by Louis H-P

November 15, 2021 Updated October 22, 2023

597

2 votes

Reading time: 15 minutes

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also.

As a consumer, you are undoubtedly familiar with the negatives of inflation. As prices rise, you will spend more and more just to cover the necessities of life. For you, the prospect of inflation might mean endless stretching of your budget (and a bit of sacrificing) to cover your daily expenses, or personal consumption expenditures (PCE).

As an investor, however, you might have a much different perspective on inflation. For you, inflation offers significant profit opportunities if you know where to look and what to do. In this guide, we not only define inflation and identify its causes, but we also highlight specific investing strategies you can use to preserve your buying power and grow your wealth during times of inflation.

At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

Inflation measures how much prices of goods and costs of goods and services have gone up over time, usually a year. Economists express the rate of inflation as a percentage increase.

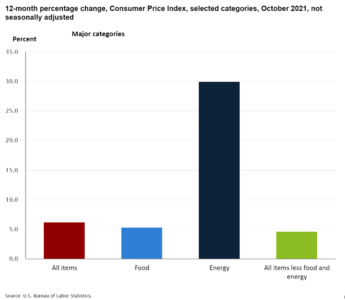

For example, in November 2021, the U.S. Bureau of Labor Statistics reported that inflation increased at the fastest rate in three decades. From October 2020 to October 2021 prices for all items rose 6.2%. Prices for food increased by 5.3%. Energy costs skyrocketed by 30%.

Inflation is not a new phenomenon. Inflationary periods are common and have occurred in many societies throughout history.

For example, in the 13th century, China suffered under high inflation when Kublai Khan’s government printed large amounts of paper money to pay for expensive wars. Between 1525 to 1618, Western Europe experienced a long-term “price revolution.” This was an inflationary period caused in part by the influx of silver coins from the American colonies. In the United States, the annual inflation rate spiked from a little over 1% in 1964 to over 14% in 1980. Economists labelled this “The Great Inflation.”

One significant way inflation risk impacts your daily life is that it erodes your purchasing power. Purchasing power refers to the amount of goods and services you can buy for a given unit of currency. As inflation increases, it takes more money to buy the same goods and services you previously bought for less money.

Excessive core inflation (such as hyperinflation) can push down a currency’s purchasing power to the point that even if your salary increases, it may not be enough to keep pace with price increases. You will see this higher cost of living in the increased prices you pay for the basics, such as housing, food, and healthcare.

The International Monetary Fund (IMF) points to four main causes of inflation:

A price index is a way of measuring the average prices over a period of time in a specific region for a set of goods or services. A price index is useful in determining the rate of inflation.

Ideally, a price index would measure inflation by tracking the change in prices of every item purchased by every household in a nation. Of course, this would be impossible to do. So, most countries choose to create an “inflation basket.”

This basket consists of a selection of consumer goods and services representing the items purchased by households. A typical basket of goods includes basic foods and beverages such as milk, tea, coffee, cereals, fruits, and vegetables. It can also include prices for housing, healthcare, clothing, furniture, entertainment, transportation, education, and other items.

A government might track hundreds of prices, reporting price changes monthly. Over time, the items in the basket might change as consumer buying patterns fluctuate. An example of this would be the inclusion of new tech products and electronics.

Two common indices that use “inflation baskets” are the retail price index (RPI) and the consumer price index (CPI).

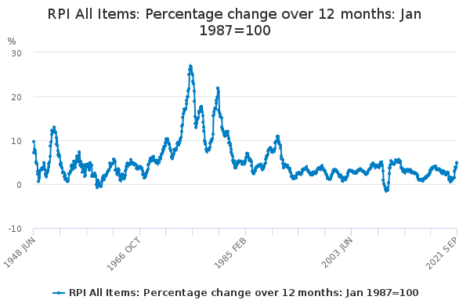

The United Kingdom’s Office for National Statistics began publishing the Retail Price Index (RPI) in 1947. The RPI calculates the cost variations in a basket of approximately 700 retail goods and services.

It also includes housing costs such as mortgage interest payments. The UK government does not consider RPI an official inflation rate statistic. However, employers use RPI during wage negotiations. The government uses it in various tax computations and to determine the rent on social housing.

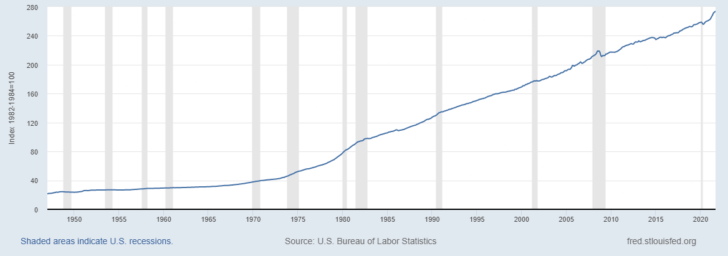

Various nations use their version of a Consumer Price Index (CPI) to identify periods of inflation or deflation. Big increases in CPI are a sign of inflation. Large drops in CPI are a sign of deflation.

In the United States, the Bureau of Labor Statistics (BLS) calculates the CPI-U, which measures the CPI for 87 urban areas. The BLS collects prices from approximately 26,000 retail establishments and 4,000 housing units. Investors and analysts highly anticipate the monthly CPI report, using it as an inflation barometer and to pinpoint trends that might impact investment returns. Above is an example of the Consumer Price Index for All Urban Consumers retrieved from the Federal Reserve Bank of St. Louis, November 8, 2021.

In the United States, the Bureau of Labor Statistics (BLS) calculates the CPI-U, which measures the CPI for 87 urban areas. The BLS collects prices from approximately 26,000 retail establishments and 4,000 housing units. Investors and analysts highly anticipate the monthly CPI report, using it as an inflation barometer and to pinpoint trends that might impact investment returns. Above is an example of the Consumer Price Index for All Urban Consumers retrieved from the Federal Reserve Bank of St. Louis, November 8, 2021.

While indices can be useful to quantify price changes, they can also have built-in weaknesses that skew results. The United Kingdom’s Office for National Statistics concludes that the RPI has many limitations. They cite technical problems with the formula and weighting. The data excludes certain pensioners and high-income households. The RPI appears to have an upward bias that overstates inflation by about 1% compared to CPI.

Economists also debate the accuracy of CPI. In the U.S., critics point to these problems with the index:

Inflation and interest rates tend to have an inverse relationship. When interest rates increase, inflation slows down. Higher interest rates encourage people to save more money because they can earn higher returns from saving. They spend less and borrow less, which slows down the economy and the inflation rate.

In contrast, when interest rates are low, inflation tends to go higher. People borrow and spend more money when interest rates are low. This leads to an uptick in both economic growth and the inflation rate.

Inflation is when prices for goods and services increase over time. Deflation is when prices for goods and services decrease over time.

One of the most common causes of inflation is an increase in the money supply. This happens when a monetary authority prints more money than is warranted by the nation’s growth and wealth.

Conversely, one of the most common causes of deflation is a reduction of the money supply or credit in an economy. If consumers have difficulty accessing credit to make purchases, they will make fewer purchases and the demand for goods will go down. This leads to a reduction in prices. Deflation happens when the inflation rate falls into negative territory below 0%.

Other inflation causes include demand shocks and supply shocks. Demand shocks (known as “demand-pull inflation”) happen when an unexpected event increases demand for a service or product, causing prices to go up. Supply shocks (known as “cost-push inflation”) happen when there is a disruption to the supply of a good or commodity, which then causes prices to increase.

Both excessive inflation and deflation can harm an economy. Higher prices can erode consumers’ purchasing power to the point that it outpaces their income. This means consumers cannot afford to buy as many goods and services as before.

On the face of it, deflation might seem like a good thing. Lower prices increase consumers’ purchasing power and they can afford to buy more. Over the long term, however, deflation can harm the economy as companies begin to generate less revenue. Companies will have less money to spend on their operations and may begin to lay off employees.

Supply chain bottlenecks and quantitative easing are two reasons why we are seeing an increase in inflation.

The COVID-19 pandemic and resulting worldwide production shutdowns led to a massive disruption in the global supply chain. As mentioned, supply shocks are a catalyst for inflation. Starting in early 2020, factories and production plants closed as workers entered lockdown. As people remained in lockdown, consumer demand for products and services decreased.

However, once governments lifted lockdown restrictions, demand picked up. Consumers are looking to buy more goods, such as cars, electronics, and appliances. On the flip side, production capacity to meet this new buying boom has not been able to keep up.

Manufacturers are scrambling to re-open their factories and ramp up production but face a range of roadblocks. They face a worker and raw materials shortage. For example, semiconductor chips are in short supply, impacting the production of smartphones, computers, and automobiles.

In the U.S., there are not enough truck drivers to deliver goods to their destination. Worker shortages at ports means cargo ships wait weeks before being unloaded. All these bottlenecks mean increased costs which are passed along to consumers in the form of higher prices.

Quantitative easing (QE) also plays a role in the measure of inflation we see today. QE is a controversial monetary tool central banks use to increase the money supply and stimulate a nation’s economic activity during times of emergency.

A central bank is a financial institution responsible for overseeing the money supply and credit for a nation or group of nations. The world’s four major central banks are the U.S. Federal Reserve, Bank of Japan, European Central Bank, and the Bank of England and are closely followed for their monetary policy decisions.

As the pandemic unfolded, the four central banks purchased large quantities of assets, such as government bonds, to support economic growth and keep borrowing costs low. Their actions increased their QE programs by a total of $9.1 trillion. As we have discussed, an increase in the money supply is one of the causes of inflation.

Over time, inflation reduces the value of your cash. As prices go up, your purchasing power decreases. The cash you hold today will not be able to buy as much in the future.

For example, suppose you hide $1,000 in cash under your mattress and leave it there for 10 years. After 10 years, you’ll still have the $1,000. But because of inflation’s impact, you probably will not be able to buy as much with that $1,000 as you did 10 years earlier.

You might be wondering what, if any, adjustments you should make to your investments to counteract the effects of inflation. Here are the steps you need to take to prepare yourself.

The first thing you should do is get a big picture view of what you are currently invested in. You will not know if you need to make changes if you do not have a solid understanding of your starting point. You will want to list and review all your investment types. This includes retirement accounts, bonds, stocks, bank products (savings accounts and CDs), real estate, precious metals, cryptocurrencies, and other assets.

Next, you will want to consider how each investment type might be impacted by an increase in inflation. You will also want to think about how your investments would fare if the central bank increases interest rates to curb inflation.

For example, some investments—such as savings accounts and CDs—will see a boost if interest rates climb. Conversely, some bond types and growth stocks might not fare as well in a high inflation, high interest rate environment.

At this point, you might feel ready to change your investment allocations based on your assumptions about future inflation and interest rates. Before doing so, it is important to have a realistic approach to inflation investment.

A good strategy is one that safeguards your portfolio’s buying power while promoting overall growth. You can achieve this by appropriately diversifying your investments to spread risk (and possible rewards) across various holdings. Diversification has the added benefit of giving your stock portfolio a level of protection should you be incorrect in your expectations of how the markets will react to inflationary pressures.

There are a surprising number of ways you can protect yourself from inflation and earn a decent profit at the same time. The good news is you do not have to rebuild your entire portfolio to reap the benefits of inflation investing.

If you are already retired or planning for an upcoming retirement, a few simple shifts in your brokerage accounts might be all you will need to provide that required inflation hedge. On the other hand, investors in the financial system with a longer timeframe might benefit from some higher-risk investments that could offer ample returns over the long haul.

While there are no guarantees that any specific investment can offer you inflation protection, we have compiled a list of a few ideas for your consideration.

Pricing power refers to a company’s ability to pass along higher prices to customers without harming sales. Customers will continue to be loyal to these companies despite price hikes. Apple Inc. is often cited as a company that enjoys strong pricing power.

The returns from most traditional bonds cannot keep up with high inflation rates. Inflation-protected bonds, however, offer a better alternative because their payments adjust to protect investors from inflationary risk.

Buying a rental property is a popular choice for investors looking to generate rental income over the short-term and gains from resale over the long-term.

Becoming a landlord isn’t everyone’s cup of tea. If you want to make money from soaring residential and commercial property values, a real estate ETF or real estate investment trust (REIT) might be a better choice.

It’s a material world

As inflation ramps up, investors often seek out consumer staple stocks and basic materials stocks. That’s because regardless of inflation, people will continue to buy consumer staples and companies will continue to buy materials to produce goods.

Commodities offer protection from the impact of inflation because commodity prices generally rise as inflation accelerates. Fortunately, you don’t need to become a commodities trader to benefit from this hedge. You can buy stock in companies that produce commodities or shares of exchange traded funds that specialize in commodities.

The World Gold Council says that gold is a strong long-term hedge against inflation, particularly when part of an inflation-protected portfolio. You can purchase physical gold, such as gold coins. Or you can opt for non-direct exposure through mining stocks and gold ETFs.

A report by JPMorgan says that some institutional investors see Bitcoin as a better inflation hedge than gold. Enthusiasts say that Bitcoin is a hedge because there’s a finite amount of it. Critics, on the other hand, say that wild price fluctuations mean Bitcoin is not a reliable store of value and thus not an inflation hedge. So, the jury is still out on this one and we’ll need more data to know which side is right.

Many investors tout gold as a haven during inflationary times. Here we summarize the pros and cons of gold as an inflation hedge.

Gold is a tangible asset. There is a finite amount available. It is a store of value and thus an effective inflation hedge.

Gold typically has a low correlation. It’s price does not move in line with other asset classes. This means that when the prices of other assets decline, the price of gold generally does not decline or declines a small amount.

It diversifies your portfolio. During times of volatility and high risk, investors can use gold to build a diversified investment portfolio.

It performs well in times of stress. Over the long term, gold performs well, particularly during bear markets, high volatility, and recessions.

How you can own it. There are several ways you can benefit from gold. You could own physical gold, such as gold coins. You could invest in gold indirectly through gold ETFs and gold mining stocks. There are also Perth Mint Certificates, a program that allows you to invest in gold and store it in Australia’s Perth Mint.

There is no yield – Gold as a physical asset does not pay a yield, such as interest or dividend payments.

Transaction costs are high. They are higher when purchasing physical gold than purchasing other investments such as stocks.

There are other costs for owning physical gold. These include the costs for transporting, storing, and insuring gold.

You might have liquidity issues with physical gold. The transaction to sell your gold, deliver it to the buyer, and receive your cash will take longer than an electronic stock trade.

Gold’s price is based on supply and demand. Gold is speculative and the price can fall dramatically in a short time.

As an investment, bonds typically suffer as inflation and interest rates accelerate. That is because there is a link between bond prices and interest rates.

Rising prices and rising interest rates result in falling bond prices, a situation known as interest rate risk. A central bank will increase its benchmark rate to put a lid on inflation and cool down an overheating economy. Because bond prices and market interest rates generally move in opposite directions, the prices of fixed-rate bonds will fall when the central bank increases interest rates to combat inflation. This can make bond investing at the wrong time risky.

Like many economic terms, hyperinflation is not something many will come across unless you live in an emerging market economy. This does not mean it does not exist. As long as humans exist economic mismanagement will always follow corruption. As an investor there is a fine line between getting in first into an opportunity and trying to catch a falling knife too early.

If you are investing in a country where there is chronic political corruption, hyperinflation is a genuine risk which you should always consider. Making money from hyperinflation is difficult, if impossible. This is one occasion, where getting away without losing any of your capital will feel like a win.

No, understanding inflation is not difficult. All you need is to learn a few key concepts like the ones we have discussed in this guide. The main factors that impact the rate of inflation are an increase in the money supply that outpaces economic growth, supply shocks, demand shocks, and the ongoing expectation of higher prices. Inflation is even easier to understand once you see how it connects with your daily life and reduces your purchasing power.

For example, the impact of inflation hits your pocketbook when the cost of everyday items like groceries and clothing creep upward. You will see the effect of supply shocks when gasoline prices spike after oil-producing countries restrict production. And when central banks implement quantitative easing strategies, “cheap money” flows into the economy and consumers borrow more and spend more, all of which tends to keep prices high.

Policymakers use an inflation target as a guide to adjust monetary policy, aiming to keep the level of prices relatively stable over time. This helps to maintain economic stability and preserve the standard of living.

The Producer Price Index (PPI), provided by the Bureau of Economic Analysis, measures the average change in selling prices received by domestic producers for their output. It’s a leading indicator of consumer price inflation, reflecting the cost of inputs which, when increased, can lead to overall inflation.

Inflation reduces purchasing power, meaning your out-of-pocket expenses can buy less over time, thus impacting your standard of living. An inflation calculator can help estimate how inflation changes the value of money over a specific period.

Many economists view a small amount of inflation as good and an indicator that an economy is growing. The Federal Reserve currently is targeting a 2% annual inflation rate. However, inflation becomes a problem when it skyrockets and stays high for a long time.

Sustained high inflation makes it challenging for people to afford necessities like food prices, utilities, and housing. Inflation is bad for retirees who live on fixed incomes. It is bad for workers whose wages do not increase to match the inflation rate. This creates a problem for investors who see their investment returns erode as higher inflation reduces their purchasing power. It impacts companies that may be forced to close and lay off employees due to soaring overhead costs.

Some economists state that inflation rates really have not been as low as reported but have been misreported by the government when measuring inflation. As we discussed in the “Criticism of Price Indices” section, governments have several incentives to distort level of inflation numbers to reflect lower rates.

Additionally, the major central banks use their control of interest rates and quantitative easing to keep the inflation rate in check. In the U.S., the Federal Reserve either cuts or hikes interest rates as needed to keep the economy on track.

For example, in response to the economic downturn caused by the pandemic, the Fed cut the federal funds rate to near 0% on March 15, 2020. This move promoted spending and borrowing. The Fed says it plans to keep the benchmark rate at a range of 0% to 0.25% until inflation averages 2% over the long run.