March 23, 2022 Updated October 22, 2023

413

1 votes

Reading time: 18 minutes

Options trading can be a good alternative to buying stocks for some investors. There is a potential to make more profits in options vs. stocks. But you need to know what you are doing. It’s not complex, but it is vital that you understand how options work and develop some trading strategies. This guide will help you understand how you can add options trading to your investing strategy. You will learn what options are, how to buy them, and how to reduce your risk.

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also. At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. “the platform offers some impressive features but withdrawing money can be difficult.” OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading. Offers multiple asset classes, platforms, and regulated in a variety of regions. Caters for a global audience. Awarded with the Highest Overall Customer Satisfaction Award for 5 years running - Investment Trends CFD Report 2015. A standalone copy-trading ecosystem, providing equities, foreign exchange, commodities and cryptocurrencies markets. Provides a global selection of brokerages. Pepperstone is a global regulated broker that provides its clients with the latest technologies for trading multiple assets such as Forex, indices, cryptocurrencies, stocks, ETFs, and commodities. This article provides an overview of its trading platforms, tools, fees, protection measures, and other aspects to help traders make a more informed decision.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

Look at the word “option”. When you buy an option, you have the right to buy or sell a stock or currency at a guaranteed price. If you exercise your option before the expiration date, you have that choice available to you.

When you buy the option, you have not bought the stock or the currency. You have purchased the right to buy or sell at a certain price. That is why options are called “derivatives.” They are based on an underlying asset.

Do not let all that confuse you. It is similar to having a contract to buy a home at a set price. If the real estate market rises, the seller cannot force you to pay a higher price. The deal has been signed.

The same would happen if you signed a contract to sell a house to a buyer at a specified price. If the market drops and the house is worth somewhat less, you still get the price that the buyer agreed to.

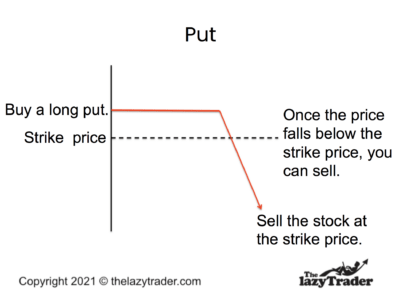

Buying Puts

You would use puts if you think the price of an asset is going down.

Here is an example. Let’s say you bought a put for XYZ stock. The specified price you will get the stock for if you exercise your option is $100. The stock price drops to $80 per share. You can make money in one of two ways.

Risk: you pay a premium when you buy a put. That premium can be as little as $1 per share up. If you do not exercise the option and it expires, you will lose your premium money. If the stock does not go the direction you thought it would just let the option expire. You are not obligated to exercise an option.

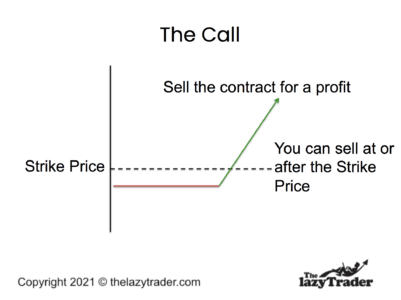

Buying Calls

You buy a call when you think the price of a stock will go up.

Here is an example of how a call works. You purchase a call that guarantees you can buy ABC stock at $100 per share. The stock rises to $120 per share. There are two ways to make money.

Risk: You lose the premium that you paid when you bought the call if you don’t exercise the option before it expires. If the stock doesn’t go the direction you anticipated, just let the option expire. You are not obligated to exercise an option.

You buy an option on an exchange. You will see the price at which you can buy, the amount of the premium, and the expiration date.

After you buy an option on an exchange, ou will see the price at which you can sell, the amount of the premium, and the expiration date.

You can sell the option to other buyers on the exchange.

You do not have to own the underlying asset – For example, you buy an option for a premium as low as $1 per share. Typically, options are for 100 shares. So you pay $100 for the right to purchase a stock at $40. The stock goes up to $60, and you exercise your option to buy at $50. (This includes your $1 premium.) You never risked the full price of buying the stock, only the premium. After your exercise the option, you will, of course, have to risk the price of the full purchase of stock shares, but you already have a profit built-in.

Paying a small amount to control a large amount of an asset is called “leverage.”

You risk less with options – Example: You buy a call option to purchase a stock at $40. But the price goes down to $30. It wouldn’t make sense to exercise your option and pay more than the stock is worth. So you let the option expire. You don’t get your premium back, but that is small compared to what you would have risked if you had purchased the stock instead of buying an option.

You can sell an option – In other words, do not have to exercise the option to make money. It can go up in value if the asset goes in the direction you anticipate.

Example: You buy a put that guarantees you can sell the stock at $50. The price drops to $40 per share. Buyers will be interested in buying your put knowing they can buy shares of the stock at $40 have a guaranteed sell price of $50. They will be willing to pay extra for your put in this circumstance.

You can buy multiple options – Since you are not buying the asset, you have more cash available to pay premiums for other options.

You are not obligated to exercise your option – if it moved against you, you would lose money if you exercised that option. Simply let the option expire. All you will lose is your premium.

There is a time limit on options – They expire. They are no good after the expiration date, and this can cause some issues. For example, if you plan to exercise a call option to buy an asset at a certain price, procrastination could cost you that opportunity.

Perhaps you want to wait just a little longer for the stock price to go up, or perhaps you forget the expiration date. In either case, your option is useless after expiration.

You have to choose a good time frame – Walk through this one: You expect an asset to drop in price, and you buy a put that expires on December 20th. But the asset is stubborn and hovers about where it was. Then your option expires. To make matters more painful, the asset drops in price after your expiration date. It behaved just like you thought it would, but now you can’t do anything about it.

You can get drawn into day trading – Options may look like short-term plays to take advantage of an asset’s change in price. But they don’t have to be used for “hit and run” day trading. You can use them to get into a long-term position. Buying an option gives you time to see how the asset behaves before you go all in. If it goes your way, you got in at a good spot. You can hold the position long-term.

Imagine you buy a call that allows you to buy a stock at $30. The stock prices rises to $40. You can exercise your option to buy a stock at $30 and have an immediate $10 per share profit. But you do not have to take that profit. You can continue holding the stock in hopes of it rising higher.

You can miss out on profits – An option usually represents 100 shares of stock. Think about a situation where the stock really performs well and you can only exercise an option on 100 shares. If you had invested in the stock to the tune of 500 shares, you would have had more profit. Yes, you could have bought 5 options contracts, but you did not.

Options can go down in value over time -The closer you get to the expiration date, the less anyone is willing to pay for them. Think about an option that is gaining value you could get if you sold it. You hold it, hoping it will gain even more value. But the expiration date nears, and now it drops in value.

Pros and cons of stocks – Options do not have to replace investing in stocks. Keep in mind some of the benefits of stock investing, while being aware of the drawbacks.

Some stocks pay dividends – Companies pay shareholders part of the profits through dividends. Options don’t pay dividends because you do not actually own the stock until you exercise your option.

No expiration – You can take as long as you want to decide whether to buy or sell a stock. This can be helpful if you want to see what others are doing. This is called waiting for “confirmation” of the direction the stock is heading. Options require you to make quick decisions because they have a time limit.

No premiums – Most brokers offer free trades for stocks. You do not any extra to buy or sell. Options charge extra–known as a “premium.” Example: You want to buy 100 shares of CDE stock. You place your order and you are done. If you buy an option instead, you will pay a premium of at least one dollar per share, so the cost will be $100.

Buy any amount – You can buy as many shares as you want. Consider: An call option for stock RST is for 100 shares. (This is typical.) WIth a stock purchase, you could buy 25 shares if you prefer.

Stocks have a simple valuation – Whereas an option can decrease in value as the expiration date approaches, a stock has no outside influences on the price.

You typically have no leverage with stocks – You must spend the full investment amount at the time of purchase. Look at the case where you buy 100 shares of a stock for $25, meaning you spend $2500. You could have bought an option for $100 and had $2400 to invest elsewhere.

A stock can theoretically go to $0 per share.

Imagine you bought 100 shares for $25. The company could run into trouble and your stock could become worthless. With an option (before you exercise it), your risk would be $100.

You must weather long-term fluctuations – For those investing for the long-term, you have to have the discipline to avoid panic selling if a stock drops. Options expire, so there is a short time frame to decide what to do.

Lack of an exit strategy – All stockholders should have an exit strategy, but many don’t Their “strategy” is to see what happens, with no guidelines for when to take profits or sell partial shares.

Example: You buy GHI stock and plan to hold it forever. But the market trend turns sour and you lose your money. An option has an expiration and forces you to decide soon whether you will exercise that option.

Overtrading stocks can be disastrous – Some people do not stick to their decisions and buy or sell a stock based on momentary trading fears. Consider: The more often you trade, the greater your chances of losing money. Note: Once you exercise an option, you must switch your thinking to the pros and cons of stocks, because you no longer have the protection of the option but instead own the stock.

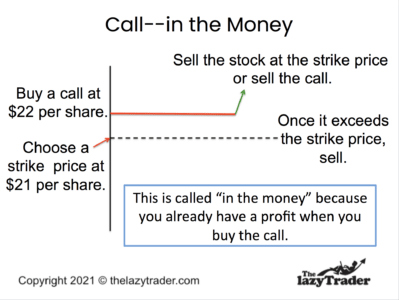

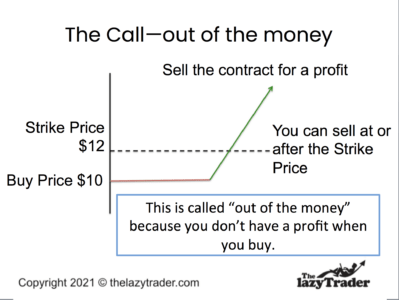

A call option gives you the opportunity to buy an asset at a specific price. You buy a call when you think the stock will rise above the strike price before your option ends. You can select an option with the strike price you want. Look at this example. The strike price is the price where you can exercise your option.

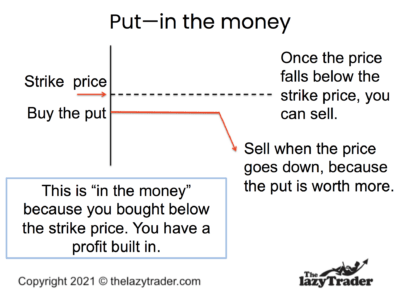

“In the money” means: the stock price has already passed the strike price. This means there is already a profit built into the call option.

A call that is “out of the money” indicates that the stock price has not reached the strike price at the time of purchase.

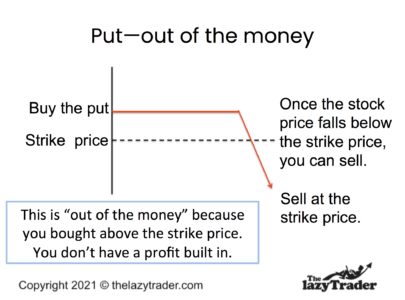

You buy a put when you expect the stock to go down in price. The put allows you to sell at a pre-determined price. You first buy the stock at a low price, then exercise your option to sell it at the guaranteed price.

You buy a put when you expect the stock to go down in price. The put allows you to sell at a pre-determined price. You first buy the stock at a low price, then exercise your option to sell it at the guaranteed price.

You can buy a put that has a high selling price guaranteed even though the stock is already low.

This occurs when you buy a put before the stock price has dropped. You are hoping the price will drop after you buy the put.

In terms of the logistics of beginning to trade options, it is simple. You open an account on a platform that offers options trading.

But before we look at options platforms, it is vital that you educate yourself about the approaches and risks.

Two books share the distinction of being called “The Bible” of options trading.

??Options as a Strategic Investment–Lawrence McMillan

This book goes back a bit, It was published in 1980. But is still relevant. McMillan offers a complete rundown of strategies and ways to reduce risks. It even goes into tax implications of options.

Option Volatility and Pricing–Sheldon Natenberg

This is another classic. IT explains how market volatility can affeçt options trading strategies. It is known for its clear instructions.

Courses can be helpful, but avoid ones that promise to make you rich. Options trading is not a scheme, it is a serious trading method.

Take a look at these courses:

Udemy’s Options Trading Basics

This is a good place to start for beginners. There are actually three courses in this series.

Beginning Options Trading – Learn How to Profit with Options. Offered by Skillshare

Good nuts-and-bolts information here helps you get started.

Look for blogs that offer practical advice rather than tricks and gimmicks.

Here are two to look at:

Option Alpha – Options Trading Blog

This blog offers straightforward tips with daily updates.

Steady Options

This educational blog focuses on giving your knowledge to enhance your trading.

Be careful with forums. Not all opinions are from experts.

Bear Bull Traders Forums

The comments are broken down into specific topics so you can find what you want.

The Options Trading Community on LinkedIn

Some serious options traders trade tips here.

Benzinga Options Newsletter

This newsletter offers insights for all levels of options traders.

The Options Strategist Newsletter

This newsletter is highly regarded, having been in publication for 28 years.

The Option Block

This podcast offers a panel of experts that discuss current options trading trends.

Options Action Podcast | CNBC

Top options traders from Wall Street translates options jargon into easy-to-understand language.

Not all YouTube videos are good for you. Be very careful about the information you gather here and verify it through other resources.

Consider these channels:

BenzingaTV

This channel talks about the upcoming direction of stocks and how to trade options on them.

Best for Beginning Options Traders: Option Alpha

This channel offers three different playlists you can choose depending on your level of expertise.

Be careful of webinars that are simply thinly disguised sales pitches. Look for those that offer real substance.

PowerOptions

This group offers numerous webinars on options so you can choose the topics you want to learn about.

Options trading at Fidelity–Offered by Fidelity Investments.

This is a series of six webinars that help beginners learn about options trading

In the options trading market, regulatory bodies like the Financial Industry Regulatory Authority (FINRA) and the Federal Deposit Insurance Corporation (FDIC) play crucial roles in investor protection. FINRA oversees brokerage firms and their subsidiaries, enforcing rules and regulations to maintain market integrity. It helps ensure that your trades are executed fairly and your broker maintains ethical practices.

The FDIC, while not directly involved in options trading, insures deposits in banks and savings associations, which can indirectly protect cash held in your margin account at a bank. However, note that options and other securities are not insured by the FDIC but by the Securities Investor Protection Corporation (SIPC).

Options are a tool. They should not determine whether you are a long-term investor or a day trader. That is your choice, based on your personality, risk tolerance, and goals.

Remember that the more often you trade, the more often you can be wrong. Don’t get excited about options to the point that you start speculating with your nest egg. Options can be used as a way to get into a long-term trade in a profitable manner.

Of course, options can also be used to day-trade. You can catch the momentum of an asset and jump in, then jump right back out. It’s a good way to profit, and it is a good way to fail.

Never put more than 1-2% of your investment funds into any trade.

If you don’t know what kind of trader you are, ease into it and see what approach appeals to you.

Trading options means paying attention, often on a daily basis. If you don’t have that kind of time, you may want to consider options as a way to get into long-term trades you can hold without daily monitoring

You must decide if you want to watch for trend reversals, or if you would rather ride long-term trends. There is a middle ground between a buy-and-hold investor and a day trader. It is called swing trading. This is like day trading, but you stay in the position for longer than a day.

Whatever approach to options you take, think about a slow and steady approach to building your wealth. Avoid the mindset that you need to make a killing in the market. Watch your account balance and tally your winning and losing trades. Are you growing, or just treading water? Or, even worse, are you sinking? If you see that you are not making any money, slow down.

Never put more than 1-2% of your trading money into a single trade.

Watch your expiration dates closely, and keep track of how much you are spending on premiums. Premiums cost money, so do not ignore them.

Make sure you use a strategy that is tried-and-true. Starting out with options is not the time to innovate. Learn the methods that have worked over many years.

Know when you will get out. Once you exercise an option, you own the underlying asset, so know whether you will get out at the first sign of a trend reversal, or whether you have a price target at which you will sell.

Here are five online brokerages that offer options trading”

This is a popular platform, and it offers options for trading for stocks. You simply open an account and then fund it. This is a good place for beginning options traders.

Trade Stocks, ETFs, Crypto, and options on this platform. Similar to E*Trade, so choose according to how intuitive you think the site is.

This brokerage is well-trusted. As with other brokerages you pay a small fee for each options contract you buy. The tools on this platform are exceptional.

This platform offers screeners you can customize to look for trends and an “Idea Hub” that helps you find ideas for options trades.

This broker is geared for options trading pros.

Options are a derivative, meaning they get their value from an underlying asset. If the stock price goes in your favor, that’s great. But if the price goes against you your option can lose value fast and you may not be able to sell it.

Your options offer protection against risk. Though a stock price may not go in the direction you want, you can let the option expire. However, you will lose the premium.

However, premiums can add up. If you buy a lot of options, you can spend $1000 or more on premiums. Remember that this is not recoverable. Keep track of how much you have paid for premiums.

Retail investors have greater access to options trading because so many online brokers offer it. They simply were not aware of options trading before, but now online education is making them realize how options can help them.

In addition, commissions have become really low. Typically, an options contract incurs a fee of only 65 cents.

Finally, options are a good way to reduce risk, and investors have recognized that they can avoid losses with an option contract.

Some options traders make 10% to 50% per trade. But when you hear figures like that, note that they do not tell you how much they lost on other trades.

One trader started with $100K and lost $84K. He was using some sophisticated options techniques that were high risk. However, he was able to recover by learning more and creating a set of rules for himself.

If you are new to options and have a small amount to trade, focus on protecting what you have rather than reaching for high profits. Learn, try, and learn again. Use knowledge from this guide and from the sources we have recommended. Go slow and never put more than 1-2% into a trade.

You do not need a whole new personality to trade options, but you do need the right mindset. To be successful you need:

Benefit from what those have learned who have gone before you. Here are some tried-and-true tips.

Follow industries you understand, perhaps those you previously bought stocks in. You are already on a learning curve. Don’t try to learn new sectors while you are learning options trading.

Most people readily understand how to make money when prices rise, but learn how to make money on puts when you think prices will drop.

That means taking small positions with options. Keep track of the value of your trading account and never put more than 1-2% into a trade, as we have discussed. However, those percentages may represent more or fewer dollars as the value of your account grows or diminishes.

When you start out, don’t overwhelm yourself. Don’t make more trades than you can manage. Later, you might be able to handle more, but know your abilities and keep the number of trades within your capacity to monitor and manage.

Many platforms do not charge you a transaction fee when you buy stocks. Find a platform that offers $0 per stock purchase or sale. After all, when you exercise an option, you are buying or selling a stock. Don’t add to your expenses by paying for that trade,

You will need money on hand when you exercise an option, particularly calls. To exercise the call, you have to buy the stock.

Fees for options contracts range from .65 to .75. You probably won’t go broke paying those amounts but do keep track of them. Your biggest issue may be the premiums, you pay sellers when you buy a contract. For example, a premium of $1 might sound small, but remember a contact usually deals with 100 shares. Even at the smallest premiums, 10 contracts would cost you $1,000.

If you are easily stressed, don’t jump into multiple options contracts. There is a lot to manage. Start small, know your tolerance for risk, and don’t battle yourself by overdoing it.

Once you get used to the ins and outs of options trading, it is not as complex as it might seem at first glance. Above all things, your first duty is to preserve your capital. Understand how to manage risk.

In options trading, ‘Greeks’ are mathematical metrics that help traders understand various aspects of option pricing, such as risk and potential losses.

They offer essential functionality in managing an options portfolio. Delta, for example, measures an option’s sensitivity to the underlying stock’s price changes, while Theta represents the time decay of options. By understanding these metrics, traders can more accurately predict how market price changes will impact their option positions, thereby potentially mitigating the risk of loss.

A ‘straddle’ is an options strategy that involves simultaneously buying a call and a put option on the same underlying security with the same strike price and expiration date. It’s typically used when a trader expects a significant price movement but is uncertain about the direction.

This strategy allows traders to leverage market data, such as volatility forecasts, to potentially profit regardless of whether the underlying stock price goes up or down. However, it’s essential to understand the associated risks, as potential losses can be significant if the stock price remains stable.

Integrating options trading strategies into your IRA or mutual funds can be an effective way to potentially increase returns or hedge against risk. Thus, a ‘Covered Call’ strategy involves holding a long stock position while selling call options on that same stock.

It generates income from the option premiums and can be used in an IRA if the custodian allows options trading. On the other hand,, an ‘Iron Condor’ is a more advanced strategy that involves four different options contracts. It can potentially generate profit in a neutral market but might not be suitable for all mutual funds due to its complexity and risk level.

The underlying security’s current price is one of the key factors influencing the option premium, which is the price you pay for buying an option contract. If the current price is significantly different from the strike price, it can result in a higher premium due to the higher inherent risk.

However, the per contract fee, which is the brokerage’s charge for executing an options trade, is usually a fixed amount and does not directly depend on the current price of the underlying security. It’s essential to factor in both the premium and per contract fee when calculating potential profits from an options trade.