October 11, 2022 Updated October 22, 2023

211

1 votes

Reading time: 12 minutes

This reversal pattern takes three days to form

All uptrends in stock prices reverse eventually. That doesn’t mean they go down to zero value, but it does mean they drop in price intermittently. You can spot when uptrends sputter out if you read price charts, particularly candlestick charts. There are a number of patterns called “reversal patterns”, one of which is the evening star.

The Evening Star is one of those. If you are in an asset that has been rising in value, the Evening Star pattern may appear on the chart, signaling that it may be time to sell. This is a fairly reliable pattern you should pay attention to. Learn to spot this pattern so you can avoid investing in an asset that is about to turn downward, or to know when to take your profits.

. Typically, you will see an up day followed by a day where prices stall, and then a significant drop on the third day.

As you look at the chart, think about buyers “giving out.” People are not buying the assets enough to drive them up, and sellers have taken over. When sellers take over, prices always drop.

This is a reliable pattern, mainly because it takes three days to form. Candle patterns that develop in a single day lack confirmation. In contrast, the Evening Star shows you an unfolding story of stalled prices.

No pattern works all the time; use candlestick patterns as a suggestion rather than as an irrefutable signal.

Studying chart patterns is “technical trading.” The other approach is called “fundamental trading.” Compare the two methods. (You may use both if you wish.)

The Evening Star is a technical trading tool, so using it means you have to develop skills and discernment. There are pros and cons.

Technical trading gives you an objective view of the price action. This helps you avoid panicking or getting greedy because you can see what is happening. It is often said that technical traders respond to what happens, not what they wish would happen. The Evening Star pattern shows you exactly what price trends are occurring, so you will stop looking for what you want to happen.

Evening Stars have proven themselves for many years. What have they proven? They have proven that most of the time when you see an Evening Star pattern, prices are headed into a downtrend. And “downtrend” means a sustained drop in prices, not just a pullback of a few days.

This pattern came into use in 18th century Japan when Munehisa Homma used this and other patterns to predict price directions for rice.

It is easy to find candlestick charts on most charting services. Most charting services offer a variety of chart types. Just select candlesticks as your chart type. These charts are easy to interpret.

You can visualize the price action and understand the highs, lows, and the open and closing prices of each day.

Charts are not about mere numbers. You can tell what traders are thinking.

The Evening Star is relatively reliable, but not 100%. You should use it as a suggested signal, not a hard-and-fast indicator.

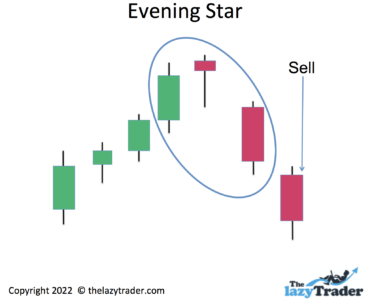

The Evening Star forms in three days. After that, it is likely you will be well into a downtrend that has cost you money.

Even a clear pattern can be derailed by sudden company or economic news.

Today, Jack Schwager is considered to be an expert on technical analysis. He has written books on the topic and uses the Evening Star pattern in his analyses.

India’s Sudarshan Sukhani is well-known for technical analysis and serves as President of the Association of Technical Analysts. The Evening Star pattern is part of his arsenal when evaluating chart patterns,

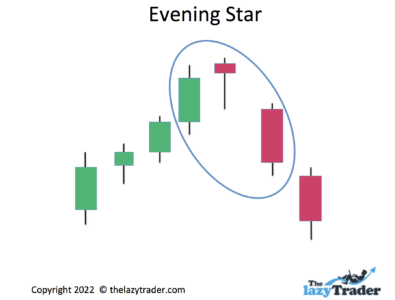

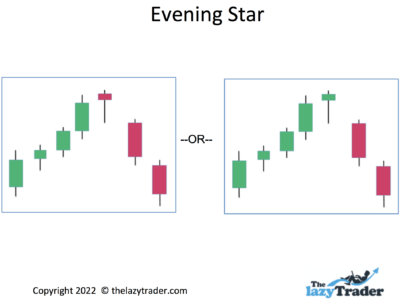

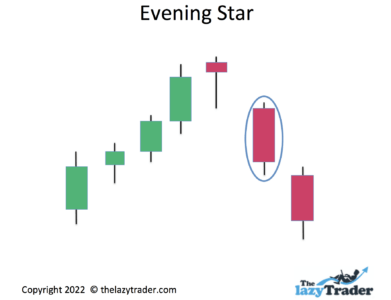

The difference in Evening Star patterns is the color of the middle candle.

An Evening Star is most reliable when the middle candle is red. This means the price on that day closed down from the opening. If the middle candle is green, you still have an Evening Star pattern. This just means that the price was slightly up but not convincingly so. The red middle candle is the most reliable version of the Evening Star.

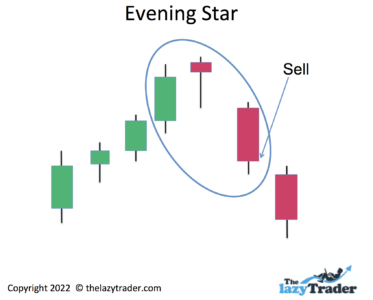

Tell yourself a story as you look at an Evening Star, upward prices continued on the first day.

Buyers initially drove the price up. Prices tried to rise but failed the second day.

Prices initially went up but settled back down. The third day shows a decline in prices.

As suggested by the Evening Star, sellers dominate.

You trade the Evening Star pattern by waiting until just before the close of the third trading day. At that point, you sell the position.

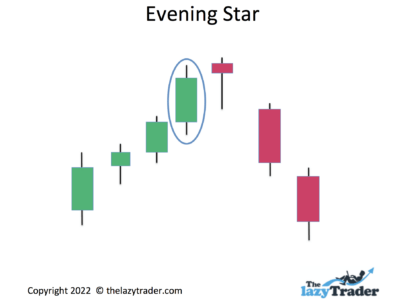

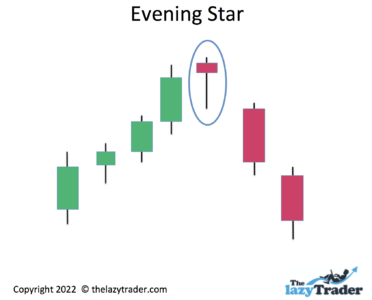

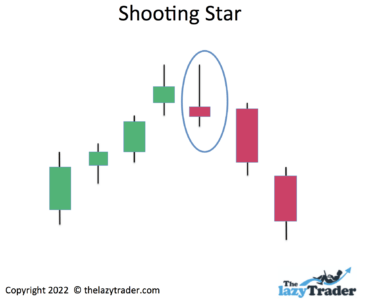

There is another pattern called the Shooting Star. This is a one-day pattern. You can watch for this pattern instead of an Evening Star. Note that a one-day pattern is not as reliable as a three-day patter

Though this looks similar to the Evening Star, note that the middle candle is much lower than the previous candle. This is considered a one-day pattern.

Prepare a strategy for trading this pattern based on your risk tolerance. A reversal in an uptrend can be an emotional time, so know what you plan to do in advance.

The Evening Star is an exit signal. Assuming you are already in a position, you “entered” the trade some time ago. However, if you are not in the position, don’t get in when you see an Evening Star.

You want to protect profits or present losses by existing as soon as possible. But you should wait until the close of the third day to take action because that is when the Evening Star will have fully formed. Here are some choices for the timing of your exit. Get out at the close of the third day.

Just before the close of the trading session, sell.

Sell at the open on the fourth day.

Choose your strategy based on how much profit you have. If you have none, get out on the third day. If you have profits that have built up during the uptrend, you can afford to wait until the fourth day or after.

When you sell and it turns out you were wrong about prices going down, you can simply buy the position again.

Be prepared to make changes to the trade. You can sell a portion of your position on successive days. Adjust your strategy according to what you see. For example, if you planned to get out gradually but the price is tumbling hard, change your approach and dump the entire position at once.

An Evening Star pattern is one of the patterns that traders use. Learn a variety of patterns by keeping up with books, podcasts, videos, webinars, and newsletters.

Start with the complete guide to candlestick trading.

Here are some other learning resources for you:

Trade What You See How to Profit from Pattern Recognition by Larry Pesavento

This is a book to help you recognize patterns in charts. It is especially useful for learning to find patterns while they are developing instead of merely identifying them after they have developed.

Trading In The Zone by Mark Douglas)

This book on general trading principles covers eliminating bad habits and remaining consistent in your strategy. It shows how to trade probabilities and ignore anomalies. –

Udemy Technical Trading

Udemy offers a comprehensive guide to all aspects of technical trading and is a reliable source for valid information. Though they promote their courses as part of this course, you won’t get come-ons to draw you into long-term commitments.

Travis Rose

This is a good place for beginners to start. Rose covers all the basics and leads you through the analysis of technical patterns.

Bullish Bears

A learn-as-you-go approach works well at Bullish Bears. You build your skills systematically while actually trading. You can elect to make practice trades with no actual money invested.

Read blogs offered by a pro with a track record. They should you through technical setups in the marketplace. Here are some to look at:

Adam H. Grimes

Grimes has more than 20 years of experience and covers all types of trades, from breakouts to reversals of trends. His posts walk you through trades and keep you abreast of current market trends.

Top-Down Charts

The emphasis here is on the macro trends. Great for learning how macro trends affect individual charts.

Marc to Market

This daily blog focuses on forex. Note that many of the technical trading principles of forex also apply to trading stocks.

Be aware that forums allow anyone to express an opinion. Take all advice in stride, as you don’t always know the credentials of the poster. Some popular ones:

Elite Trader

Elite Trader offers forums on every type of trading style and approach. It is a good idea to join discussions that may be outside of your current interests so you can learn about various methods. Look at the general technical forums first, then launch into technical forums on stocks, forex, commodities, etc.

Morningstar

Morningstar forums have some quality input from experienced technical traders. You won’t find any wild observations or insights here, but remember that not everything in a forum is reliable.

Traders Laboratory

This discusses ideas and strategies for both long-term and short-term trading.

Look for newsletters from seasoned pros. A good newsletter will give you tips and specific recommendations.

The Technical Indicator–Marketwatch

Here you will find in-depth chart analysis. This is the most helpful learning method because each newsletter uses current technical setups. You can see actual patterns developing.

There are many newsletters among the Morningstar offerings. Select areas of technical analysis, and follow them regularly to get a knack for spotting trends.

Choose an expert, not just someone selling courses.

Technical Analysis Radio

Interviews and tips on technical trading.

The Weekly Trend

This podcast covers all markets and focuses on technical analysis.

YouTube is a place where anyone can offer an opinion. Confirm whatever you learn there by looking at multiple sources. Here are some good videos to get you started.

Candlestick Pattern Trading #12: What is an Evening Star by Rayner Teo

Here you can walk through trades on various versions of the Evening Star.

How to Trade the Bearish Evening Star Pattern by UK Spreadbetting

This video gives details on recognizing and trading the Evening Star.

Evening Star Candlestick Pattern: Multiple Candlestick Patterns By Shobha

Webinars can be sales pitches masquerading as instruction. Be careful.

Online Trading Academy

This provides solid advice on technical trading, with examples.

Technical Analysis–Fidelity

Fidelity is a reliable name, and the variety of technical trading webinars here adds a comprehensive and trustworthy series that can help you profit.

The Evening Star forms over three days. You have to act at the right time to protect profits. If you are not the type who likes to get in and out of positions, this pattern may not be for you.

Watch price action daily or weekly, even if you are doing well in a position. Evaluate what is going on and watch for signs of trouble. In other words, be vigilant and remain ready to take action.

Build wealth slowly. Do not panic every time you trade, and do not get greedy and hold. Investing is not gambling. Build wealth slowly instead of trying to make a killing in the market.

Never place more than 1-2% of your account value into any trade.

While it is understandable that you may adjust your strategy according to what is happening, at least have one in place to work from. Make rules about how much loss you will tolerate, and stick to those rules. Do not ride an Evening Star pattern down and down, hoping it will go back up. Take a deep breath and sell when things go against you.

Track how you are doing. Note when you made good decisions, and count your mistakes. You are your own best teacher.

Look for a platform that offers candlestick charts. Here are some:

This platform allows traders to communicate as you do on Twitter and Facebook. You can share trading ideas and experiences with other traders. This site offers a wide variety of investment vehicles, from stocks to cryptocurrencies. The stock offerings are worldwide, making this a good place to invest internationally. The demo account works in real time so you can watch patterns develop and track what your profits and losses would have been if you had invested money. Stock trades are free.

Ava offers platforms for multiple experience levels. You can automate your trades and follow expert traders to learn from their insights.

This platform is not available in the U.S. Naga allows you to copy the best traders on the platform.

This forex and CFD broker makes it easy for traders to get started quickly.

FP uses the Autotrade tool, which allows traders to copy trade. It offers live statistics, along with risk-management systems. You can see the entire trading history of the most successful traders and mimic their methods.

The platform allows a low minimum deposit. Those trading for the first time can get started here. Free demo available.

This platform works well for technical traders. You can see a variety of charts to identify patterns, and this includes, of course, the Evening Star pattern. You can go straight from the chart to placing a trade order. There is no cost for online trades; you can trade from your phone. You can use the paperMoney account to practice trading without actually investing money.

This is a good place for beginners because you open a free account and get immediate access to the demo version. The site includes thousands of international stocks. When you decide to start investing, the minimum deposit is only $20. You will find good educational and research sources here.

You can trade stocks from 25 markets worldwide. Importantly, you can buy fractional shares. This is good for expensive stocks where one share can cost hundreds or even thousands of dollars. You can buy a fraction of a share for much less. The demo account, Active Trader Pro, allows you to place as many as 50 orders at once (no actual money is invested). You can use technical indicators and create your own charts.

You can access the free demo without even opening an account. Here you can “paper trade” thousands of stocks from the U.S., the U.K., and Europe. Even when you decide to open an account and invest real money, there is no charge for trades.

Trend – A Trend is a sustained price direction (either up or down). “Sustained” usually means weeks. For example, traders usually call a brief downtrend a “dip” or a “pullback.”

Uptrend – Prices tend upward for days, weeks, or months. The movement is not always up–there are some down days–but the overall trend moves higher.

Downtrend – Prices slope downward on a chart for days, weeks, or months.

Pattern – Over time, the price action will form a “shape.” Traders have come to recognize that these shapes have occurred throughout trading history.

Multiple-day Pattern – The Evening Star is one of several multiple-day patterns to watch for. It is a more reliable signal than a candlestick that forms in one day.

Reversal Pattern – A reversal is a change in price direction. There are reversal patterns when prices reach a top or a bottom, and you should know both.

Exit or Sell Point – You can decide in advance of a purchase when you will get out. This can be a specific price or a percentage gain.

Stop-Loss Order – You place a sell order that automatically triggers if prices drop to a specific point. You choose this based on your tolerance for losses.

Getting Stopped Out – This happens when you set a stop-sell order too close to the current price. Normal fluctuations can cause the price to drop momentarily, triggering a sell order when you don’t want one.

Target Price – Many analysts name a target price for an investment, meaning they think it will rise to that point. Don’t follow these blindly, analysts can be wrong.

Top – A “top” is the highest point an asset has reached in its current uptrend before turning downward.

The Evening Star pattern comes after an uptrend. You may see something that looks similar during a downtrend but consider that a continuation pattern. Your pivot point should be the top of an uptrend. The longer the uptrend has been, the more likely it will reverse.

An Evening Star after a long uptrend means a reversal is more likely. Do not use only one pattern for your trading. There are many bearish reversal patterns and you should familiarize yourself with all of them. Learn something new about technical trading every day.

It is accurate about 72% of the time. That is very high for a technical indicator.

It is bearish. Expect prices to go down.

Sell your position on the third day when the pattern is complete. Why is it called Evening Star? Think of it as the sun setting on the good times. Time to prepare for a dark night.

The risk is that prices will bounce back up. But you can always buy back in.