September 6, 2022 Updated October 23, 2023

308

1 votes

Reading time: 1 minutes

Knowing when a declining stock is reversing gives you an opportunity to buy and profit. But it can take a lot of courage to buy a stock that has been going down in value. It turns out that you don’t need courage; you kneed knowledge. The Three White Soldiers chart pattern signals that an uptrend may be beginning. Learn how to identify and trade this pattern.

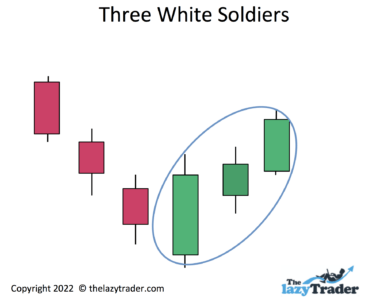

The Three White Soldiers candlestick pattern is a series of three upward candles at the bottom of a downtrend. They indicate that buyers are taking over and sellers are through selling for a while. This pattern suggests that prices will rise and start a new uptrend.

Here you can see that the downtrend has ceased, and momentum is building for an uptrend.

You must realize that no candle pattern or other technical indicator works all the time. But the Three White Soldiers pattern works 82% of the time.

It has high reliability because it is made up of three candlesticks. That means you look at the trading activity for three days and can confirm the new direction because there is follow-through. Buyers drive prices up on subsequent days, which suggests the pattern may have staying power.

When you use the Three White Soldiers pattern, you are using stock charts. Trading based on charts is called technical trading. Here is how technical trading differs from fundamental trading.

| Technical Analysis | Fundamental Analysis |

| Uses chart patterns and technical indicators. | Focuses on company finances and economic trends. |

| Looks for trends, reversal patterns, and trading volume. | Evaluates company announcements. |

| Determines buy signals related to what other traders are doing. | Suggests a trader should stay in positions if fundamentals are good. |

| Watches for formations that indicate sellers are taking over. | Signals a sell if profits or sales drop. |

| Uses candlesticks to understand price action. | Looks at profitability and seeks consensus on company projections. |

This pattern is worth your attention but is not a perfect predictor. Understand the plusses and minuses of using it. Here are some pros and cons of using the Three White Soldiers pattern.

The Three White Soldiers pattern is an unmistakable formation that lets you objectively identify price action problems. The fact that it is easy to spot helps you sort through the emotional judgments you might otherwise have if you simply saw a report saying the stock had gone up.

The Three White Soldiers pattern has a long history and has been used effectively by traders. Understanding that history can give you confidence in trading this formation. It has a high success rate that has been well-established.,

Charting sites routinely offer candlestick charts. These charts make it easy to see the price action over a period of days to years. The Three White Soldiers pattern is easy to comprehend because it is an upward march.

Helps to provide clarity. You can’t remember endless figures. But when you look at a candlestick chart, you can see the patterns of those numbers. With candle charts such as the Three White Soldiers pattern, you can see patterns developing.

The Three White Soldiers pattern tells you what traders are thinking. It can tell you a story: “Buyers have started pouring into the stock as fewer sellers want to get rid of shares. This is driving the price up because there is more competition to buy.

Think of the Three White Soldiers as a suggestion. Never assume any pattern is a sure thing. Here are some negatives to watch for.

Another way of saying the Three White Soldiers is reliable 82% of the time is to say it is wrong 18% of the time. Always protect yourself from losses. Any trade can go wrong. Trading is not exactly a science; it is usually an informed guess.

It tends to be visible only in a short timeframe. You can see this pattern form over a period of three days. That is the prime time to get into it. If you miss those three days, you can still buy into the uptrend, but you will make less profit since it has already risen.

A Three White Soldiers pattern can fall apart in the face of sudden bad news. Recent buyers may abandon their optimism and sell their positions, driving the price down.

Almost any trader who uses candlesticks will use the Three White Soldiers. They are trained to “trade what you see, not what you think.” That means do not guess; let the patterns tell you what is happening.

Here are some traders who use candlesticks and are likely to use the Three White Soldiers.

Thomas Bulkowski – is known for his use of candle patterns, and this is likely to include the Three White Soldiers formation.

Steve Nison – While at E.F. Hutton., Nison became known for introducing candlestick trading to the Western hemisphere. He was familiar with the Three White Soldiers.

Jack Schwager – Wrote a book called Market Wizards that talks about using the Three White Soldiers.

Sudarshan Sukhani – President of the Association of Technical Analysts, uses the Three White Soldiers.

The pattern can be interrupted temporarily and still be a good indicator. The three upward candles may have a downward day in the middle. That’s okay, but you must see the Three White Soldiers within one week for it to be reliable.

Any downtrend will reverse at some point, except for failing companies. When following a healthy company, look for a big up day. This will be a candle whose body is larger than the one before it. This is your signal to pay attention. Watch for confirmation over the next two days.

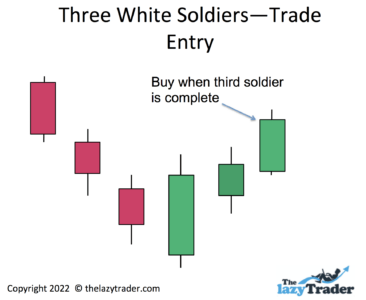

When you look at a completed Three White Soldiers pattern, you have the advantage of hindsight. It is best to wait until near the close of the third day and buy at that point if the pattern has fully formed.

Create a strategy long before you spot such a pattern. Stick to the strategy that makes the most sense for your situation.

Do not sit and watch for a pattern and then get excited and buy. Have a strategy in place. For example, you may be tempted to jump in on the second day when you see a potential Three White Soldiers formation. Stick to your strategy, and do not let emotions rule.

The close of the third day is the best time to trade this pattern. You have confirmation as the third “soldier” falls into formation. A down day on the fourth candle does not mean the pattern has failed. Just make sure there is not a drop below the price of the first candle in the Three White Soldiers pattern.

Always be ready to change your mind. If prices drop dramatically, sell and protect your investment dollars. If you are unsure, consider selling a percentage of your position. Otherwise, hold your position until you see a reversal pattern that suggests prices will drop.

Your strategy must reflect your risk tolerance. If you are using retirement money or can’t afford to lose much, create a strategy that reflects that. On the other hand, if you have a 10-year time horizon, you might be more patient with the up and down zigzags.

Watch the aftermath of the pattern to see if it goes against you. Give it a week to make sure it is holding up.

Your strategy should include learning–about candlesticks, technical trading, and reversal patterns. Here are some ideas.

Trade What You See How to Profit from Pattern Recognition by Larry Pesavento

Recognizing patterns is an essential part of technical trading, and this includes the Three White Soldiers. This book explains how to trade them.

Trading In The Zone by Mark Douglas)

This is an excellent source for eliminating bad habits and creating sound strategies. You learn to trade probabilities and ignore anomalies.

Thomas Bulkowski’s Encyclopedia of Candlestick Charts.

This reference work helps you can look up patterns as needed.

The Complete Guide to Candlestick Charting by Alan Northcott

You’ll find strategies that go with chart reading.

Candlestick Trading for Beginners: A Comprehensive Beginner’s Guide to Learn about Candlestick Trading by Edward Jones.

This comprehensive guide will get you started if you are just starting to learn about candlesticks.

Courses on technical trading almost always include sections on the bearish engulfing candle pattern. Avoid classes that promise outlandish returns.

The Candlestick Course by Steve Nison, William Sarris, et al. Nison brought candlesticks to the West and is considered an expert.

This is a good place to learn about candlestick patterns and broader lessons in technical trading.

Travis Rose – Travis rose is recommended for beginners. Learn to analyze patterns.

Bullish Bears – Bullish Bears offers hands-on skill building. You can make paper trades.

Use blogs to stay abreast of current techniques.

Adam H. Grimes – Grimes shows you how to spot patterns.

Top-Down Charts – Learn microtrends and macrotrends. The Three White Soldiers pattern is a microtrend. See how it relates to more significant trends and market dynamics.

Marc to Market – This is a forex blog. Technical trading principles apply to forex, so this is worth a read.

Forums can be helpful, but remember that not all traders giving advice are trustworthy.

Elite Trader – Elite Trader provides forums on candlestick trading.

Morningstar – This is a place for quality input from traders.

Look for newsletters from seasoned pros with a published track record. Expect timely tips and specific recommendations.

The Technical Indicator–Marketwatch

This newsletter will get you deep into technical chart analysis. Use current-market set-ups and follow their development.

Morningstar Investor Newsletters

There is such a wide variety of newsletters here that it is recommended that you focus on your narrow interests before branching out.

Choose a podcast based on the podcasters’ credentials and track record. Make sure the podcast is not merely a sales tool.

Allstarcharts Podcast on Technical Analysis Radio

Here you learn about current patterns that are developing in the marketplace.

Charting Wealth–Daily Stock Trading Review

Follow current market conditions and analyze weekly.

YouTube has a lot of fake gurus. Research the background of anyone giving trading advice there.

“Three White Soldiers Pattern” by Mind Math Money can get you started trading the Three White Soldiers. This presentation is short but thorough.

“Bullish Three White Soldiers-Bearish Candlestick Pattern” by UKspreadbetting walks you through trading this formation. This is a reliable company.

Webinars can be thinly disguised sales pitches. Make sure you learn nuts-and-bolts information.

Online Trading Academy – This quality resource leads you through technical trading techniques and indicators.

Technical Analysis–Fidelity – Fidelity’s webinars are trustworthy. Choose the webinars that explain candlestick patterns.

This pattern is quite popular, but that doesn’t mean it appeals to all. You may be uncomfortable trading dramatic reversal, for example. Make sure you know your trading personality.

You must be willing to pay attention daily. When you see the Three White Soldiers pattern forming, check the action a couple of times per day. If you purchase, keep an eye on how the chart does. You should see a clear uptrend.

Manage your expectations

The Three White Soldiers is not a trick to beat the market. Create a slow approach to building profits.

Only place 1-2% of your investment money into a trade. Even if your judgment is wrong, you will live to fight another day.

The Three White Soldiers is reasonably reliable. Trade it the way this guide has laid out and stick to your approach.

Review your trades weekly and monthly to see how you are doing.

Many platforms offer candlestick charts. Here are some reliable ones.

This platform allows traders to communicate as you do on Twitter and Facebook. You can share trading ideas and experiences with other traders. One useful feature is the ability to examine professionally managed portfolios.

Ava offers platforms for multiple experience levels. You can automate your trades and follow expert traders to learn from their insights.

This platform is unavailable in the U.S. naga allows you to copy the best traders. You can trade stocks, cryptocurrencies, and forex across the world.

This forex and CFD broker makes it easy for traders to get started quickly.

FP uses the Autotrade tool, which allows traders to copy trade. It offers live statistics, along with risk-management systems. You can see the entire trading history of the most successful traders and mimic their methods.

The platform allows a low minimum deposit. Those trading for the first time can get started here. Free demo available.

1. This pattern only works after a downtrend. The longer the downtrend, the better, because it will be more likely to reverse.

2. Don’t panic sell. Trust the pattern long enough to see if it follows through. Buyer’s remorse can cheat you out of profits. Set a level at which you must sell to avoid losing your original investment, and stay put as long as prices don’t hit that level.

3. Consider easing into the trade. Put a third in each time as your confidence in the uptrend grows.

4. Check the news about the company regularly to see if anything may disrupt the pattern.

5. Take profits on the way up. Many traders sell a portion of a position that has done well so they have guaranteed profits in hand.

Confirmation – When the days following a reversal move in the direction that the reversal suggests. Days two and three of the Three White Soldiers pattern are confirmation days.

Candlestick, or Candle – This visual represents the high, low, open, and close of the day or week for any asset.

Bullish Engulfing Candle – candle “engulfs” another when the body reaches both lower and higher than the previous day’s candle. If the first candle of the Three White Soldiers pattern engulfs the previous day’s, it is a Bullish Engulfing Candle. That makes the pattern a powerful indicator and suggests that an uptrend is coming.

Uptrend – Prices tend upward for days, weeks, or months.

Downtrend – Prices slope downward on a chart for days, weeks, or months.

Gapping UP – This is a sudden rise in a price with no gradual uptrend. Instead, the asset will open higher with no intervening trades.

Trend line – This is an imaginary line you draw the line access the lows for an upward trend and across the highs for a downward trend. Drawing this line will help you identify the necessary downtrend before the Three White Soldiers and the uptrend that may follow.

Volume – This is the number of shares exchanged each day. A bullish Three White Soldiers pattern with high volume has a better chance of success.

Top – A “top” is the highest point an asset has reached in its current uptrend before turning downward.

Bottom – A bottom is the lowest price followed by an uptrend. It is not the lowest price the asset has ever reached, just the lowest price before an uptrend began.

Look for a Three White Soldiers pattern as you watch a long downtrend – “long” as in weeks or even months. When you see this reversal formation, get ready to buy. You will be more successful than traders who wait for a “buzz” about the stock in the news. Take your time, study the chart, and make your move in a level-headed manner.

This pattern successfully predicts a reversal from a downtrend to an uptrend around 82% of the time. T

The pattern is bullish, meaning traders expect it to go up in price.

Watch for prices to fall and get in near the bottom of that decline. Look for a bullish reversal pattern such as the Three White Soldiers as a sign to buy.

Candlesticks were initially named after war terms. In addition, an “up” candle is often white. Think of marshaling your troops to charge onward and upward.

It can be wrong. This can occur when the economy is choppy, the markets are unsteady, or a company has financial difficulties.