October 11, 2022 Updated October 22, 2023

254

1 votes

Reading time: 1 minutes

Learning how to trade the Morning star pattern can improve your success in investing. This pattern is one of several candlestick patterns you can see on a price chart. Once you learn to recognize it, you will be able to anticipate when prices will reverse course and rise.

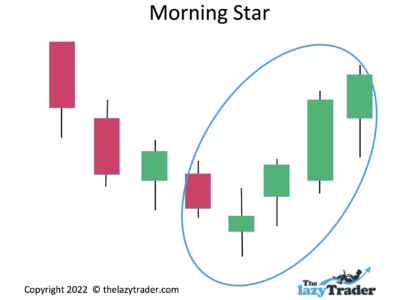

This pattern forms over a period of one to four days and occurs after prices have been in an extended downtrend. It signals a possible reversal in price direction, meaning prices may be about to rise and start a new uptrend.

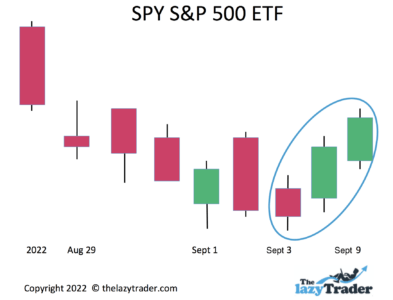

Here is an actual Morning Star pattern that occurred in the S&P 500 in Sept. of 2022

The Morning Star is considered one of the most reliable patterns in trading. It is accurate between 70% and 80% of the time.

Trading patterns are part of technical trading. This type of trader watches charts for signals about price action. A fundamental trader examines a company’s sales, profits, growth, and other factors to decide whether to invest.

Fundamental analysis means examining the company’s past, present, and future. A fundamental trader would look at past growth, current debt, and sales projections. He would also evaluate management and look at how the company is doing against competitors.

The most notable fundamental trader is Warren Buffet. He examines company fundamentals and looks for “value stocks”-those below fair value.

Technical traders won’t ignore a company’s health, but they focus on price momentum and reversals. Certain patterns have been proven to predict the near future of prices, and technical traders follow those trends.

Candlesticks are a visualization of price action, represented by a drawing that shows the open, close, high, and low for any asset. Technical traders use these candlesticks to evaluate price patterns. A word about the reliability of the Morning Star pattern: the pattern is not 100% reliable.

Evaluate the pros and cons of using the Morning Star before you decide to use it.

The Morning Star pattern eliminates the need to fret and guess. When you see the pattern, it’s to evaluate your decision on whether to buy.

The Morning Star has been in use for centuries. It is tried and true and will continue to be used for a long time to come.

You do not have to search widely for a charting service that shows candlestick representations. Most chart sites offer candlesticks. You can read candlesticks easily on these sites, with little instruction.

Seeing a picture of what is happening to prices beats hearing or reading about it. You can see how prices behaved and do not have to imagine what happened.

You can see what people are thinking. For example, you might realize that buyers thought the price would go up, but sellers decided to take profits, and their selling drove the price down. You can see a consensus developing.

Though a Morning Star pattern has high reliability, it can fail. Never pile into a trade just because you see an indicator. This pattern can and does fail.

The Morning Star may indicate that an upward trend is possible, but it cannot tell you how long that trend will last.

Companies can make surprise earnings announcements, report a bad debt, and release news that CEO is leaving. These and other events can make the Morningstar Pattern fail as fundamental traders take over.

Charles Dow – is credited with formalizing and spreading technical trading. He helped create the Dow Jones Industrial Average, which is cited daily as an index for the market.

Jack Schwager – is considered a prominent modern user of technical analysis. HIs book Market Wizards provides guidance on using the patterns such as the Morning Star.

Sudarshan Sukhani – is the president of the Association of Technical Analysts and is considered an expert in technical analysis.

Robert Rhea – wrote the book The Dow Theory, which explains the foundations of technical trading.

William P. Hamilton – used technical analysis to predict the 1929 stock market crash.

John Magee – wrote Technical Analysis of Stock Trends. Though the above pioneers helped create technical analyses of the markets, Magee was the first person to make trades based only on stock prices and patterns. The Morning Star pattern figures prominently in his analysis.

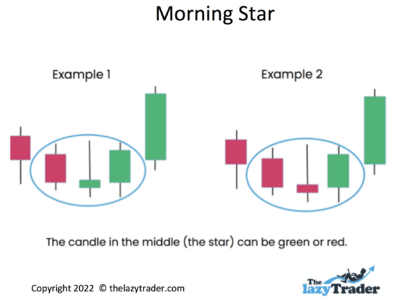

A Morning Star may have either a red or a green candlestick at the lowest point of the pattern.

First, look for an extended downward trend. The first candle in the Morning Star is a downward or red candle. Then you see a red or green candle showing that he price action didn’t change as much that day. The third candlestick is green, meaning buyers jumped in and drove the price up. If that is followed by another green candle, you have even stronger confirmation.

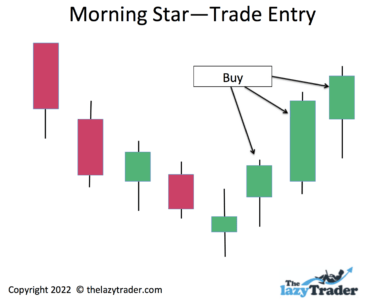

A full morning star requires two to three days of follow-through to complete. Your risk goes down with each day you wait.

When you see the Morning Star forming, enter the trade the day after you are convinced.

You have a few ways to plan to exit the trade.

You can (and should) place a stop-loss order that will trigger a sale. Consider placing a stop-loss order at the stock’s low when it formed the Hammer. Setting it too close to the current price could cause it to sell during normal fluctuations in price. This is known as “getting stopped out.”

If you start to see profits building, consider a trailing stop-loss order. You select a percentage for this type of order. As your price moves up, the trailing stop-loss order moves up with it so that you always have the same percentage you are willing to lose.

If all goes well and you are making profits, your exit strategy can be to hold the stock until you see a reversal pattern that suggests it may come back down.

You should have a strategy, and that strategy should be based on your risk tolerance. If your plan is to take on as little risk as possible, you will want to wait until the second follow-through day. If your strategy is to take high risks in anticipation of high rewards, you may want to get in on the first day.

In addition to setting your automatic stop-loss orders, you should be prepared to make changes to the trade. Some people sell partial shares to take profits as prices rise so that they lock in profits.

You may want to reinvest any dividends you receive. And you may want to sell early and move your funds to a more attractive opportunity. The point is that you must manage the trade as long as you own the asset.

The Morning Star pattern is one of many tools technical traders use. You can learn more about it through sources that deal with technical trading. Learn how patterns work, including the Inverted Hammer, so you will understand the context for using that pattern.

You will need to learn about candlestick trading. This is a graphic representation of prices, as seen throughout the images in this guide. Here are some learning sources to get you started.

Trade What You See How to Profit from Pattern Recognition by Larry Pesavento

This is a book to help you recognize patterns in charts. It is especially useful for learning to find patterns while they are developing instead of merely identifying them after they have developed.

Trading In The Zone by Mark Douglas)

This book on general trading principles covers things like eliminating bad habits and remaining consistent in your strategy. It shows how to trade probabilities and ignore anomalies.

Market Wizards: Interviews with Top Traders by Jack Schwager

The interviews in this book allow you to get inside the heads of successful investors. You learn not only their techniques but also their mindsets.

Technical Analysis of Stock Trends. By John Magee.

Here you will learn about technical analysis as well as strategies and tactics for using technical indicators

You will find some excellent trading courses online but remain aware that some “courses” are come-ons that give you a little free information but charge you extra for the in-depth stuff. Here are some reliable ones.

Trading with Rayner

This course focuses on the Morning Star pattern in class #11.

Udemy Technical Trading

Udemy offers a comprehensive guide to all aspects of technical trading and is a reliable source for valid information. Though they promote their own courses as part of this course, you won’t get come-ons to draw you into long-term commitments.

Travis Rose

This is a good place for beginners to start. Rose covers all the basics and leads you through analyzing technical patterns.

Bullish Bears

A learn-as-you-go approach works well at Bullish Bears. You build your skills systematically while actually trading. You can elect to make practice trades with no actual money invested.

Blogs can be good if they are offered by a pro with a track record. Look for blogs that walk you through various technical setups in the actual market. Keep score and see how often the blogger is right. Anyone can start a blog, so look for those associated with a recognized expert.

Here are some to look at:

Morning Star Pattern: A Great Way To Identify Bullish Reversal

This blog entry by Day Trade the World takes an in-depth look at the Morning Star pattern and how to trade it.

Understanding Morning Start Candlestick Pattern by

Adam H. Grimes

Grimes has more than 20 years of experience and covers all types of trades, from breakouts to reversals of trends. His posts walk you through trades and keep you abreast of trends in the current marketplace.

Be aware that forums allow anyone to express an opinion. Take all advice in stride, as you don’t always know the credentials of the poster.

Some popular ones:

Traders Laboratory

Forum members discuss all aspects of technical trading. You can start threads about the Morning Star pattern.

Elite Trader

Elite Trader offers forums on every type of trading style and approach. It is a good idea to join discussions that may be outside of your current interests so you can learn about various methods. Look at the general technical forums first, and then launch into technical forums on stocks, Forex, commodities, etc.

Morningstar

Morningstar forums have some quality input from experienced technical traders. You will not find any wild observations or insights here, but keep in mind that not everything in a forum is reliable.

Look for newsletters from seasoned pros. A good newsletter will give you tips and specific recommendations.

The Technical Indicator–Marketwatch

Here you will find in-depth chart analysis. This is the most helpful way to learn because each newsletter uses current technical setups. You can see actual patterns developing in the marketplace, including the Morning Star pattern.

Trade-Ideas Strength Alerts

The focus is on the Relative Strength Index. This index alone can show you reversal points and entry points. The strength alerts in this newsletter are invaluable for anyone wanting to use technical analysis. This is good for learning how the Relative Strength Index can work with the Morning Star pattern.

Morningstar Investor Newsletters

There are a variety of newsletters here to choose from. Select those areas of technical analysis you want to learn, and follow them regularly to get a knack for spotting trends and trading patterns. Note that the name of the newsletter is similar to Morning Star, but the newsletters cover more than just that pattern.

Choose an expert, not just someone selling something.

Allstarcharts Podcast on Technical Analysis Radio

This podcast offers timely insights into technical setups, trends, and reversals happening in the current marketplace. Use it to see how and when an Inverted Hammer forms.

The Weekly Trend

This podcast looks across all markets and provides technical analysis of the price action.

YouTube is the home of many a fake guru, so beware. However, you can glean important information on YouTube. Just make sure you verify it and don’t fall for videos that make claims such as “investing tricks Wall Street doesn’t want you to know,” or “my secret trading method that made me millions.”

Examine these to get started:

Morning Star and Evening Star Candlestick Patterns Explained by David Moadel.

Here you will find an in-depth exploration of the Morning Star pattern, with visuals.

Morning Star Candlestick Pattern Trading Tips by ukspreadbetting

This video offers some tactics and strategies for trading the Morning Star.

Webinars can be thinly disguised sales pitches. Make sure you learn nuts-and-bolts information.

Online Trading Academy

This gives a solid approach to technical trading with examples. It includes the Inverted Hammer.

Technical Analysis–Fidelity

Fidelity is a reliable name, and the variety of technical trading webinars here adds a comprehensive and trustworthy series that can help you profit. It covers the Inverted Hammer.

This is one of the most popular and effective trading patterns, so give some thought as to whether you want to use it.

When you think a Morning Star is forming, be prepared to watch it over the next three to five days. It’s not time to take a break.

Finding the lowest prices is not easy, even for experts. Make some paper trades (with no money) to see how well you can spot this pattern.

You must practice, practice, practice. When you are trading actual money, be prepared to lose some. This pattern is not a guarantee: it is a strong suggestion.

Watch for sustained downtrends. You must be willing to check daily to see if the downtrend is an actual trend or just a dip.

The Morning Star is not a “secret trick” the experts don’t know. It has been used for a long time, centuries. Do not expect to make a sudden fortune by becoming adept at using the Morning Star. Go slow, expect to get it wrong sometimes, learn, and learn some more.

Even after you gain some experience, do not treat the Morning Star like a sure thing. Study your winning trades and examine the losers. Remember, even when the Morning Star looks perfect, the market can turn on you and drive prices down.

Never put more than 1-2% of your money into a Morning Star trade. You’re not trying to make a killing; you just hope to make a profit. Therefore focus on your risk management. Putting too much in a reversal trade can deplete your funds.

Establish rules for entry and exit on trades and stick to those rules. You have some suggestions and guidelines in this guide, so make choices that make sense to you and don’t change every time you make a mistake.

This platform allows traders to communicate as you do on Twitter and Facebook. You can share trading ideas and experiences with other traders. One useful feature is the ability to examine professionally managed stock portfolios.

Ava offers platforms for multiple experience levels. You can automate your trades and follow expert traders to learn from their insights.

This platform is not available in the U.S. Naga allows you to copy the best traders on the platform. You can trade stocks, cryptocurrencies, and Forex across the world.

FP uses the Autotrade tool. This allows traders to copy-trade, and it offers live statistics, along with risk-management systems. You can see the entire trading history of the most successful traders and mimic their methods.

The platform allows a low minimum deposit. Those trading for the first time can get started here. Free demo available. Trade forex, commodities, indices, stock, and cryptocurrencies.

You must eliminate bias in your appraisal of your trading skills. Memory is not reliable. Write down your trades and keep track of your percentage of winners. Are you actually making money?

Reversal – This term refers to a sudden change of the trend so that it heads in the opposite direction.

Support – Support is a level the price has consistently dropped to and then sprung upward again.

Gapping – This is a sudden surge in a price with no gradual rise. Instead, the asset will open higher with no intervening trades.

Volume – This is the number of shares exchanged each day. If you see an increase in volume on up-trades after a Morning Star, that suggests strength.

Stop-loss – Set a stop-loss order that executes automatically if the price drops to a specified level.

Dead cat bounce – It refers to a fake price recovery after an asset has dropped severely in price. The bounce does not sustain itself, and prices continue to drop.

Moving average – This is the average price direction over a specified period. Use a moving average to identify a downward trend.

Trend line – This is an imaginary line you can draw across the highs and lows (peaks and valleys) of prices.

Limit Order – This is a buy order that specifies the price at which you want the trade to execute.

Market Order – This is a buy order that allows the market to set your price. This can be dangerous because the price could pop higher at the moment your order is executed.

Getting Stopped Out – This happens when you set a stop-sell order too close to the current price.

Bullish vs. Bull Market – When you hear that a pattern is bullish, that means the price is likely to rise, but only for that asset. A bull market refers to an overall uptrend in all assets in an index.

If you are going to use technical trading, you need to know the Morning Star pattern. It is a strong signal and is relatively easy to spot. Study it, practice with it. Also, look over past charts to see when it has formed and how prices responded.

It is one of the more reliable. Most traders rate it at 70-80% reliability.

This is a bullish pattern.

It is not clear where the name came from. When candlesticks were invented, many of the names were warlike. This gentle one perhaps indicates a new day is coming?

Whenever you are trying to pick a bottom for prices, there is a risk that prices may continue the downward trend.