by Louis H-P

June 29, 2021 Updated October 22, 2023

430

2 votes

Reading time: 1 minutes

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also.

Momentum investing has become a popular investment strategy in the 21st century.

Yet, stock markets throughout time have been driven by momentum at one time or other. In this article we cover all that you need to know about momentum investing so as to help understand how you could use it for your personal success.

At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

Price momentum is the change in the speed of a price of a security or stock price.

The velocity in the movement of the price of a security can increase or decrease in short periods of time. This momentum can be upwards or downwards.

This attracts traders and investors who sense an opportunity to make easy and quick money. They will often focus on the chart pattern as opposed to understanding the fundamentals of the business.

A trader or investor will seek to identify a security whose value may suddenly increase due to a news release or other financial media comment. These other factors can be as simple as retail investors following each other without analysing what they are buying.

Some traders will seek to ride a momentum factor as their trading strategy. So if a security has already displayed momentum and an investor believes it will continue, they will jump on for the ride.

Securities that typically end up with strong momentum will often sell a concept, megatrend, or are seen as disruptive (Think Tesla stock).

This creates a wave of opportunism which leads other investors to want a piece of the action.

Momentum trades are often found in a bull market, where the strong buying biases across the board, creates a situation where every asset price increases in value. An example would be Bitcoin whose momentum continues to defy logic and expectation.

It is impossible to invest in the stock market with some form of downside risk, such as a market correction. Momentum investing is no different. Below we have highlighted the risks specific to momentum investing strategies.

This has become an increasingly big part of all forms of investing and is responsible for pushing many asset prices out of kilter with reality.

This occurs when an investor has missed out on a large gain in an asset that many others have benefited from. Typically the asset in question will have extensive media coverage. Recent examples include Apple and Amazon in the early 2000s and Tesla and Bitcoin in 2020.

This is directly linked to FOMO. As everyone chases the same trade, the value increases to beyond any reasonable value.

This creates a situation where late-arriving investors are essentially buying when many/the majority are looking to exit. It also creates other issues around exiting the trade and where investors are focused on trading the news.

If you buy an investment that is small in value, it is likely there will be a reduced number of shares to trade. If you decide to exit this investment at the same time as everyone, there may not be enough buyers and you will be stuck.

When momentum changes, it changes very quickly. As a result investors will rush to log into their trading accounts. Yet many of these platforms struggle to handle such a surge of clients logging in and you can be blocked from placing that key buy or sell order you wanted to. This happened to eToro investors who were locked out in February 2021 when cryptocurrency trading became volatile again. This has affected other platforms. It can be an idea to have accounts with different brokers.

You could blow up your account and worse, be asked to add more cash if a momentum trade goes the wrong way. Most brokers are keen for you to take on leverage as this is how they make your money. The problem is:

The market can be irrational longer than you can stay solvent.

As a result, keep the amount of leverage as low as possible and ensure you use stop losses to give some form of protection.

This is to warn you to be prepared for a specific risk you were not/never expecting. Many major hedge funds lost big when retail investors took on the hedge funds. Few if any of these hedge funds would have been watching Reddit day trading boards and were likely to slow to react when they did. You should therefore be prepared to adjust quickly to new risks.

When a systematic risk strikes, it takes everything with it. These happen regularly over time. Recently the lockdowns imposed by governments were not expecting by many. The Kobe earthquake is another example of a systematic event that caused the Nikkei to fall sharply (and in the process flush out the rogue trader Nick Leeson).

Yes, it is.

Fundamentally you are buying stocks that are going up.

The problem you will have is to decide which upwardly mobile stocks you should ignore. These may be flash-in-the-pan type stocks that crash and burn later.

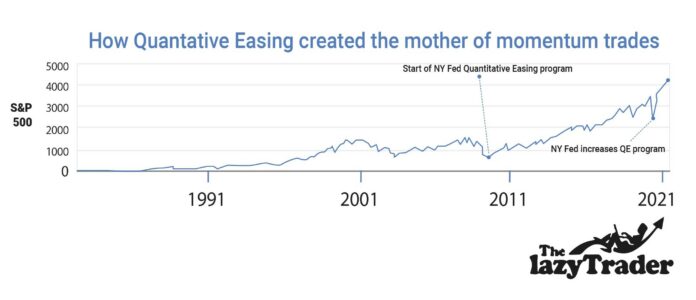

Whilst the New York Fed continues with its quantative easing program, the seemingly endless market rally will continue. If inflation re-appears in a meaningful manner, then the Fed will want to raise interest rates. This will make momentum stocks less appealing.

This scenario will give rise to value stocks re-entering favour. There will always be stocks with momentum, but the future is likely to see less momentum across the board as we have seen over the past two decades.

These change constantly, so it is difficult to name specific names. To identify these, beginners should focus on a trend. For example, any carmaker in the electric car space will likely be popular and might outperform other more traditional car companies.

The same with companies that can solve problems using technology or reduce carbon emissions through environmental initiatives. A tech company that is able to produce the latest online media craze is another example.

It takes time and experience to identify price trends.

Like Richard Driehaus, the father of momentum trading, you may get lucky and be successful with your first trade, but that can be a misleading benchmark and give you a false sense of confidence.

Equally, you may lose out on your first trade but develop into a good momentum trader.

Whichever it is, there are some simple steps to follow to increase your success and reduce your risk of loss.

To identify an opportunity you have to understand it. Although the finger-up-in-the-air-approach to work out wind direction is fine, over the long term this does not work.

If you read regularly about companies and markets, you will gain an understanding of how the investment reacts to news, and you could profit.

If there is a sudden spike in the price of the asset, or better for a substantial drop you will already know if this is an over-reaction / over-pricing. This then gives you the information advantage to buy before the moment sets in.

Market timing is incredibly difficult, especially if the move has started. If you follow investments regularly, and have some understanding of technical analysis, you will know when there is an opportunity to buy at a discount.

Although difficult to understand for risk-averse traders, when the volatility is highest and fear has entered the market, this is often the best time to buy, as when momentum switches back to the upside, you are in a position to benefit.

Ideas to implement this are if there is a bad day of trading, say markets start the day down immediately, then buy in the late afternoon, when panic may have increased.

You will be sure that the next morning when rationality sets back in after traders have slept on it, asset prices will bounce back. Indeed you can often find attractive prices for high returns on a Friday afternoon in a sell off situation as traders fear holding onto positions over the weekend.

Before you invest and once the investment is in the money, it is useful to give some thought as to when you intend to exit the trade. Although you may be tempted to hang on, you may hang on too long. You could end up losing a substantial part of your profit when everyone does a sector rotation before you do. Even professional investors can be too slow.

This is also good discipline because as others lose their heads and get caught up in the momentum, you are exiting. This means you can identify your next opportunity before anyone else does.

Once a trade starts to go right, you will notice the profitable side of it increasing quickly. This may also mean that it becomes an overlarge position within your stock portfolio , whic creates a concentration risk.

By reducing your position, you still benefit from any upside by you also ensure you bank some profit. You simply never know when the momentum will turn against you. You don’t lose money by reducing a profitable position.

Determining momentum comes in two parts. Either it is about to happen and you have already identified the opportunity or it is happening and you are joining in after hearing about it through the news or friends. The following should help you with either.

Keeping abreast of the news is sensible for all manner of reasons.

Serious papers and business papers will often explain why something is important, this increases your ability to understand a potential dislocation in price and, therefore if there is an opportunity to be had for higher returns.

Unless it is a long-term momentum trade, something which appears in the news will already have ‘priced this in’, so do not expect them to give an immediate trade.

Are there factors that are affecting business and may cause a change in the business environment?

Brexit made Britain unpopular as a place to invest, which led Sterling to hit multi-years lows… A government with a strong majority can lead to a change in momentum – i.e. upwards!

When the Covid lockdowns were imposed, where were there stocks which would benefit? The increase in price of Zoom and companies offering working-from-home facilitators were examples of this.

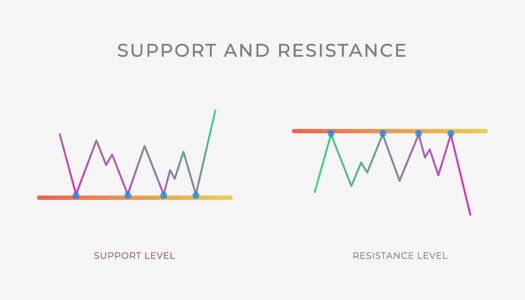

There is an entire subset in trading around reading charts and predicting what will happen next. This does not take into account any fundamental research and is uniquely focused on trading what is in front of you. Terms such as ‘breakout’ ‘Fibonacci’ ‘candlestick charts’ ‘support line’ ‘resistance line’ are used to assist in identifying a stock whose forecast momentum is about to change.

A sudden increase in the volume and market volatility of the shares will usually see a corresponding move in the share price.

This is an excellent indication that some form of momentum is about to occur. It is also possible to see a change in the Beta (volatility of an individual stock compared to the stock market), which will also highlight how a stock could be on the verge of a large move. This move could quickly develop into a momentum.

Momentum strategies are essentially all the same in that you are trying to buy something which is on the move. What is difficult is working out when to buy. Here it is useful to look at previous examples of multi-year momentum strategies as history has a tendency of repeating itself.

The title of this momentum trade should be a warning for all.

The word ‘bubble’ highlights how (too) far this trade reached. When it collapsed, and collapse it did, many lost a great of money as companies went bankrupt or were taken over a rock-bottom valuations.

From 1995 to 2000 when the bubble burst, the NASDAQ increased in value by 400%, only to then lose over three quarters of its value. FOMO pushed valuations of companies who were yet to turn a profit to incredible valuations.

Portfolio managers were even allocating 50%* of their portfolios to tech stocks as more and more professional investors chased returns. (*30% is seen as the maximum you should put in one sector).

This episode was a perfect display of how even professional investors are susceptible to the same failures that private investors are when it comes to overvalued stocks. Remember, use diversification, look at the longer time frame and time periods, and try to identify price movements based on the relative strength of your experience and confidence.

In December 2008, the New York Federal Reserve introduced a quantative easing program to support confidence and in particular liquidity in the markets. In what became known as the ‘credit crunch‘ investors stopped lending to each other due to the fear of default. The Fed’s QE program gave confidence to investors who jumped back in.

Over the coming months and years, propelled by this ‘new money’ markets recovered and were propelled to new highs. The mantra of ‘Don’t fight the Fed’ led to a multi-decade long momentum trade where the Chief Investment officer of the stock market was none other than the (NY Fed) central bank!

Momentum means buying the right stock or investment at the right time. There is an old adage that states to make your capital grow you need to:

Spend time in the market and not time the market.

Momentum investing often involves buying hot stocks, which are in turn the most volatile stocks. Volatility is seen as risky, because it highlights lack of stability with high trading volume.

You need to keep a close eye on market trends. That means interrupting your day at regular intervals. In turn this can be distracting from your day job.

Once you have spotted a share which is trending upwards, do you know why it has done so?

Could this be a short-term bounce or an over-reaction? You will only know this by understanding the company and what it does. This requires reading widely and regularly. You will also need to keep abreast of trading updates.

Without this knowledge you cannot make an informed decision as to whether this volatility or upwards move is truly worth it.

There is a risk, especially for technical traders, that you may open and subsequently close too many positions, leading to overtrading.

As a momentum investor, you do not necessarily have the luxury of patient trading, as you need your capital for another (potential) better opportunity you may have spotted.

Momentum investing has been the strategy to use in the 21st century. Without it your portfolio would have lagged behind many others. But this may not always be the case. Therefore let us explore the pros and cons of a more traditional buy and hold long-term trading approach.

Momentum is part of every strategy in some form. If you do not own the stocks which are in an uptrend you are not growing your portfolio or mutual funds and won’t receive annual returns.

Some firms require a little faith before becoming momentum stocks. Amazon nearly failed in the dot.com crash but has been one of the biggest momentum trades of all time.

If a share price is rising or the moving average is positive, then their usually something positive about it. You may not be the first to realise this but there is nothing stopping you from joining the crowd. As a result, you investing with the crowd rather than against. There is a risk the crowd is wrong though. (see below!)

Momentum value investing will sometimes mean owning total trash, which could lose all its value overnight. This is high-risk investing. With buy and hold, you can sleep soundly at night, safe in the knowledge you own quality investments.

Today’s investors is after a quick buck. Therefore any investment which has momentum will be fund others flocking to it. If you sold out before the herd did, great, but if not, we feel your pain. Some novice GameStop investors got burnt in this way. Essentially you need to know when to sell stocks – not easy.

This creates a dilemma for investors, namely what do you do? You can have the safe approach of dividend investing or chasing the latest new idea. The answer is somewhere in the middle. At any one time a few stocks will be propelled upwards by anything from thematic investing, fear of missing out or some excellent trade update. Not owning these stocks will detract from your performance.

Momentum investing can be a good strategy for some investors, as it involves buying assets with strong recent performance and selling those with poor performance, aiming to capitalize on market trends. However, its success depends on an investor’s ability to accurately identify and react to trends, as well as their risk tolerance and overall investment goals.

A famous momentum investor is William O’Neil, who is also known as the founder of the financial newspaper Investor’s Business Daily. O’Neil developed the CANSLIM investing strategy, which combines aspects of fundamental analysis with technical analysis and momentum investing principles to identify high-growth stocks.

Momentum investing can be risky due to the potential for increased volatility and the possibility of sudden trend reversals. The success of this strategy relies on accurately identifying and reacting to market trends, which can be challenging even for experienced investors.