November 29, 2021 Updated October 22, 2023

470

1 votes

Reading time: 1 minutes

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also.

It’s hard to imagine a daily inflation rate of 207%. But that’s exactly what people living in Hungary in 1945 and 1946 suffered through. At this rate, prices doubled every 15 hours. The groceries people purchased in the morning would cost them twice as much by the evening. This is the danger with hyperinflation Hungary’s catastrophic inflation peaked in July 1946 at a mind-boggling 41.9 quadrillion percent a month.

As you might have guessed, this is no ordinary inflation—it’s “hyperinflation.” In this guide, we explain how and why hyperinflation occurs. We describe what happens in an economy when hyperinflation hits and how it impacts the daily lives of people. And, perhaps most importantly, we highlight specific investing strategies you can use immediately to protect your wealth from out-of-control price increases.

At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

Hyperinflation refers to an extremely rapid and unchecked increase in the prices of goods and services. A nation that experiences hyperinflation will suffer from price increases of 50% or more a month lasting for more than 30 consecutive days. To put this in perspective, at a 50% monthly increase, the cost of your normal basket of groceries would more than double in just two months.

Phillip Cagan, an economics professor at Columbia University, called inflation—and hyperinflation in particular—a “Hydra-headed monster.” This refers to the wild and uncontrolled nature of hyperinflation. In Greek mythology, a Hydra was a multiple-headed serpent that was seemingly impossible to kill. Each time a would-be slayer cut off one head, two more would grow in its place.

Similarly, hyperinflation grows at a pace that defies belief, doubling prices in weeks and sometimes even days or hours. Government interventions (which are often the cause of hyperinflation) frequently just worsen the problem.

Hyperinflation can have a catastrophic impact on an economy. It can lead to shortages of food and hoarding as people attempt to secure necessities for survival. At its worst, it can lead to large-scale bankruptcies and business closures, massive unemployment, rioting, starvation, and a complete shutdown of a country’s productive capacity.

Government policies are often the main culprits of hyperinflation. Hyperinflation can be triggered by a variety of factors, including a severe economic crisis, a civil war, a large fall in exports, or a drastic increase in the money supply. In some cases, macroeconomic shocks like a pandemic could also exacerbate inflationary pressures, leading to hyperinflation if not managed effectively by entities such as the Fed or the local Reserve Bank. Other causes include:

This is when the government implements various expensive programs and prints money to cover the costs. For example, a government might print money to counteract the effects of a recession or geopolitics: to cover the cost of a war. Governments may print large amounts of money when political upheavals have depressed the economy.

If tax revenues are low, the government may print money to cover its costs. If this rapid increase in the money supply is not warranted by a corresponding increase in the nation’s production of valuable goods and services, hyperinflation can occur. When a nation does not have the wealth to accommodate such high levels of spending, it will operate at a deficit that eventually becomes unsustainable.

The more currency the government injects into the economy, the less valuable each unit of currency becomes, and prices will continue to skyrocket. This becomes a vicious circle as the government pays for its deficits by continuing to print more money.

Demand-pull inflation occurs when the demand for goods outpaces the supply. This imbalance leads to the increase in the prices of goods. Hyperinflation and demand-pull inflation often occur together. As prices soar, people hoard goods in the anticipation that prices will be higher in the future. This causes shortages, which in turn pushes prices even higher.

During times of war and political instability, people can lose faith in the currency backed by their government. They may be reluctant to use the currency and will look to exchange it for a more stable currency from another country. As more people look to get rid of their currency, the value of the currency will erode, and inflation will spike.

This lack of confidence can also spread to other countries that will insist on extra compensation (known as a risk premium) to accept the currency. This added charge can cause prices to surge and contribute to hyperinflation.

Inflation measures the increase in prices for a set of goods and services. The rate of inflation is generally expressed as a percentage increase over time, most often a month or year. Many economists say that a small amount of annual inflation is to be expected and is a sign of a growing economy.

In the United States, the Federal Reserve is currently targeting 2% as an acceptable annual inflation rate. Most central banks around the world also target a 2% to 3% annual inflation rate. They will implement central bank monetary policies, such as increasing or lowering interest rates, to ensure the inflation rate stays in a healthy range.

Hyperinflation is well beyond a single-digit yearly increase and usually rare in developed nations. Hyperinflation is when the inflation rate exceeds 50% per month and lasts for more than 30 consecutive days. Historically, it’s more common in developing economies that are undergoing drastic economic or political upheavals. Russia, Hungary, Zimbabwe, China, and Brazil have all experienced some of the worst inflation in history.

Argentina is one notable example of a country that has faced hyperinflation, particularly during its financial crisis. In extreme cases, countries may have to introduce a new currency to stabilize their economy and regain public trust, as the Reserve Bank of Zimbabwe did. Other examples include:

This hyperinflationary period started soon after the Weimar government missed a reparations payment. In the aftermath of World War I, Germany owed the Allied victors financial restitution amounting to 132 billion gold marks, or about $269 billion today.

The payment default spiraled into a chain of events that included occupation by French and Belgium forces and a workers’ revolt. To pay the striking workers, the government resorted to printing more money.

The government increased the German marks in circulation by a factor of 7.32 x 109. During the sixteen months of hyperinflation, prices on average quadrupled each month. By November 1923, the monthly inflation rate soared to 322%.

An even larger hyperinflation occurred in Hungary after World War II. Large portions of the nation’s production capacity and infrastructure were destroyed during the war.

To stimulate growth, the government printed huge sums of money to be used by the banking sector to fund new enterprises. The government pumped money into the economy, increasing the money supply by 1.19 x 1025. This resulted in dramatic price increases of more than 19,000% per month.

The breakup of Yugoslavia in 1992 triggered a series of events that resulted in hyperinflation. Even before the disintegration, government spending and deficits were high. Government bureaucracy, ineptitude, and spending continued, worsened by the escalating war in Croatia and Bosnia-Herzegovina.

The high cost of regional conflicts, along with trade sanctions against the country, plunged an already weak economy into collapse. In January 1994, the monthly inflation rate peaked at 313,000,000%.

This period of hyperinflation in Zimbabwe was caused by many factors, including a corrupt government, a failed land reform policy, and costs associated with war. Reductions in food production resulted in hoarding and shortages. Foreign investors pulled their money from the country as the economy collapsed.

The government resorted to printing money in higher and higher denominations, which included a 100 trillion Zimbabwean dollar banknote. According to Steve Hanke, applied economics professor at John Hopkins University, Zimbabwe’s inflation rate as of November 2008, reached an astonishing 89.7 sextillion (1021) percent.

At one point, Venezuela was the wealthiest country in Latin America. With the largest crude oil reserves in the world, Venezuela saw its revenue from oil grow dramatically in the early 2000s. However, this windfall was mismanaged by the government, which controlled the state-owned oil and gas company, Petróleos de Venezuela.

The government spent heavily on a wide range of social programs, often at the expense of developing the nation’s infrastructure or reinvesting in oil production. Analysts cite the government’s mismanagement of the economy as the main contributor to Venezuela’s ongoing hyperinflation.

The government had no savings to see it through years of plummeting oil prices. Instead of cutting spending, the government printed even more money, pushing the inflation rate higher. Government corruption, along with mandated price controls that forced many domestic companies into bankruptcy, added to the nation’s long list of problems.

Hyperinflation in Venezuela soared to 2,740% in 2016 and continues to plague the country as of November 2021. The International Monetary Fund (IMF) estimated the country’s annual inflation rate at over 65,000% in 2018 and projected a 2,700% inflation rate for 2021.

During times of hyperinflation, the value of a nation’s currency erodes quickly. People understand this and will attempt to get rid of the cash they hold as soon as possible. The goods and services they purchase today will cost more tomorrow, so the incentive is to purchase immediately whatever is available. This demand causes prices to rise even more in a vicious cycle.

For example, at the height of Zimbabwe’s 2007-2008 hyperinflation, the cost of everyday goods rose to astronomical prices. Shoppers resorted to bringing wheelbarrows full of cash to the grocery store to buy a few simple items such as bread and milk. People were desperate to turn cash into assets, lugging backpacks and suitcases of money to their local shops only to discover how little they could actually buy.

Another impact of hyperinflation is the rate of savings goes down as there is little benefit to holding onto cash. This impacts banks that rely on customer savings to fund loans. Additionally, the loans they already have on the books lose value. This can ultimately lead to bank insolvency and a collapse of the entire banking system.

Hyperinflation can affect your investments in different ways. Here we review how high inflation impacts three asset classes.

Hyperinflation can influence stock prices. As the prices of goods and services increase, company revenues can also increase. For some companies, this will translate into growing profits, a higher share price, and a bump in dividends. Still, a higher share price may not equate to higher real returns if the share price does not keep pace with rapidly escalating inflation rates.

Stocks that will see the greatest increase tend to be for those companies where the demand for their products remains high despite inflation. These include consumer staples and basic materials stocks.

This is because even in times of inflation people will continue to buy the basics such as food and household supplies. And companies will continue to buy the materials needed to produce those consumer goods. Utility stocks also tend to do well because people will prioritize paying their utility bills over other types of purchases.

Stocks that might take the greatest hit are generally in the luxury or non-essentials category. Sales for high-priced clothing, travel, automobiles, and consumer goods could all face a slump as people economize and focus on meeting basic needs.

If you have large amounts of cash in savings accounts or certificates of deposit (CDs), you will see the value of your cash quickly erode. Investors who rely on fixed-income securities, such as bonds, will be especially hard hit by hyperinflation.

Whatever interest they make on these investments will not be enough to make up for the loss in purchasing power experienced through hyperinflation.

Homeowners and real estate investors who have fixed-rate mortgages can benefit from high inflation. This is because they will pay back their loans using money that has decreased in value due to inflation’s impact.

In general, real estate can be a good investment during inflationary times because of escalating home and property prices. The danger lies in the development of a real estate bubble, which could lead to a sudden drop in real estate values. Real estate is not a liquid investment—meaning it generally cannot be sold and converted to cash quickly. In the event of a real estate crash, investors may not be able to get out fast enough before suffering major losses.

Because hyperinflation is so rare, there is not a lot of data available about which investments do well during these times. Still, there are assets that typically do well during regular high inflationary periods. We discuss these assets below.

As we mentioned earlier, you might see higher returns investing in consumer staples and basic materials stocks. Also, look at investing in companies that can pass along higher prices to their customers without harming sales. In these cases, customers will continue to be loyal to these brands despite price hikes.

Not all stocks are good investments during high inflation. The yields on dividend stocks will struggle to keep up with the pace of inflation. For example, during Germany’s Weimar inflation, dividend yields plunged as prices soared.

Bonds are generally regarded as the worst assets to own during inflationary times. That is because rising inflation eats away at the real value of any interest payments you receive. Inflation-indexed securities offer bond investors an alternative.

In the U.S., these bonds are called Treasury Inflation-Protected Securities (TIPS). When inflation rises, the base value of the security increases along with the interest payments. Other countries also issue inflation-indexed bonds.

Investing in commodities can act as a hedge against inflation because commodity prices generally rise as inflation accelerates. You will see price increases in a wide range of commodities. This includes everything from precious metals to agricultural products to energy products.

Gold is a particularly popular hedge against inflation, as we discuss in greater detail in the next section. You can invest in commodity futures contracts to gain direct exposure to commodity price changes. Or you can buy stock in companies that produce commodities or shares of exchange traded funds that focus on commodities.

As the cost of buying a home or renting a property increases, some investors see real estate as a good long-term investment. You can either invest directly through physical real estate or indirectly through real estate exchange traded funds (ETFs) or real estate investment trusts (REITs).

As inflation soars, some types of collectible investing become more popular. Some people use collectibles to diversify and hold physical assets that are more valuable than their nation’s currency. Collectible examples include art, wine, stamps, and coins.

Quite a few top analysts and institutional investors are now discussing cryptocurrency as a potential hedge against inflation. Of course, cryptocurrencies have not been around long enough for anyone to know how they will fare as a hyperinflationary investment.

Enthusiasts point to the limited supply of Bitcoin as the main reason for its hedge status. Unlike fiat money, which governments can print in huge quantities, the number of bitcoins is capped at 21 million. Critics say that the big problem with cryptocurrencies as a hedge is that their underlying value is not really known, making it a more speculative than stable investment.

Many investors tout gold as an inflation hedge. They make the case for gold offering especially good protection against high and rapidly growing inflation.

People will turn to gold—a physical asset—when they have lost confidence in fiat money. Fiat money refers to a national currency that is only backed by the faith in a government, but not by a physical commodity, such as gold or silver. As hyperinflation destroys people’s faith in their government and its currency, they will flee to the safety of purchasing and holding gold.

There is a finite amount of gold. It is a tangible asset and retains its value or purchasing power, thus making it an effective inflation hedge.

It has diversification benefits. Investors can use gold as part of a diversified stock portfolio that can hold up well during volatile times.

It is uncorrelated to other assets. Gold’s low correlation with most other asset classes means gold generally does not decline when the prices of other assets dip.

It performs well in recessions. Gold has historically performed well during bear markets and recessions.

There are different ways of investing in gold. There are a variety of ways to invest in gold beyond holding physical gold. Other methods include gold ETFs and gold mining stocks. Australia’s Perth Mint has their Perth Mint Certificate program that allows investors to buy and store gold at the Perth mint.

It demands capital. Because gold is a high-value commodity, you may need to invest a significant amount of money in it to make it an inflationary hedge.

There is no yield. You won’t earn a yield—such as a dividend or interest payment—for holding physical gold.

It cost money to hold. In fact, you may end up paying certain costs just for owning gold directly. You will incur costs for transporting, insuring, and storing your gold.

Be aware of transaction costs. There are also transaction costs associated with buying and selling gold. These costs are usually higher than purchasing other investments such as stocks.

Liquidity might also be an issue if you own gold. It takes longer to buy and sell physical gold compared to an electronic stock trade. This might be a problem if the market is falling, and you want to cash out quickly.

Historically, hyperinflation ends when the government finally takes extreme measures. The government may drastically reduce spending or institute currency reform. “Dollarization” is a type of currency reform that requires the government to replace the use of the domestic currency with that of another country. The replacement currency does not have to be the U.S. dollar, although it frequently is.

The benefit of dollarization is that it helps stabilize the value of money and reduce the inflation rate. It requires the government engaging in dollarization to give up its autonomy in making its own monetary policy. In effect, the nation now relies on the monetary policies established by the government of the foreign currency.

A drawback is that the foreign government will make monetary decisions that are in the best interest of its own nation. These policies may have a negative result for those nations who have abandoned their own currency in favor of dollarization.

To avoid the pitfalls of dollarization, Brazil combined cost-cutting measures to reduce government spending with a monetary reform system known as “Plano Real” or the “Real Plan.” The reform relied on a transition currency—known as the Real Value Unit (URV – Unidade Real de Valor)—to bring price stability back into the marketplace. The URV was a unit of account used during the transition period before the adoption of the new Brazilian currency, the Brazilian Real, in 1994.

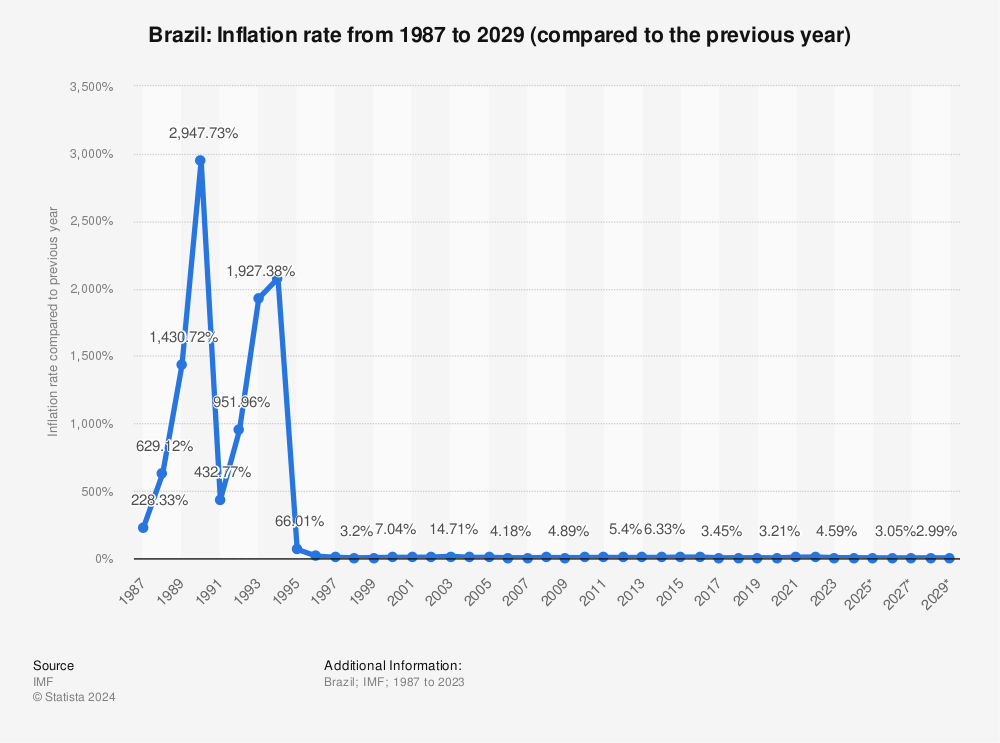

The success of the Plano Real is clear from this graph that shows Brazil’s inflation rate before and after the plan’s implementation.

Prior to the implementation of its “Plano Real,” Brazil suffered over a decade of hyperinflation. The new government plan worked remarkably fast, slashing inflation from about 2,000% annually in 1993 to approximately 22% in 1995. Brazil’s inflation rate has been in the single digits since 1997.

Hyperinflation is a rare event, occurring most often in developing countries that are undergoing significant political or economic stress. As we have seen from historical examples, it often occurs during times of war or economic downturns. A government’s ineptitude at managing the economy and monetary supply can cause or worsen hyperinflation.

Inflation is a more common event. Most countries have experienced times of high inflation that have eroded consumers’ purchasing power. As an investor, you should take some simple measures to protect your portfolio from the negative impact of inflation.

A good first step is to review all your current investment types. Make a list of all your holdings, such as retirement funds, brokerage accounts, and savings accounts. Review how each investment type might be affected by an increase in inflation. You may find your investments are overweighted in one asset type that typically does not do well during high inflation. If so, consider a diversification strategy that promotes hedging and spreads your risk across different asset types.

Institutions like the Cato Institute and central banks track hyperinflation using indicators such as the Consumer Price Index (CPI) and the rate of increase in money supply. These indices measure the changes in the price level of a basket of consumer goods and services, providing valuable data on the rate at which the general level of prices for goods and services is rising, and subsequently, the purchasing power of the currency is falling.

Hyperinflation can lead to recession as it destabilizes the economy and leads to uncertainty, causing businesses to hold back on investments and consumers to cut back on spending. It can also undermine the local currency’s credibility, disrupt the financial system, and contribute to a negative economic growth.

Hyperinflation is generally considered bad as it erodes purchasing power, destabilizes economies, and can lead to severe economic recessions. It disrupts normal economic behavior and can drastically lower living standards as prices of goods and services skyrocket.

The worst case of hyperinflation in history occurred in Zimbabwe in the late 2000s, with a monthly inflation rate of approximately 79.6 billion percent, according to the Cato Institute. The situation was so extreme that the government had to abandon the Zimbabwean dollar and introduce a new currency.

During hyperinflation, people often resort to bartering goods and services due to the local currency’s depreciating value. Others may seek to hold and transact in stable foreign currencies or tangible assets like gold, and focus on basic survival necessities like food and medicine, adjusting their spending habits to prioritize these essential items.