by Louis H-P

May 24, 2021 Updated July 3, 2023

357

1 votes

Reading time: 8 minutes

Investing is difficult, so having to potentially deal with losing all your money in a Ponzi scheme can be soul destroying. Unfortunately they are all too common and often there are red flags. Do you know the differences between the largest Ponzi schemes in history? What can we learn to ensure that we do not get caught up in a Ponzi scheme too?

[keytakeaways]

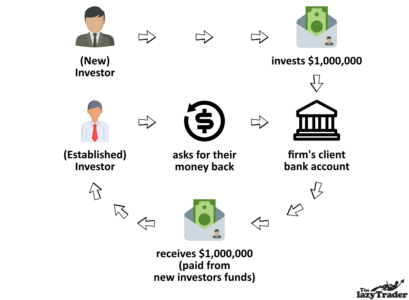

A Ponzi scheme refers to a firm returning an existing investor’s money with money paid in by a new investor. In effect, the firm does not have enough money to reimburse all its investors. It was originally known by the name: ‘rob Peter to pay Paul’ scheme. Despite not being the inventor, Charles Ponzi gave these schemes his name. In his case he regularly defrauded investors in the early 1920’s.

Ponzi schemes have drawn much media attention, as investors lose everything once one is exposed. This is because the entire operation is a fraud. Nominally in Western markets, client assets are held separate from a firm’s assets. Therefore if a firm runs into trouble, then the client should get their money back. The problem with a Ponzi scheme, is the firm is using one client’s money to reimburse another.

As a a result, in a liquidation scenario, there is simply no money to repay to investors. To make matters worse, whoever is running the Ponzi scheme will create fictional accounts and statements to avoid being found out. This also means drawing a salary, which will also be taken from the client deposits.

Few Ponzi schemes actually have any money to invest. This is due to the natural attrition of money for reimbursing existing investors who are asking for their money back. This creates a situation where to survive, a Ponzi scheme has to keep growing to ensure it can meet redemptions. Remember it also has to be able pay the increased asset value that its fictional client statements are stating.

Firstly you need to convince investors to part with their cash, secondly you have to dissuade them from asking for their money back. The first is achieved by displaying good returns, the second by consistently good investment returns.

As humans are greedy, if an investment performs well, they will want to get involved due to the Fear Of Missing Out (FOMO). If an investment does well they think about how much more they can make, rather than being cautious. Therefore few will ask for their money back in normal circumstances. It is only in times of volatility when investors panic that redemptions come in. Unsurprisingly this is also when Ponzi schemes are found out.

Investors seldom do any research on the holdings in their stock portfolios, which means it is easy to ensnare them into parting with their cash. Therefore a Ponzi scheme only needs to find a simple reason to approach a would be victim. Some of these are listed below:

A Ponzi scheme is illegal because it is a fraud. When someone invests, they will have been informed how their return will likely exhibit itself. Examples would include, expanding a successful business, providing capital for a takeover or selling a new in-demand product. Investors would not invest in a scheme, if they knew that their profits were actually being paid out with the money from newer investors.

By offering an incredible return early on, someone running a Ponzi scheme will hoover up assets. These assets are paid back to over investors who want their money back. The beauty is the fraudster does not actually need to ‘make’ any money, they just transfer money from one client account to another.

Ponzi scheme’s are usually identified in a financial crisis. As investors panic, they retreat to cash and ask for their investments back. The combination of so many clients asking for their money back, means the fraudster cannot repay everyone.

It doesn’t. Money paid in by a new investor is used to pay back a previously invested investor who has requested their cash back. To keep the scheme going, false statements have to be produced to show buying and selling of securities. Frank DiPascali, who was one of Bernie Madoff’s key lieutenants, pleaded guilty to falsifying books and records. He admitted to creating fictional wealth in client’s statements to hide the ongoing fraud.

As this goes on, the fraudster will likely siphon a small amount somewhere safe. Or they can do a disappearing act with all their client’s money as Ruja Ignatova did.

Bernie Madoff is universally agreed to be the biggest Ponzi scheme in history. In an example of someone getting in over their heads, it did not start as a Ponzi scheme. Mr Madoff ran a brokerage which dabbled in running other’s money. This asset management business grew and after initially performing well, the returns tailed off. Madoff felt inclined to lie to his clients and used creative accounting to falsify his client’s statements. To keep the scheme (and probably his expensive lifestyle) going, Madoff would send his newer clients money to meet old client’s redemption request.

Bernie Madoff is universally agreed to be the biggest Ponzi scheme in history. In an example of someone getting in over their heads, it did not start as a Ponzi scheme. Mr Madoff ran a brokerage which dabbled in running other’s money. This asset management business grew and after initially performing well, the returns tailed off. Madoff felt inclined to lie to his clients and used creative accounting to falsify his client’s statements. To keep the scheme (and probably his expensive lifestyle) going, Madoff would send his newer clients money to meet old client’s redemption request.

When the 2008 financial sell off occurred, and clients wanted the safety of their assets back in cash, he could not meet redemptions. Despite being flagged as a potential fraud for some time, regulatory bodies never investigated him properly.

This is even after Wall street refused to deal with him as trading desks never saw his trades. (You will be surprised how much market intelligence traders know from seeing who is buying and selling what).

He was a successful businessman who owned a number of businesses including Polaroid. This ensured trust. Sadly he stole nearly $3.6 billion, by convincing investors to fund selling electronic goods to large retailers who were not actually ordering them. To perpetuate his fraud he would produce fake invoices and falsify bank statements to convince investors to invest with him. He was eventually caught when a whistle blower went to the authorities and is now serving the equivalent of a life sentence.

He was a successful businessman who owned a number of businesses including Polaroid. This ensured trust. Sadly he stole nearly $3.6 billion, by convincing investors to fund selling electronic goods to large retailers who were not actually ordering them. To perpetuate his fraud he would produce fake invoices and falsify bank statements to convince investors to invest with him. He was eventually caught when a whistle blower went to the authorities and is now serving the equivalent of a life sentence.

In 2015, the father and son pair were convicted of operating a $1.5 billion Ponzi scheme. They both had links to MRI International, an investment company headquartered in Las Vegas. Junzo was executive vice president for the Asia-Pacific region. Paul Suzuki had been the company’s Japanese general manager. They claimed they would collect medical accounts receivable at a discount, before getting the full amount back from insurers. They specifically targeted Japanese residents

In 2015, the father and son pair were convicted of operating a $1.5 billion Ponzi scheme. They both had links to MRI International, an investment company headquartered in Las Vegas. Junzo was executive vice president for the Asia-Pacific region. Paul Suzuki had been the company’s Japanese general manager. They claimed they would collect medical accounts receivable at a discount, before getting the full amount back from insurers. They specifically targeted Japanese residents

In 2015, the Fanya Metal Exchange in China collapsed into bankruptcy. Investors who backed this rare metal exchange by buying its products (which promised returns off 13%!), lost $6.7 billion. What made this Ponzi scheme notable, was the involvement of local government officials. Fanya had run advertisements for its product on the Chinese state TV, giving it credibility.

In 2015, the Fanya Metal Exchange in China collapsed into bankruptcy. Investors who backed this rare metal exchange by buying its products (which promised returns off 13%!), lost $6.7 billion. What made this Ponzi scheme notable, was the involvement of local government officials. Fanya had run advertisements for its product on the Chinese state TV, giving it credibility.

Ruja ran a high profile media campaign to launch the OneCoin cryptocurrency. She had impeccable pedigree: an Oxford university education and a stint at a prestigious consulting firm. She even held an event at Wembley arena. This profile created trust and ensnared many investors. Having amassed approximately $4bn, Ruja disappeared in 2017. At the time of writing, she has still not been found but her brother has been charged with assisting with the running of a Ponzi scheme.

Ruja ran a high profile media campaign to launch the OneCoin cryptocurrency. She had impeccable pedigree: an Oxford university education and a stint at a prestigious consulting firm. She even held an event at Wembley arena. This profile created trust and ensnared many investors. Having amassed approximately $4bn, Ruja disappeared in 2017. At the time of writing, she has still not been found but her brother has been charged with assisting with the running of a Ponzi scheme.

If the stock market crashes and an investment has no discernible loss in value, then be suspicious. Madoff rarely had a negative year. You should check the shareholder register if it is a publicly listed company. Investigate a large holding by a billionaire from an obscure country. If the investment is a private one, google the company name, the trading name and directors. Be aware that everyone can ask Google to remove information about them. Therefore just because there is no ‘bad news’ on Google does not mean there isn’t any historical bad behaviour.

If it is too good to be true, it probably is.

If an investment scheme promises you out sized returns over a short period of time, compare it to others. You will likely find that the only such comparable offering were Ponzi schemes. Check the details. Understand how the scheme makes it money. If it does not add up, even after extensive research, just walk away. Do not give it the benefit of the doubt. Humans struggle to walk away from something which looks good. Have the discipline to focus on preserving your capital.

If an investment scheme promises you out sized returns over a short period of time, compare it to others. You will likely find that the only such comparable offering were Ponzi schemes. Check the details. Understand how the scheme makes it money. If it does not add up, even after extensive research, just walk away. Do not give it the benefit of the doubt. Humans struggle to walk away from something which looks good. Have the discipline to focus on preserving your capital.

It is amazing how few investors actually research their investments. Some years ago a company tracked how many times the annual report of a major S&P500 listed company was downloaded. Only 30 times was the answer! Just because professional stock brokers and portfolio managers do not do the work, does not mean you shouldn’t either. In fact you should be able to be far more thorough in your own checks than they have the time for. The downside risk is too huge to be lazy.

Someone successful will have a professional ‘journey’ which displays how and where they gained their (technical) training and experience. If someone was a used car salesmen and suddenly starts hawking a complex derivative investment strategy, they do not know what they doing. Often it is the details which are telling: Bernie Madoff was a respected broker. On the other hand, he had no discernible investment management qualification or experience.

Complicated accounts are great way of hiding a Ponzi scheme. One way of achieving this is by constantly buying other companies. This allows for goodwill, write downs and valuing assets at whatever is convenient for a company which is a Ponzi scheme. Indeed an acquiring company will often issue shares, i.e. raising cash. This cash can then be used to keep the Ponzi scheme running.

No it is not. A pyramid scheme works by getting people to recruit others to sell a firm’s product. In theory they earn large commission’s for doing so. In practice this is rarely the case. People lose their money by buying this firm’s products but struggling to actually sell them.

A Ponzi scheme operates by taking the money invested by one (new) investor to repay an existing investor. Investor’s lose their money because the person running the Ponzi scheme has spent their money. Usually this is on an expensive lifestyle.

The welfare state which underpins most Western governments, is technically a giant Ponzi scheme. The employed young pay (through) their taxes, for the older to receive their state pension. The issue is that we are having less children, so there are less people to pay taxes and the retired. Yet more people are retiring, increasing the state’s liability.

There is an argument for saying that governments are already bankrupt. They cannot afford their future liabilities. The government’s solution is to issue debt. This is why governments raise the retirement age at which you will receive your state pension, to reduce this enormous liability.

It is worrying how few mentions there are of the threat of fraud in how to start investing publications. Remember, portfolio protection is also about protecting your assets from theft and fraud. Bernie Madoff gave himself up, he was not identified by regulators despite the SEC being tipped off numerous times.

Give yourself a margin of safety by only placing part of your wealth in each scheme, asset class, broker or bank. Diversification is the best form of defense for capital preservation.