December 22, 2021 Updated October 22, 2023

412

1 votes

Reading time: 12 minutes

Futures trading can be a way to accelerate your trading profits. While it’s certainly not a place to begin trading, it can be lucrative. The most important thing is to educate yourself so that you understand this high-risk method. This guide will introduce you to the ins and outs of futures trading.

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also. At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

You can use futures contracts to buy and sell stocks, commodities, currencies, and other assets. The idea is that you make an educated guess where prices will be in the future. You agree to buy or sell the asset for a specific price at a specified date.

Futures contracts give details about:

Some examples:

A December contract could be for 2,000 bushels of soybeans to be bought at $12 per bushel.

An oil futures contract for 1000 barrels of oil requires the seller to deliver the oil for $100 per barrel in December.

An S&P 500 contract could require the buyer to purchase 1,000 shares for a set price as of the expiration date.

Futures contracts initially involved agricultural products. These contracts were used to hedge against losses due to price fluctuations in these products. But in the early 1980s, the stock index future was created by the CME Group. Speculation began.

Today, the speculation in futures far outweighs their use for hedging. In fact, it is infrequent for a futures trader to take possession of the underlying products.

Options are contracts. They give a buyer and a seller the right–but not an obligation to buy or sell at a price and time in the future.

Futures contracts require the buyer to purchase and a seller to sell at a future date. Futures contracts are legally binding–the buyer or seller is obligated to buy or sell.

Futures traders seek to profit from speculating on what prices will be in the coming months. Because the risk of being wrong is high, the rewards are high. So it is the possibility of high rewards that drives people to futures trading.

You are agreeing to make a transaction based on your guess about what prices will be at a future date. You lock in a buy or sell transaction before actually making it.

There are four significant steps in trading futures.

You sell the contract for a profit or loss, depending on how the underlying security acts.

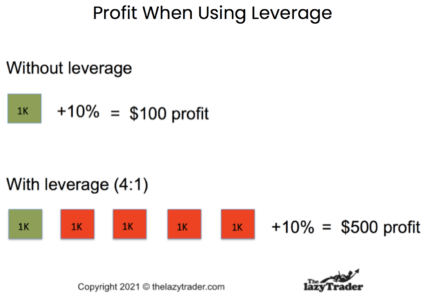

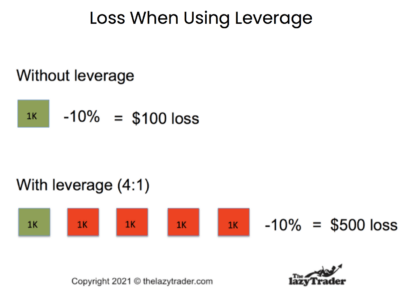

So why buy a futures contract instead of just buying the stock? Leverage. When purchasing a futures contract, you “borrow” part of the money from your broker.

Attractive, yes? Well, there is a catch, of course. The asset can go down in value. You could lose a lot of money. If prices go the opposite of what you wanted, you could lose.

Then there is another peril. You could get a “margin call”. Consider what happens if the price drops and the value of your contract is, let’s say, $5,000 less than what you paid. However, you do not have enough in your account to cover that loss. Then the broker can sell the contract to recoup the loss unless you deposit more money in your trading account.

Note: You can lose more than 100% of your investment.

As you can see, you stand to gain a lot or lose a lot because you are borrowing money to make the transaction. This is why you must follow the specific asset and understand the overall economic and financial news that could affect share prices. In other words, only take educated risks.

Here are basic futures trades:

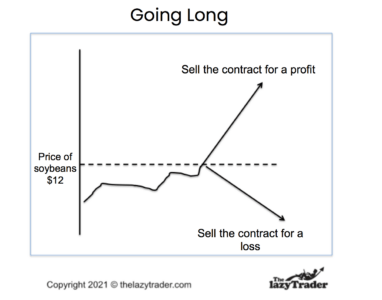

Going long

You buy a futures contract that says you will purchase 100 bushels of soybeans in the coming September. The price agreed upon is $12.00 per bushel. The seller agrees to sell those 200 bushels at the agreed price.

How it works:

If the price goes above $12.00 per bushel, your contract increases in value. You can sell the contract at a premium.

If the price drops below $12.00 per bushel, your contract decreases in value and you lose money.

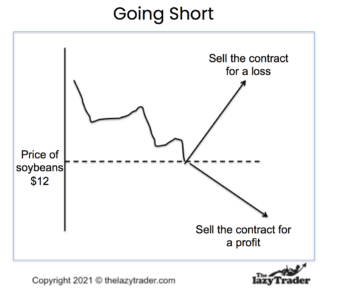

Going short

You buy a futures contract that says you will sell 100 bushels of soybeans in the coming December The price agreed upon is $12.00 per bushel.

How it works:

If the price goes below $12.00 per bushel, your contract increases in value. You can sell the contract for a premium.

If the price rises above $12.00 per bushel, your contract decreases in value.

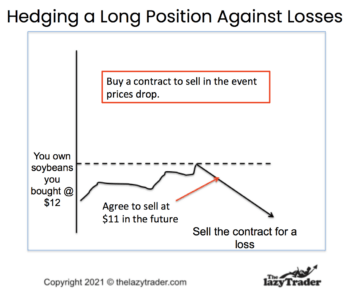

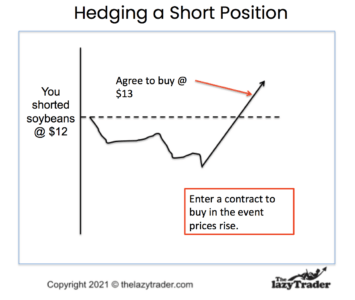

You can protect yourself from losses by taking out a contract that is a bet on prices moving the opposite of what you hoped.

A contract’s expiration date is the last day you can sell it. This typically occurs on the third Friday of the expiration month, but varies by contract.

But you do not have to wait for the expiration date to close out a contract. Here are three ways to exit.

This means buying a contract for the opposite position than you already own. So if you are short on oil, you take out a long contract for the same amount. The two contracts cancel each other out. You still receive all the profits (or losses) you have on the original contract.

This is for those who want to continue a position beyond the expiration date. You offset your current contract by purchasing an opposite contract. Example: you are short soybeans so you buy a long contract on soybeans (for the same quantity). Then you buy a new contract for a date further out.

If your contract expires, you have the option of taking a cash settlement. (No, you do not have to store 50 barrels of newly purchased oil in your backyard.) Some platforms, such as Ameritrade, will not allow the delivery of the physical commodity. You simply take the cash that is owed to you.

Look for books that walk you through trading futures and serve as good reference works on trading in general.

A Complete Guide to the Futures Market– by Jack Schwager

This is an in-depth look at futures analysis and strategies. It offers practical trading strategies and explains why they work for traders. IT is a must-have for futures traders.

Futures Made Simple–by Kel Butcher

This is a simple guide and is good for beginners. It helps newbies get started without complex calculations and advanced strategies. It provides methods for analysis of trades and solid approaches to finding opportunities.

Trade What You See How to Profit from Pattern Recognition by Larry Pesavento

This is a book to help you recognize patterns in charts. It is especially useful for learning to find patterns while they are developing, instead of merely recognizing them after they have developed.

Trading In The Zone by Mark Douglas)

This book on general trading principles covers things like eliminating bad trading habits and remaining consistent in your strategy. It shows how to trade probabilities and ignore anomalies.

Look for courses that offer good basic technical information, not ones that offer get-rich-quick schemes. Consider:

Simpler Trading – You do not look at past trades. Instead, you see trading setups in real time. This means you are not looking at “cherry-picked” examples, but at possible trades as patterns emerge on a chart.

Futures Trading Ninja: DIY Futures Trading Course–Udemy – This is a good foundational course that teaches how to enter and exit trades, understand how expiration dates affect trading, and learn some solid strategies.

Blogs that offer sound technical or instructional information can be helpful. Avoid those that are simply sales pitches for other products. Examine these:

Daniels Trading Futures 101 – Posts here cover the basics, as well as strategies you can personalize. They also compare futures trading to other types of trading.

Optimus Futures – Futures Day Trading Strategies. A good source for upgrading your strategies and refreshing your knowledge.

NinjaTrader – Futures & Forex Trading Blog. Good guidance for developing intermediate and advanced skills in futures trading.

Public forums can include all levels of traders, so confirm any advice you read.

Elite Trader Forums – There are many forums to choose from, depending on your particular interest in trading. This is a good place to learn from experienced traders and look at alternatives to futures trading.

Optimus Futures Trading Community – You will find good education articles here. You can learn some detailed analysis techniques here.

Look for newsletters offered by seasoned pros. Some good places to start:

Trading Pit History – This is a good source for keeping up with changes in offerings, as well as understanding the history of trading.

The Futures Wizard – This newsletter attempts to predict trends for both futures and stocks.

Podcasts should be timely, with commentary on the current marketplace. Examples:

This Week in Futures Options – This is an up-to-date analysis of commodities, trends, and prices.

Futures Radio Show – This is a weekly podcast featuring interviews with seasoned traders and experts.

Be careful. YouTube has many self-proclaimed gurus. Look for reliable technical information. Examine:

Optimus Futures – This channel is constantly updated with interviews and insights that can keep you abreast of developments while you learn new skills.

Look for solid technical information, not mere sales pitches. Start here:

Daniels Trading – Daniels offers a variety of futures webinars that can give you a well-rounded education quickly.

RJO Futures Webinars – Multiple webinars from RJO guide you through trading futures from beginning to end.

This is advanced trading and is not for everybody. It requires a great deal of confidence and a commitment to constant improvement and attention. Be very honest with yourself about whether futures trading fits your personality and lifestyle.

You must create and maintain a calendar that shows you when your contracts expire. You will be actively trading based on expiration dates.

Also, you must understand the macroeconomic environment and the ramifications for your individual trades and strategies.

You will need to regularly search for opportunities and make decisions not only on which ones to take advantage of, but what strategy to use for each one. This is not a “one size fits all” trading approach.

Though futures trading can move quickly and you may make frequent trades, use it as part of a wealth-building strategy rather than a “get rich quick” approach. You will have winning and losing trades, so keep track of how you are doing and accumulate wealth methodically according to a long-term plan.

Invest only 1-2% risk of your trading account value per trade – NEVER any more.

Setting a limit on the amount you are willing to lose in your account will trigger an automatic exit from the position.

This is very precise trading. You must know when you plan to get in and when you plan to get out of each trade. If you find yourself switching strategies often or abandoning a trade right after making it, you need to recommit to a disciplined approach.

This platform is a leader in its field on account of its history, size and the features available on its platform. Experienced traders, our those who want an all encompassing view, will like the amount of windows you can have open. It is regulated by multiple regulators across the world, which includes top-tier regulators such as the UK’s FCA and Germany’s BaFin. As it is a publicaly listed company you are also able to view its accounts and business performance. This could help keen to check if their broker is in sound financial health.

Another platform which has been around for a while. City Index is also regulated by several top tier regulators including the FCA, the Australian Securities and Investments Commission and the Monetary Authority of Singapore. Its cash withdrawal fees are lower than most but its desktop is not necessarily as easy to use as other.

A good platform for beginners as it offers plenty of educational content. It is owned by Charles Schwab, the large UK broker, meaning one of its regulators is none other than the US’s The U.S. Securities and Exchange Commission. Its customer service has proven helpful which is useful for those starting out.

You can find advanced analytics here. This will attract experienced traders who are looking for greater information before placing trades. This can also help for those looking to run complex strategies such as Futures trading. Helpfully, eSignal has different price plans so a beginner does not have to go all out before deciding whether trading is for them.

Futures trading is a core part of its offering. Day traders will find this platform appealing as it specifically targets this kind of clientele. Ninjatrader is a privately owned platform headquartered in the USA. They were slow to offer cryptocurrency trading as there focus has been on trading derivatives.

Almost exclusively dedicated to options and futures, this platform works for both PC and Mac.

Review your trade history frequently. Do not just add up the wins and losses; understand why you were right or wrong. This is your best learning tool.

The most significant risk is having a position move against you. Remember, you borrowed most of the position’s value. If it does not go the direction you want, your account could lose enough value that you have to deposit more money. It is quite possible to lose 100% of your investment money.

More than one seasoned professional has lost a ton of money using futures.

For example, Brian Hunter of the Amaranth hedge fund (no longer operating) lost $6.6 billion because he guessed wrongly about gas futures.

And Metallgellschaft, a German company, expected oil prices to increase, but they declined. CEO Heinz Schemmerlbush and those under him lost a total of $1.3 billion, and Schemmerlbush lost his job over the debacle.

Besides leveraged losses, another risk of futures trading is opportunity loss. Futures platforms require you to have a minimum amount of money to even open an account. So you will have to commit funds to futures trading that may be more than you want to invest. That means you will not be able to invest that money elsewhere.

Before you try futures, you must educate yourself. And that education must be ongoing even after you start trading futures. Futures traders use complex trading strategies, and even the best make trading mistakes. Brokers will check your financial knowledge and suitability before letting you trade.

Start with assets you understand. If you are familiar with how oil prices act, that may be a good place to begin. Or, if you understand cattle or gold, start there. If none of those are for you, you can trade stock futures.

Keep your leverage low. It may be a good idea to start with “micro” futures. These opportunities require much less money to get started, and that will limit your losses. Start small and get used to the “feel” of investing with futures.

Futures trading was once an exotic method used by Wall Street big shots. They used it to hedge their investments, that is, to reduce losses.

But it has evolved into a popular trading method that even the novice can use. That brings a lot of peril. It is a little too easy to jump in and lose money if you do not understand the subtleties of futures. Just because it is available to all does not mean it is easy.

This means buying a contract that requires as little as 10% of the value. It is a loan from the broker.

You get a margin call when the funds in your investment account fall below the minimum requirement. If you don’t deposit more money quickly, the broker may sell your positions.

Every contract has an expiration date. Many traders never let their contracts expire. Instead, they sell the contract. But if you do let it expire, you simply get your cash from the contract. The only ones who accept delivery of the commodity are business owners who want the gold, oil, etc.

You can offset your current contract and buy a new one with an expiration further in the future. Basically, you are just transferring your current contract to a new one.

This means buying a contract that will make money if the market moves in the opposite direction than you anticipated, such as a market correction. IMPORTANT: if you have both long and short contracts with the same expiration date for the same commodity, one contract will lose while the other gains. Your losses cancel your profits. Once you see a clear direction in the market, close out the losing contract.

Many platforms allow you to set a limit on how much you are willing to lose. Once you hit that limit, your contract gets sold for you.

Higher potential rewards mean higher risk. Futures offer very high rewards, but the chances of losing a lot of money are also high. That does not mean you should not try them, but it does mean you need to know what you are doing and know how to limit your risk. It may be a good idea to start with micro futures. These opportunities require much less money, and that will limit your losses. Start small and get used to the “feel” of investing with futures. And always learn and study more so you can grow your expertise.

Yes it is. Futures trading involving leverage which means any movement, whether profitable or not is accentuated. As Futures are derivatives, they are complex for a novice investor. This means you may not understand all the permeables to a Futures price.

We do not recommend so. Futures derive their prices of the other assets. You therefore need to understand how those other assets function and are priced. It can take time to fully understand these assets, let alone how something as complex as the Futures market works.

Yes it is, but if you are a complete beginner it is likely to take a year or two before you understand the risks involved. You may find the risks are too big for you. If you are able to understand the risks involved and above all quantify them, then trading for profit could work for you. Remember the market can stay irrational longer than you can stay solvent!