December 2, 2021 Updated October 22, 2023

650

1 votes

Reading time: 1 minutes

day trading

You must choose a trading approach that suits your personality and trading goals. While we all invest in the same market, there are many ways to go about it, one of which is scalping. Whichever way you choose, the important thing is to educate yourself before you start.

This is particularly true of “scalping.” This is a very fast technique for buying and selling that requires intense attention and quick decisions. If you think scalping may be for you, this guide will help you understand the ins and outs of this kind of trading. Read on to discover how to make money scalping.

Scalping is not selling tickets to a sporting event. In stock trading, it is a kind of , where you buy and sell a stock within seconds or minutes. The idea is to make a lot of mini-trades and let the small profits add up.

| Pros | Cons |

| You can keep your investment amounts low, buying small positions. | You have to place many orders to realize a significant profit. |

| Small positions mean you have lower risk. | You must watch your trades in real-time, and act quickly to buy and sell. |

| Short-term price targets are easier to reach. The momentum is less likely to give out in a few seconds or minutes than it would overnight or longer. | Because you can make hundreds of trades in a day, you must be able to withstand stress and pressure. |

| Less research is needed because you trade based on momentum, not underlying fundamentals. | You can’t walk away and check the trade later. You must be online and watching. Your trading schedule must match the hours the markets are open. |

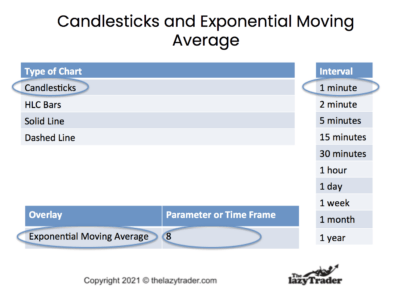

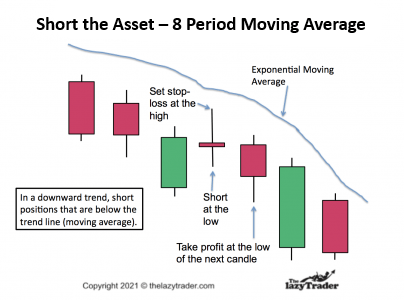

Use charting software or an online charting service that lets you use candlesticks and an exponential moving average.

Set the interval (amount of time for each candlestick) to one minute. A moving average shows the general trend of prices. “Exponential” means the latest prices have the most influence on the direction of the trend. Set the parameter for the moving average to 8. This means the moving average will use 8 candlesticks for its calculations.

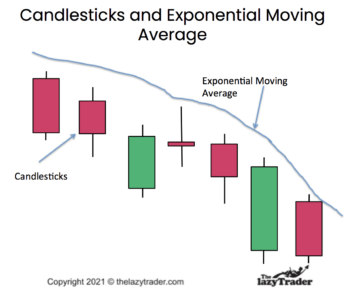

Here is how your chart will look. (Downtrend depicted)

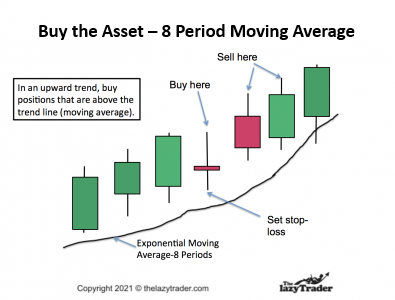

Note that you should trade in direction of the trend that is indicated by the moving average. If the trend is up, buy, If the trend is down, short the asset.

It is not mandatory to sell the position at the high of the next candle. However, waiting longer to sell increases risk.

Note: Trade in direction of the trend that is indicated by the moving average. If the trend is up, buy, If the trend is down, short the asset.=

The example shows a quick exit, but you can wait longer. This will increase the risk.

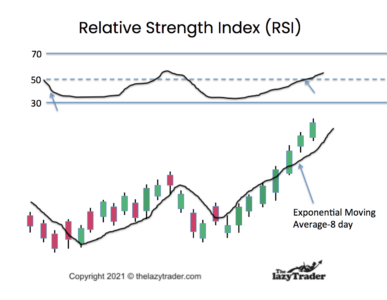

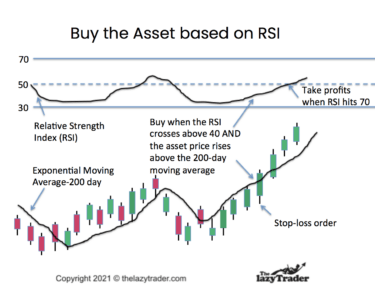

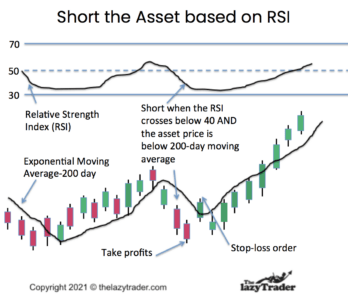

Another scalping strategy involves the relative strength index (RSI). You can select this indicator on most charting services and software. Traders use it to predict prices

If the RSI is above 70, the market is overbought, and is likely to drop lower. If the RSI is below 30, the market is likely to rise. Use 1-minute candles for this type of trading.

Note that the RSI is not a guarantee of the direction. It is an indicator that shows a possible direction for the market. Use it in conjunction with the 200-day exponential moving average.

You can see why you must watch chart patterns in real time to execute scalping strategies. Things change quickly

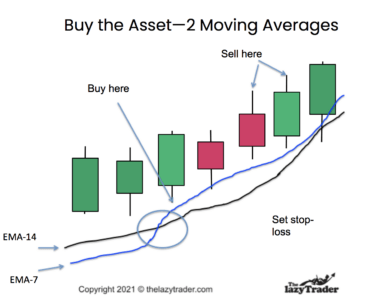

You can use two exponential moving averages at the same time. Using the exponential moving average, set one to 7 periods and one to 14 periods. When they cross each other, you may have a trading opportunity.

You can use this strategy when the EMA-7 crosses above the EMA-14.

If you want to hold the position longer sell when the EMA-7 crosses below the EMA-14.

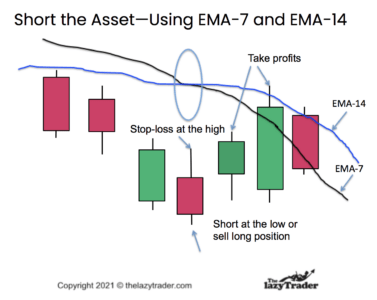

Look for the EMA-7 to cross below the EMA-14

For scalping, do not hold more than a few minutes, or even a few seconds. You do not hold a position overnight.

Make sure you have a broker that does not charge for trades.

Scalping is for people who know what they are doing, Study the strategy before trading.

Books are not only an excellent way to learn scalping in-depth, you can keep them for reference. Do not use books that offer “tricks” or get-rich-quick schemes. Here are two suggestions:

Trade What You See-How to Profit from Pattern Recognition by Larry Pesavento and Trading In The Zone by Mark Douglas

Trading courses can be useful but avoid “gurus” offering to make you rich with huge returns. Consider these:

Blogs give a daily or weekly market view and can offer good trade ideas. Be careful of blogs that make extravagant claims.

Here are some to look at:

A word of caution about forums. Anyone can post and a lot of amateurs give advice. Confirm anything you read on a forum. Examine these:

Newsletters can be much more thoughtful than forums and blogs, but they are also used as sales tools. The Securities and Exchange Commission has issued a fraud warning.

The commission says to watch out for:

Here are some to review. Do your due diligence.

Look for podcasts that explain nuts-and-bolts trading. If you hear overt sales pitches, be wary.

Live Traders. The focus here is Forex trading, but the principles apply to stocks.

Motley Fool Money

YouTube is riddled with fake investing gurus who use their videos to sell you something. Look for instructive presentations that focus on details instead of promising the “real” information if your “sign up today.”Look at these:

Webinars may be used as thinly disguised sales pitches, but there are some good ones.

Scalping involves lifestyle commitments. You must be available during trading hours to actively trade and monitor your assets. Another consideration is that it can be high-stress. Determine if you can handle daily pressure to win.

There are some essential things you must consider.

Scalping is very fast trading, but that does not mean very fast wealth. You have to make hundreds of trades for all the small profits to add up to something significant.

Never put more than 1-2% of your money into a trade. To be even more cautious, use only 1-2% of your money for all of your scalping trading added together.

As you have seen in this guide, there are several ways to approach scalping. Choose a method that has worked for others and stick with it.

It can be useful to practice trading with a demo account. You put no actual money in the trades and track your winners and losers.

Keep up with how many losers and winners you have. If you consistently lose money, stop trading for a while and refresh your knowledge.

After scouring the seven continents for the best trading platforms, we have compiled a list of five that get our approval (provided you are not a US citizen). Read through each bio to find which is the best social trading platform to suits your needs.

From the AVA Group of companies, AvaTrade is an international Forex broker that has been around since 2006.

One of the main reasons why individuals love AvaTrade is due to the number of compatible trading platforms for every experience level. This includes MetaTrader 4, MetaTrader 5, MetaTrader for Mac, and the MetaTrader mobile app.

AvaTrade also offers a range of automated trading tools, such as RoboX, Mirror Trader, MQL5 Signal Service, API Trading, and Duplitrade.

Founded in 2015, NAGA is a Fintech company that offers access to traditional financial markets, along with cryptocurrencies and virtual goods.

Users are attracted to the NAGA Wallet, which offers safe storage of fiat and cryptocurrency assets with a built-in exchange and a gateway to NAGA Messenger for direct trader-to-trader discussion.

Users also have access to the NAGA card, which is a Mastercard that offers 24/7 free and instant withdrawals.

Their social trading capability is built with a proprietary algorithm for finding the top traders to copy on the platform. But perhaps the biggest benefit of the NAGA exchange is the unlimited and commission-free crypto and fiat trading.

Founded in 2005 and regulated by ASIC, MultiBank is a global Forex and CFD broker.

Their platform allows users to start trading with just a few simple steps. Benefits include no cap on the number of signal traders that can be copied at the same time.

Users can customise their copy trading strategy by assigning ratios to each signal provider they subscribe to. It also allows for trades to be executed in proportion to the equity of the account that is being replicated.

FP Markets is a global online financial trading platform that offers forex and CFDs trading.

Regulated by ASIC and storing all client’s funds in segregated bank accounts, this is a platform built on trust.

The platform offers an Autotrade tool, which is provided through Myfxbook (considered by many as the “gold standard” for keeping traders fully-transparent when reporting their performance). This allows traders to copy trade via any system in their FP Markets MT4 trading account. This tool also provides real-time statistics, risk-management systems, and the ability to remove and add trading systems at any moment.

Your risk goes up as you do more trades. Some scalpers make a hundred or more trades in a day. Yes, every trade is a chance to make money, but is also a chance to lose money. Higher potential rewards = higher risk.

Another risk is not realizing how much you have lost. Scalping is fast trading, and you may be tempted to keep a running total in your head. Check your trading results daily, weekly, and monthly to see if you are headed in the right direction.

Making large trades. Avoid placing a lot of money into any one trade. While the usual recommendation is to never put more than 1-2% of your investment funds in a single trade, you may want to think about limiting the total value of your scalping trades to 1-2% of your account value. In other words, you can set aside 1-2% of your money for scalping, and keep the rest in long-term assets.

Scalping is best used when it is just a part of your strategy to make money. Set aside 1-2% of your investment money for scalping, and do not dip into the rest.

Emotions can destroy judgment. If you get upset, afraid, or overly confident, walk away and wait until you are rational again.

Scalping trades can last a few seconds to a few minutes. The other time frame you must consider is how many hours to do your trading each day. This is intense effort, and focus can fade after two or three hours.

Ignore any percentages of wins someone else claims. And certainly, ignore brags about 80% and above winning trades. The reliability of scalping depends on your knowledge, aptitude, and judgment.

”Every time you sell, your funds must settle. How long does this take? The answer is T+3. That is the trade date plus 3 days. You cannot use unsettled funds for more trades until the money has settled.

This should be based on your personal finances. Never risk more than 1-2% of your investment money in scalping. But on top of that, you should only invest the amount you can afford to lose.

Paying a broker for up to 100 trades per day is not practical. You need to act within seconds and delays in contacting a broker can disrupt your timing.

Because you need to sell quickly, only buy assets that have a lot of buyers and sellers each day. You can determine this by looking at the “volume” indicator that is at the bottom of most charts. you need ready buyers when you are ready to sell.

It can be. It is fair to say that experienced traders are more likely to do well. Many beginners give up too early. They need to learn patience and discipline. It is best to trade in small amounts until you gain the experience you need.

This is your plan for getting out of the position. The plan should include not only when to get out because you are losing too much, but also when to take your profits. The idea behind scalping is to make a lot of little profits that add up.

These brokers provide fast execution or allow users to buy and sell over an electronic network. The trading fees can be low, but access to the network will cost you.

This is an order you place that automatically executes when the price of an asset reaches a price you choose. With scalping, you always need a stop-loss order because you are trading mini-trends that can reverse suddenly.

When a sudden jump in the price exceeds your stop-loss order, you have been gapped out.

Many scalpers find a lot of trades 30minutes or so before the market closes for the day. This is because buyers and sellers are very active at the end-of-day.

This is the official opening of the market for the day. Many overnight orders will execute at this time, and investors will buy and sell more positions as the market opens. Scalpers find opportunities in this flurry of trades.

When an asset is for sale, a buyer posts the highest price he will pay. That is a bid. A seller posts the lowest price she will sell. That is the ask. The difference between those two prices is the bid-ask spread.

Tick charts show bars based on a specified number of trades. Example: a 200-tick chart makes a bar after every 200 transactions. A time chart creates a bar according to the interval you specify. A one-minute interval means a time chart creates a bar every minute.

This is a formula that describes how much you could make vs. how much you could lose on any trade. A 1:4 ratio means that for Alternatively, a risk/reward ratio of 1:3 signals that an expected profit of $1 per share, the trader could lose $3 per share. Many scalpers use a 1:1 ratio to determine their stop-loss price and profit-taking price. This means for every dollar of profit, they risk a dollar of loss.

Technical indicators are graphs (such as bars and lines) on charts that traders use to determine trends, relative strength, momentum, and volume of trading of an asset:

Trend trading is a strategy traders use to buy or sell depending on whether prices are rising or falling in a sustained pattern. Go long if the trend is up, and sell short if the trend is down.

Scalping is the opposite of the buy-and-hold approach. You make quick trades and get out of them in a very small amount of time. Scalpers do not stay in a position overnight.

This kind of trading requires you to constantly watch your trades and be ready to place a buy or sell order at a moment’s notice.

It can be high-stress. It can also cause you to lose a lot of money. Scalping is much riskier than other types of trading. But of course, that means it offers the chance to make more money than other types of trading.

Educate yourself and practice before putting any money into trades. If you find that you consistently make wrong choices after learning as much as you can, scalping may not be for you.

Yes you can teach yourself, but you must use reliable, authoritative sources for your learning. This is not the kind of trading where you can simply watch a video and get started. Review the recommendations for books, newsletters, and other resources. Take your time and understand the risks.

You can judge best by trading on paper first. This means do not put any money into trades at first so you can track how much you would have made or lost.

AThis is high-risk trading, and most fail at it. That does not mean you will, but it means you must understand how to control risk.

Forex scalping is a style of trading where forex scalpers aim to capitalize on small price changes in currency pairs. They typically make many trades within a trading session. They hold positions for a short period of time, often just a few minutes. Unlike day trading or swing trading, which can hold positions for a day to several days respectively, forex scalping involves rapid trade execution and exit, targeting small price moves for successful trades.

Day traders employing a scalping strategy use technical analysis to anticipate small price changes in the currency market. They analyze price action, using charts and indicators to predict price movements and identify trading opportunities. This information essentially acts as their investment advice andis different to fundamental analysis, which looks at economic conditions and geopolitical events.

Market makers play a significant role in scalping by providing liquidity, enabling scalpers to enter and exit positions quickly. Scalpers often trade with market makers to exploit small price moves during a trading session. However, if scalp trading, you must consider the transaction cost associated with frequent trading, as these costs can eat into profits from small moves.

Forex scalpers aim for small, consistent profits rather than large gains from single trades. Therefore, they set a narrow profit target, often just a few pips. To manage risk and maximize profit potential, scalpers often use larger position sizes compared to other styles of trading, but this comes with increased risk. A common practice is to set a take-profit order at the desired profit target and a stop-loss order to limit potential losses.

Market conditions greatly influence the success of a forex scalping strategy. Scalpers thrive in volatile markets where small price changes occur frequently. However, high volatility can also increase risk. Therefore, scalpers need to constantly monitor market conditions and adjust their strategy accordingly. In quiet or trending markets, other day trading strategies might be more effective. Scalping requires quick decisions and close attention to price action throughout the trading session.