Quick and Easy Ways to Simplify Your Trading

We often say that we're willing to do "whatever it takes" to trade successfully, even if that means a whole lot of "blood, sweat, and tears," right?

We often say that we're willing to do "whatever it takes" to trade successfully, even if that means a whole lot of "blood, sweat, and tears," right?

We often say that we're willing to do "whatever it takes" to trade successfully, even if that means a whole lot of "blood, sweat, and tears," right?

Well, the devotion is admirable, but I think that whole way of thinking is flawed, and I'll tell you why. It's because it implies that Forex trading has to be a frenzied and difficult process, and that it's always complex and all-consuming.

But what about the need to simplify your trading to ensure that it's efficient and sustainable over the longer term? And what about your desire to live life outside the markets, have fun, and not toil away in front of the charts for hours every day?

Sure, all told, patient trading is not easy, and this is not to imply that it is. The point here is that you shouldn't be so fixated on your continuing development that you forget to take steps to simplify your trading along the way. Here are a few things you can do quickly and with relative ease to do just that.

Takeaways

Takeaways

The easy ways to simplify your trading

How you can make money whilst enjoying life!

Find out how simplicity will make you so much more profitable

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also. At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers

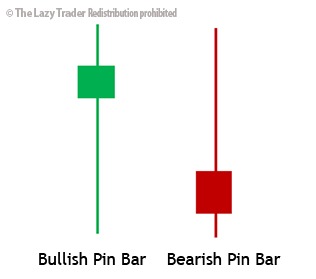

Fact: You can have a healthy and relatively stress-free career by trading just isolated trade set-ups in one market and on one time frame. There are plenty of traders out there who are doing it right now, in fact. From pivots or pin bar reversals in major currency pairs, which are a big part of the Lazy Trader methodology, to gaps in major stock indices, there are endless possibilities to fit the needs and varying personalities of every trader. There are many traders who only trade EUR/USD, for example, and by targeting your strengths—rather than trying to be a "jack of all trades"—you stand to not only alleviate stress, but also greatly simplify your trading.

Fact: You can have a healthy and relatively stress-free career by trading just isolated trade set-ups in one market and on one time frame. There are plenty of traders out there who are doing it right now, in fact. From pivots or pin bar reversals in major currency pairs, which are a big part of the Lazy Trader methodology, to gaps in major stock indices, there are endless possibilities to fit the needs and varying personalities of every trader. There are many traders who only trade EUR/USD, for example, and by targeting your strengths—rather than trying to be a "jack of all trades"—you stand to not only alleviate stress, but also greatly simplify your trading.

Think about your "bread and butter"… what market and set-up(s) you like trading the most? Also, check your trade journal and you'll quickly see which tend to be most consistent and profitable for you.

If you're trading multiple markets or set-ups because you think you have to, or because you think that's just what traders are "supposed to do," well, stop. You can start doing more with less and immediately simplify your trading just by eliminating non-essential markets and set-ups from your arsenal.

It's simple trading tips that works both in and out of the markets: do more of what you're good at and you'll immediately have more fun, and breed more confidence in the process. And what trader doesn't want that?

In trading, simplicity is using clear and efficient methods for analysis, risk management, execution, and money management. They become so familiar and your process so predictable that many veteran traders have even spoken candidly about battling boredom and solitude because their work is so repetitive day in and day out. It's funny, though, that you never see the pros out there trying to re-invent their trading or searching for "the next big thing," but inexperienced traders follow that temptation all the time. And, there's always some over-hyped new strategy or set-up to spur them on, too.

In trading, simplicity is using clear and efficient methods for analysis, risk management, execution, and money management. They become so familiar and your process so predictable that many veteran traders have even spoken candidly about battling boredom and solitude because their work is so repetitive day in and day out. It's funny, though, that you never see the pros out there trying to re-invent their trading or searching for "the next big thing," but inexperienced traders follow that temptation all the time. And, there's always some over-hyped new strategy or set-up to spur them on, too.

What are your trading goals? Hopefully, they're more focused than just "to make money," and to be certain, they probably don't include "mastering every available trading strategy."

See also: Trading Hang-ups That Bug the Pros, Too

If you're looking for consistency, success, and to maintain your lifestyle in the process, then you should take steps to simplify your trading, not complicate it. Make simplicity one of your goals, track it using your trade journal, and as you continue to learn and grow your skills, use good sense to refine what you do, increase efficiency, build repetition, and "trim the fat" by eliminating unnecessary steps.

Essentially, to simplify your trading, you want to get to where you just do the same things every time…provided they work, of course. And if they do, then why change a proven Forex strategy?

Fast-moving markets add an element of complexity that's all their own. The solution? End of day trading, when the impact of news and economic data is muted, and emotion runs relatively low, but opportunities still exist for clearly defined trades you can simply "set and forget." Lifestyle traders love trading end of day for the convenience, and for the fact that trading that way doesn't require spending hours in front of the screens. That means it's a great way to simplify your trading by eliminating difficult variables like the fear and emotion we often feel while watching trades in progress.

Fast-moving markets add an element of complexity that's all their own. The solution? End of day trading, when the impact of news and economic data is muted, and emotion runs relatively low, but opportunities still exist for clearly defined trades you can simply "set and forget." Lifestyle traders love trading end of day for the convenience, and for the fact that trading that way doesn't require spending hours in front of the screens. That means it's a great way to simplify your trading by eliminating difficult variables like the fear and emotion we often feel while watching trades in progress.

The set-ups are the same, and risk/reward profile remains unchanged, but end-of-day traders can often capitalize on powerful market moves that occur when capital flows back into the market overnight, and especially around the market open.

Then, when volatility kicks in and price action picks up, the end-of-day trader can be clear-minded, or maybe even oblivious to it, as they are going on with their lives and have proper risk controls in place so their position can simply unfold on its own.

If you want to simplify your trading, see if you feel comfortable trading end of day. You can always try back testing or demo trading to get a feel for it first, and once you do, you may wonder why you didn't make the transition sooner!

The rise of copy trading means you can copy the best human traders out there. If you do not trust human intuition you can always copy automated trading programs through mirror trading.

In trading, we're forever learning, and it's easy to get so caught up in what we still don't know that we underestimate the power of what we do. Trading becomes over-complicated when we keep adding to our methods, and in the end, more information and effort does not equal better results.

Instead, take strides to simplify your trading by eliminating under-performing markets and set-ups from your arsenal, making simplicity one of your non-monetary trading goals, and perhaps even trying end-of-day trading. Any one or all of these things can help you get more out of your existing skills and make an immediate positive impact on your performance.