be long. Do not try to plow through an entire report. Initially, just focus on the financial statement section. This section will have the most important figures you’ll need for your research. If the numbers reveal the company has investment potential, you can then scan through the rest of the report.

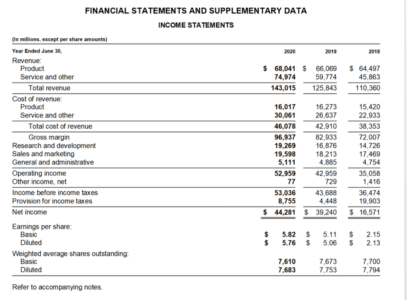

Here’s an example of an income statement from Microsoft’s 2020 Annual Report.

Next, analyze the company’s value based on non-quantifiable information. A qualitative analysis reviews intangible factors. This includes things like a company’s ethics, the strength of its brand. With ESG in focus today, this will also include how it treats its employees and the customer satisfaction level.

Now consider what’s going on in the broader economy and the company’s industry. Consider macroeconomics like inflation, central bank monetary policies, government regulations, geopolitics and supply shortages. Read about demand projections for the products or services in the company’s sector. How could these or other factors impact the company?

Based on your research, you will now need to estimate the intrinsic value of the stock. The intrinsic value of a stock is its true value or what it is actually worth. This value can be different than the stock’s current price.

If your research leads you to believe the stock is overvalued, then that means the stock is selling for more than it is worth. In this case, you would not want to buy the stock. You believe the current price is not justified and you expect it to fall.

However, if your research leads you to believe the stock is undervalued, then that means the stock is selling for less than it is worth. You anticipate the stock price will be higher in the future. An undervalued stock represents a buying opportunity.

Fundamental analysis tries to determine value by weighing all the information in the markets that might impact a stock’s price. It examines everything from a company’s financials to macroeconomic factors to intangibles. Technical analysis, assumes that the factors studied in fundamental analysis are already priced in. This theory is known as the efficient market hypothesis (EMH). EMH states that stock prices already indicate everything known about the stock. Because of this, stocks always trade at their fair value. The technical analyst does not believe that stocks can be overvalued or undervalued.

Instead, technical analysts evaluate investments based on historical price patterns and trends. They review various indicators, including chart patterns, volume indicators, support levels, and resistance levels. The goal is to spot patterns that indicate where a security’s price is headed. Based on these patterns, technical analysts make buying and selling decisions.

In many respects, the differences between fundamental and technical analysis are like night and day. Proponents of fundamental analysis see profit opportunities in perceived gaps between a stock’s current trading price and the price it should trade at if correctly valued.

Meanwhile, technical analysts do not believe in these price gaps. They examine past or current price action as indicators of where future prices will go.

Next, we summarize the pros and cons of each strategy.

Provides a complete picture. A fundamental analysis gives as complete a picture as possible of the factors affecting a stock’s price. It considers the overall economy, the sector, the industry, and the company itself.

Easily accessible data. Much of the information needed to do an analysis is public and quickly accessed through the Internet.

Comparison of multiple stocks. The structured analysis process enables investors to compare multiple stocks to find the best investment choice.

Good for long-term investing. The analysis guides investors to undervalued stocks that tend to do well over time.

Use of objective data. Technical analysis forecasts stock prices using the objective data of price and volume. This data is precise, easily accessible, and not distorted by qualitative factors.

Easy to learn. Compared to fundamental analysis, the technical analysis data set is much smaller. This can make it easier to learn basic concepts.

Available tools. Investors can use free or low-cost tools to create charts and perform an analysis. These flexible tools enable investors to change parameters to identify investment opportunities.

Pinpoint entry/exit. Technical analysis can help investors determine a buy and sell strategy based on predictable patterns. For example, we created this chart using Yahoo Finance. It shows the moving average convergence divergence (MACD) indicator for Apple. The MACD helps identify points in a price chart where the trend might be accelerating. The two lines of the MACD represent two moving averages with different time periods. Technical traders use the crossing of the two lines as an entry signal.

Subjective interpretation. A fundamental analysis may end up being flawed because of the subjective interpretation of factors. Investors can incorrectly interpret qualitative factors, thus distorting the analysis.

Time required. It can take a lot of time to go through all the data for a fundamental analysis. This is often the case if an investor needs to compare multiple investments to make a decision.

No entry/exit data. A fundamental analysis may indicate a potential gap between current price and intrinsic value. However, it does not identify when an investor should enter or exit a trade.

Analysis paralysis. Charts with too many indicators or conflicting indicators can overwhelm an investor. For some, this makes it challenging to make an investing decision.

Incorrect interpretations. While the data in technical analysis is objective, its interpretation is not always. Investors can have varying opinions on how to interpret the data. They can become emotionally attached to their forecasts. If the market moves against them, they can find it difficult to let go of a losing trade.

Not a long-term strategy. Technical analysis can take advantage of short-term swings in price. However, the model does not work as well for “buy and hold” investing.

You are probably familiar with the phrase “buy low, sell high.” This intuitive concept is key to understanding the importance of fundamental analysis. After spotting an undervalued stock, you can make a profit by buying while the price is low and selling when the price moves up.

Fundamental analysis gives investors straightforward strategies and tools needed to analyze a company’s strengths and weaknesses. This understanding can be especially meaningful for investors looking to make long-term investments.

In the next sections, we will review how you can use fundamental analysis to develop an investing strategy. We will explain the three layers of fundamental analysis. We will discuss the differences between top-down and bottom-up analysis. This involves examining tools you can use to complete your analysis. Then, we will review seven quotes from top investors who have used the trading strategy to generate profits.

Investors who use fundamental analysis examine various financial factors to determine an asset’s true worth. These factors represent the three layers of fundamental analysis.

Economic Analysis: Investors look at what is going on in the broader economy that might impact a stock’s value. This includes things like inflation, unemployment, government regulations, and interest rates.

Industry Analysis: Investors then review what is going on in the specific industry in which a company operates. They research the overall strength of the industry as well.

For example, if you are interested in investing in the aerospace industry, you might review reports focusing on aircraft and spacecraft products . You might read forecasts to see if demand is going up or down. And you would probably research recent industry developments affecting aviation manufacturers.

Company Analysis: A company analysis requires you to research and examine basic company metrics. This will be how much money the company is making and if it is profitable.

Additionally, you would want to review the company’s reputation and how effective their management is. You would want to learn how they stack up against their competitors. And you might also want to read what financial analysts are saying about the company’s earnings projections.

Top-down and bottom-up refer to two different ways of approaching a fundamental analysis.

If you opt for a top-down approach, you will start by considering broad economic factors. You might review data related to interest rates, unemployment, gross domestic product, and taxation. You will be interested in what is going on both domestically and globally. Your goal is to assess the overall direction the economy is heading.

Next, based on your macroeconomic analysis, you will drill down into the sectors and industries that offer favorable investment choices. You will want to pinpoint those sectors and industries that should do well in the coming years.

From there, you will want to generate a list of companies within these sectors and industries that are your top investment candidates. These are the companies that will be the focus of your fundamental analysis.

In comparison to the top-down approach, a bottom-up approach reverses the order of analysis. You will start by examining microeconomic factors that exist within your target company. You will study both quantitative and qualitative factors. Next, you will move on to analyze the industry and sector in which the company operates. Lastly, you will evaluate the macroeconomic factors at play both globally and domestically.

To do a fundamental analysis of a company, you will want to review both quantitative and qualitative factors.

Quantitative refers to the numbers that represent a company’s financial performance. These metrics are often found on a company’s financial statements. They are sometimes called key performance indicators (KPIs). KPIs give you an idea of a company’s overall financial health.

According to the Harvard Business School, there are 13 financial KPIs that can help you understand how a company is performing. These include a company’s gross profit margin, net profit margin, working capital, and return on equity.

While a quantitative analysis examines a company’s numbers, a qualitative analysis is more subjective. It looks at intangible factors impacting a company.

This might include such intangibles as the integrity of a company’s leadership or the enthusiasm of its employees. It could encompass the relationships it fosters with vendors and the brand loyalty it’s built with customers.

In this step, you will want to evaluate how the company rates both quantitatively and qualitatively. A good approach is to compare your target company with its competitors. You will want to examine your company’s weaknesses and strengths. Then compare this to other companies in the same industry.

Based on your quantitative and qualitative research, you will need to decide if your target company is fairly valued, overvalued, or undervalued.

If you find the stock is undervalued, you will need to decide if the gap between the current price and the intrinsic value represents enough of a profit potential for you to invest.

IMPORTANT: Remember, a fundamental analysis that indicates a stock is undervalued is an estimation. It is not a guarantee that the stock’s price will increase. The analysis could be inaccurate. In addition, a market correction could occur. There is always risk you could lose money on the investment. For this reason, investors should maintain a diversified portfolio. This could include foreign portfolio investment.

There are many ratios and metrics that investors can use as part of a fundamental analysis. Here are some of the most common ones.

The current ratio estimates a company’s capacity to fully pay its short-term debts using available assets. To calculate the current ratio, divide a company’s current assets by its current liabilities.

This ratio shows the amount in dividends a business pays annually compared to its stock price. To calculate the dividend yield, divide the annual dividends per share by the price per share.

The EPS ratio represents the part of a company’s profits belonging to the shareholder. To calculate basic EPS, divide shareholders’ net income by the weighted average of shares outstanding.

The P/E ratio measures the relationship between a company’s current share price relative to its EPS. To calculate the P/E ratio, divide the company’s current share price by its EPS.

The PEG ratio helps investors see a stock’s earnings potential by comparing price to earnings and growth. To calculate the PEG ratio, divide the P/E ratio by the EPS growth rate.

Operating profit margin is the percentage of profit a company generates from operations before deducting interest and taxes. To calculate OPM, divide the company’s operating profit by its total revenue.

The P/B ratio contrasts a stock’s price with the value of a company if it were liquidated and sold. To calculate the P/B ratio, divide the market price per share by the book value per share.

The debt-to-equity ratio compares a company’s total debt with total shareholders’ equity. Shareholders’ equity refers to the claim owners have on the assets of a company after all debts have been paid. To calculate the debt-to-equity ratio, divide a company’s total liabilities by its total shareholders’ equity.

The dividend pay-out ratio compares the amount of dividends a company pays to shareholders with the company’s net income. To calculate DPR, divide total annual dividends by a company’ s net income. Another method is to divide annual dividends per common share by earnings per share.

ROE helps investors evaluate their investments by measuring a firm’s capacity to convert investments into profits. To calculate ROE, divide a company’s net annual income by its shareholders’ equity.

Some investors use a combination of both fundamental and technical analysis to create a hybrid investing strategy. They will use fundamental analysis to discover stocks with good growth potential selling at a low price. They will then use technical analysis to determine good entry and exit points for their trades. This creates a blended strategy that incorporates the strengths of each technique to help the investor find and execute trades.

Here is our compilation of some of the best investing tips from successful investors who are known for their fundamental analysis strategies.

“…Ownership of stocks is very much a ‘positive-sum’ game. Indeed, a patient and level-headed monkey, who constructs a portfolio by throwing 50 darts at a board listing all of the S&P 500, will—over time—enjoy dividends and capital gains, just as long as it never gets tempted to make changes in its original ‘selections.’”

—Warren Buffett, CEO of Berkshire Hathaway, 2020 Shareholders’ Letter, page 12.

“I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than when they got up and boy does that help—particularly when you have a long run ahead of you.”

—Charlie Munger, Vice Chairman of Berkshire Hathaway, USC Commencement Address

“Never is there a better time to buy a stock than when a basically sound company, for whatever reason, temporarily falls out of favor with the investment community.”

—Geraldine Weiss, co-founder of the investment advisory service, Investment Quality Trends, and author of Dividends Don’t Lie: Finding Value in Blue-Chip Stocks

“The trick is not to learn to trust your gut feelings, but rather to discipline yourself to ignore them. Stand by your stocks as long as the fundamental story of the company hasn’t changed.”

?Peter Lynch, former manager of the Magellan Fund, Author of One Up On Wall Street: How To Use What You Already Know To Make Money In the Market

“I’ve passed along the same advice that I was given when I was a kid: Be cautious with leverage. What I mean by leverage is buying assets with borrowed money… When the stock market and real estate prices are going up, leverage can seem like a sure way to boost returns. But when the bull market eventually stalls, as it always does, then too much debt can quickly overwhelm an individual’s personal finances, just like it does with a company’s balance sheet. ”

—Abigail Johnson, Chairman and CEO of Fidelity Investments, The Wall Street Journal, “Just Starting Out? Here’s Money Advice From the Pros”

“As parents we are often afraid to talk to our children about money. We actually rank it behind talking to them about sex and drugs because we have a lot of money fears. What I challenge parents to know is that whatever money issues you have, I promise you, you are passing them onto your child because that’s the way we learn. We watch and observe… Do you max out your credit cards? Do you buy things you shouldn’t or make impulse purchases? All of those things are being taught subconsciously to your children.”

— Mellody Hobson, co-CEO of Ariel Investments, as quoted from Yahoo Finance Influencers Video Series

“The investor with a stock portfolio of sound stocks should expect their prices to fluctuate and should neither be concerned by sizable declines nor become excited by sizable advances… He should never buy a stock because it has gone up or sell one because it has gone down. He would not be far wrong if this motto read more simply: Never buy a stock immediately after a substantial rise or sell one immediately after a substantial drop.”

—Benjamin Graham, The Intelligent Investor

One trait common among many successful investors is their ability to keep calm during market sell offs. This is especially the case during market crashes. As Warren Buffett so famously points out, be “fearful when others are greedy, and greedy when others are fearful.”

Of course, remaining calm and continuing to invest wisely during a bear market can be challenging even for the most contrarian investor. This is where understanding fundamental analysis can be beneficial.

During market meltdowns, the method helps direct the investor’s attention to study the true value of an investment. This is rather than focusing on the temporary gyrations of a market under turmoil. Learning how to spot bargains, act upon the information quickly, and execute trades with an eye toward long-term growth are critical for investors looking to reap the rewards of fundamental analysis.

Typically, value investors use fundamental analysis to focus their attention on undervalued companies. Value investors look for stocks that sell for less than their book value. They shop around for those investments that are selling at a discount and scoop them up.

Value investors believe different factors can cause a stock to sell for less than its true worth. For example, market overreaction to perceived bad news could cause a stock to plummet. For the value investor, this overreaction represents a key buying opportunity.

Benjamin Graham is widely acknowledged as the father of value investing. He is seen as one of the key figures that advanced the core principles of fundamental analysis. Born in London in 1894 and educated in the U.S., Graham launched his career on Wall Street in the 1920s.

He witnessed firsthand the devastation caused by the stock market crash of 1929. The huge losses he experienced galvanized his resolve to develop a better system for securities analysis. This was one that would center on calculating the true value of a stock independent from its market value.

Security Analysis, written by Benjamin Graham and David L. Dodd in 1934, is the classic book that introduced the world to value investing. Fundamental analysis proponents consider the book an indispensable primer on investing.

The Intelligent Investor: The Definitive Book on Value Investing is Graham’s 1949 follow-up book to Security Analysis. Warren Buffett describes it as “by far the best book about investing ever written.” In the book, Graham introduces investors to the fickleness of “Mr. Market.” This now-famous allegory highlights the importance of doing one’s own research.

In fundamental analysis, understanding a company’s business model, competitive advantage, and growth strategies is crucial. Analysts use tools like discounted cash flow (DCF) to predict future earnings and check if the stock’s current valuation reflects its potential.

Macroeconomic indicators, including GDP, interest rates, and inflation, are key in fundamental analysis. They offer insight into the economy’s health, influencing price movements and market volatility. A rising GDP, for example, may suggest a bullish market and potential earnings growth.

Individuals can perform fundamental analysis independently using publicly accessible data like annual reports. However, this requires a strong understanding of financial markets and in-depth research into economic indicators, financial statements, and company data.