by David Craik

June 6, 2018 Updated October 22, 2023

1583

6 votes

Reading time: 10 minutes

“Buy the book before the coin.”

Coin collecting can be a fun hobby, and also extremely profitable.

It’s the ultimate Lazy Trader investment – identify the best modern and ancient coins to buy, store them safely and securely and sit back and watch their value rise year after year.

With some coins going for over $10 million, it’s no wonder there are over 615 million coin cllectors worldwide.

In this article, we’ll teach you how to join them.

Coin collectors are known as ‘numismatics’ originating from the Greek word ‘nomisma’ meaning coin.

The pursuit of coin collecting was once known as the ‘Hobby of Kings’. Indeed, according to the US Mint the earliest recorded coin collection was held by Augustus Caesar, the first emperor of Rome living between 63BC and AD14.

In the Renaissance period – around the 12th century – coin collecting was taken up by scholars enthralled by the artistic, cultural and historical elements of the hobby.

But now, it is not just for the great and the good. Everyone can hold a valuable piece of history in their hands.

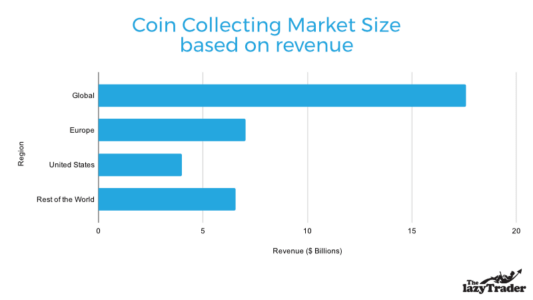

According to Mhojhos the global numismatics market is worth around $17.59billion in annual revenues.

Coins can generate huge values at auctions mainly driven by their condition and rarity value. In March 2020 at the Stack’s Bower auction in the US, an 1854 S half eagle coin worth just $5 when minted was sold for $1.92million.

“The first coin to set a price record at the million-dollar level ($990,000) was in 1989 when the world-famous Dexter 1804 silver dollar sold at auction. Since then, hundreds of coins have sold for prices that have exceeded $1 million,” says expert Mark Ferguson or the American Numismatic Association”.

“A 1794 silver dollar sold for $10,016,875 in 2013. Some insiders are already setting their sights at $100,000,000 as the next price frontier in 20 years or so for famous high-end rarities.”

The 1794 silver dollar also known as the ‘Flowing Hair’ dollar, as it features the long locks of Lady Liberty on one side and an eagle on the other is a good indicator of how coins can rise in value. America the beautiful quarters, lincoln cents buffalo nickels are other popular united states coins.

Believed to be one of the first silver dollars struck by the United States Mint it was valued at $1,250 when purchased in 1947, $264,000 when bought in 1984, $506,000 in 1991, $2million in 2002 and $7.8million in 2010.

But you don’t have to rely on rare coins to make money.

According to the Knight Frank Luxury Investment Index the value of coins as an investment asset has soared by 72% over the last 10 years. That compares with a 25% rise in the FTSE All Share Index over the same period.

Instead of investing in shares or relying on bank interest coin collecting can bring you more value, return, personal enjoyment and the physical closeness of ownership.

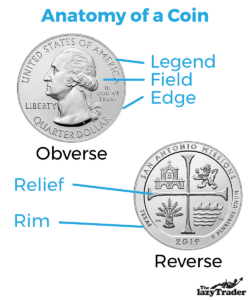

To truly love and value something you need to know its characteristics. Here are the common vocabulary around coins.

These are the types of coins that could make you money.

Coins minted from precious metals such as gold coins, silver and platinum. They are not typically used on a daily basis.

Proof coins are the highest quality of coin that a Mint will produce. They are struck out of platinum, gold, silver or base metals, using hand-finished dies to ensure that there are no imperfections. They typically have distinctive designs on either side.

According to Bullion by Post, it can take up to an hour to strike 50 proof coins compared with the 3,000 per hour rate for bullion silver coins. Only a small amount are issued every year giving them rarity value and therefore high prices.

A recent example is a limited edition ‘The 95th Birthday of Her Majesty the Queen 2021 £5 Gold Proof Coin’ struck by the Royal Mint and featuring a design by a heraldic artist. It is priced at £2,590.

As outlined by Bullion by Post they tend to have the abbreviations BU, B.U, or B.UNC in product names.

“The hand-finish is excellent for these coins but lacks the mirror-like sheen of the proof coins,” it states. “BU coins are struck twice in the minting process, making them twice as

quick to produce compared to proof coins for only marginally less quality.”

Mistakes made on any coin from the design to the lettering, or colour which gives it rarity value. One example on the coinhunter.co.uk website is a bronze coloured 20p coin – should be silver – with a guide price estimate of £750. Another could be the misspelt name of a Monarch. King Enry VIII for example!

Your everyday general circulation coins – the ones that are jangling in your pocket right now. They can prove valuable if kept for the long term i.e., shillings.

Often issued by Mints to honour historical or special events such as coronations, famous battles or people.

Usually dating back to the times of Ancient Rome or Greece. They are often handmade with beautiful designs. A great example is The Brutus “Eid Mar” coin from 42 BC which marks the assassination of Julius Caesar. There is a picture of Brutus on one side and two haunting daggers on the other. Only 100 of these old coins are left.

Don’t just stick to coins minted in your own country, like U.S. coins – some of the most valuable coins are foreign coins.

These are coins where because of age, low mintage, numbers, circulation, distribution or a design error are few and far between raising their value like the half dollar.

The value of a coin often hinges on its condition – or grading. The better preserved a coin is then the higher the price that will be paid.

A grade helps a collector quickly identify the potential worth of a coin and gives certainty that they are getting what they paid for.

There is no universal grading system. Instead, there are three different coin grades – Average Raw UK, Average Standard USA Sheldon and CGS Numerical Grade.

Similarly, there are three primary grading companies – the UK CGS or coin grading service, the PCGS – the Professional Coin Grading Service in the US and the NGC or Numerical Guaranty Corporation

Let’s take the most valuable coin as an example.

In the UK grading it would be a Fleur-de-coin or FDC – usually a proof coin with no marks, wear or blemishes. Under CGS it will be CGS-90-100 or MS 66-70.

At the other end of the scale a coin which has significant wear, but the design is still distinguishable is graded by the UK as fair, CGS 1-4 and Badly Worn.

A very worn coin with vanished lettering would be graded Poor, No CGS or Worn.

| CGS Numerical Grade | Average Raw UK Grade | Sheldon Scale (USA) |

|---|---|---|

| 100 | Fleur-de-coin (FDC) | MS70 |

| 99 | Fleur-de-coin (FDC) | MS70 |

| 98 | Fleur-de-coin (FDC) | MS70 |

| 97 | Fleur-de-coin (FDC) | MS70 |

| 96 | Fleur-de-coin (FDC) | M69 |

| 95 | Fleur-de-coin (FDC) | MS 68 -69 |

| 94 | Almost Fleur-de-coin (aFDC) | MS68 |

| 93 | Almost Fleur-de-coin (aFDC) | MS 67 -68 |

| 92 | Almost Fleur-de-coin (aFDC) | MS67 |

| 91 | Almost Fleur-de-coin (aFDC) | MS66 -67 |

| 90 | NFDC | MS 66 |

| 88 | BU -NFDC | MS65 -66 |

| 85 | Uncirculated (Unc) - Brilliant Uncirculated (BU) | MS 65 |

| 82 | Choice Uncirculated (UNC) | MS 64 -65 |

| 80 | Choice Uncirculated (UNC) | MS 64 |

| 78 | Uncirculated (UNC) | MS 63 -64 |

| 75 | Uncirculated (UNC) or near so | MS 62 - 63 |

| 70 | AlmostUncirculated (aUNC) | MS60 -61 |

| 65 | Good Extremely Fine (GEF) | MS60 -61 |

| 60 | Extremely Fine (EF) | AU58 - MS60 |

| 55 | Near Extremely Fine (NEF) | AU55 |

| 50 | Good Very Fine (GVF) | AU55 |

| 45 | Good Very Fine (GVF) | AU 53 |

| 40 | Very Fine (VF) | AU 50 |

| 35 | Near Very Fine (NVF) | EF 45 |

| 30 | Good Fine (GF) | EF 40 |

| 25 | Good Fine (GF) | F35 |

| 20 | Fine (F) | F30 |

| 15 | Near Fine (NF) | |

| 10 | Very Good (VG) | |

| 8 | Very Good (VG) | |

| 5 | Good | |

| 4 | Fair | |

| 3 | Fair | |

| 2 | Fair | |

| 1 | Fair |

Go to an auction or buy from a coin dealer. You can find a reputable dealer or auctioneer from the British Numismatic Trade Association website, the Professional Numismatists Guild or PNG in the US and the International Association of Professional Numismatists.

You can also buy coins directly from mints such as The Royal Mint or at coin trade fairs and shows.

Buy through auction marketplace eBay but be careful. Don’t bid on private auctions where the seller does not reveal their name or those where there is no seller feedback. Another mark against eBay is that it is difficult to see and the true grade of a coin.

Watch out for fake coins made not amongst the olive trees of Ancient Greece but above a fish and chips shop in Rotherham. It really needs an experienced eye to spot a fake such as uneven rims, design inconsistencies, or a grainy texture on the coin’s surface resulting from casting.

Affordability

It is an affordable hobby compared with other potential investments such as art or fast cars. For example, you can buy a 2020 Winnie The Pooh brilliant uncirculated coin from The Royal Mint for £10.

Increasing in value

Coins are a perfect long-term investment as they typically increase in value as decades pass. Bullion coins are a great hedge against inflation.

Fulfilling

It can be an exciting and educational hobby opening you up to historical times, characters and events you never knew about before.

Market liquidity

It is a very liquid market i.e., there are millions of other numismatists around the globe looking to buy and sell.

Storage

Coins are very low maintenance and are easy to store.

You won’t earn interest or dividends with coins.

It’s not for the ‘get rich quick’ short-term investor unless you are extremely lucky and find an exceedingly rare coin worth millions of pounds.

As they are a physical asset, they can be lost or stolen leaving you with nothing.

The value of some coins made of gold, silver or platinum can fluctuate in relation to metal prices.

It can take beginners a lot of spare time to research coins and track them down as well as going to coin auctions or trade fairs.

Coin collecting is one of the easiest hobbies or investments to start at any age. That’s because they are always with us – in our pockets, in or purses or scattered around the car.

The key is to be patient. Don’t go out and buy hundreds and hundreds of coins. Only look for those that you believe are going to appreciate in value over time and fit in with your collecting strategy.

Given that much of a coin’s value is to do with its condition you need to be careful with handling and storage. Invest in some soft cotton gloves and specialist coin holders, folders, acid-free paper envelopes or air-tight albums.

You want to avoid soft plastic and anything containing PVC as this could lead to your coins emitting a sticky green slime!

Store your collection in a cool and dry place such as a safe. For coins of high value, a bank may be the best option.

Globally, individual investors put approximately 10% of their investible assets into “treasure assets” or “investments of passion.” Coins and paper money are collectibles that are time-tested as a hobby and are part of a vibrant, liquid global market. Furthermore, the coin market benefits from ties to precious metals markets.

Market values of rare coins are easy to look up in price guides by finding a coin’s date and mintmark in the guide and finding the price listed in the coin’s grade column. Auction houses, collectors and dealers recognise the grades given to coins by the top third-party grading services.

Another plus for rare coins is that anyone can participate. You don’t need millions of dollars to buy high-quality rare coins. In the American market, high-grade coins can be purchased for a few hundred or a few thousand dollars.

Where to begin? During the past couple of decades, new collectors have largely been introduced to coins through ads, websites and new issues rolled out by the government and private mints around the world.

But there’s a world of rare coin treasures awaiting discovery by new collectors in the form of earlier issues. The United States began minting coins in 1792 and there is a multitude of interesting coin designs, denominations and metals to choose from in building a collection investment.

A great resource in which to explore earlier issues is in the CoinFacts section of the PCGS website: www.PCGS.com/CoinFacts. You can also find listings of the various coin issues that make up a series, such as Indian cents, Morgan silver dollars or Saint-Gaudens double eagles.

If you plan on investing a sum of money in rare coins that’s substantial for you, find a trusted advisor or mentor. There is a saying in numismatics that’s worth remembering,

Coin collecting can be both a fun and valuable hobby. It can open new doors to the past, enlighten your mind about old civilisations, events and people from history.

It can be thrilling identifying, finding and then buying a coin to add to your collection.

Over the long-term, coin collecting can also prove a sound passive investment. The value of those jangling bits of metal increases as the years go by.

It’s something you can start this moment, by opening your purse or your pocket.

What will you find?

The collection of coins is called “numismatics.” People who collect coins are known as numismatists, and they often study the history, designs, and production of various coins from around the world.

While coin collecting can be a rewarding hobby, it’s essential to do proper research, learn about grading and authentication, and have realistic expectations about potential financial returns. It’s also crucial to collect coins because you enjoy the process and are passionate about the subject, rather than focusing solely on their investment potential.

As a beginner, it’s essential to focus on coins that interest you and match your budget. Remember, the best coins to collect are those that genuinely interest you. Start by learning about various coins, reading books or articles, and visiting coin shops or shows. As you gain experience, you can refine your collecting focus and expand into more specialized areas.