by Glen Goodman

February 18, 2022 Updated October 22, 2023

993

1 votes

Reading time: 12 minutes

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also.

It’s rare to witness the dawn of an entirely new investment asset class. It’s even rarer for those assets to be available to ordinary investors. Many who missed out on the big crypto booms were overjoyed to discover yet another new opportunity in the form of NFTs. The technological potential of this invention is extraordinary, and – as we will discover – many of the key benefits will only come to light in the years ahead.

But for the time being – let’s be clear – NFT investing needs the world’s biggest BUYER BEWARE sign slapped onto the front of it. It’s a fraudster’s playground out there… but for those with a strong stomach for risk, there is serious money to be made.

At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

NFT stands for non-fungible token. The basic difference between an NFT and a typical cryptocurrency token is that ordinary tokens are interchangeable while NFTs are not. Ordinary crypto tokens are like coins and banknotes in that sense – you can swap one for another and there is no difference between them (though of course each token will have a different transaction history, as it passes through different hands).

Non-fungibility means that each token is unique. An NFT is simply a piece of data stored on a blockchain (a type of database), but because each one is unique, it can be used to identify a particular digital asset or even a physical object, and it can contain the details of any license to use that asset.

People are often told that a particular digital artwork is an ‘NFT’. For example, I was gifted this piece by a digital artist.

The art itself is not the NFT. The NFT is – as I said – a piece of data that sits on a blockchain. It is linked to this image, providing ‘proof of ownership’ (though perhaps not in a legal sense, as we shall see…)

Way way back in prehistoric 2014, two blokes called Kevin and Anil made the first NFT. Kevin McCoy’s wife Jennifer had made a short video clip. Kevin and Anil Dash then together built Monegraph, a system based on blockchain, with the aim of enabling digital artists to verify their artworks, to be able to earn some money and control the sale of their work.

As Anil tells it, they couldn’t fit entire images, sounds or videos in blockchains because of technical size limits, so they took a shortcut, just creating the data NFT on the blockchain with a web link to the artwork. Today, all the popular NFT platforms still use Anil’s shortcut.

Kevin registered his wife’s 5-second video on the Namecoin blockchain and sold it to Anil for $4… seven years later, Sotheby’s sold it at auction for $1,472,000.

NFTs are often used to give provenance to a piece of art – to say “look – it was created by her, it was sold here, here and here, and now it belongs to him.” It can be seen as a kind of certificate of ownership.

If you’ve ever struggled to sell your digital creations online, you will immediately appreciate the potential value in this idea. Let’s say you made some lovely pixel art, as shown below, and you wanted to sell it. Before NFTs you may have had a spot of bother doing that, because the person buying would say “well how do I know you own it? And how can I prove I own it once I’ve bought it from you? What if I want to resell it?”

For those reasons, it was often very difficult to charge serious amounts of money for digital images and create a thriving digital art market. Now all the important provenance data can be stored on the blockchain as an NFT, so a piece of digital art can have a verifiable history.

NFTs are also taking off in the world of gaming, because they allow gamers to take possession of their in-game items in a more meaningful sense. Currently, most in-game items are effectively controlled by the game developer because the items are kept within your personal account for that game or that developer. NFTs dangle the tantalising possibility of having skins or other items that are portable from game to game, and that do not cease to exist if a developer decides to shut down a particular game’s servers.

Axie Infinity is one of the biggest play-to-earn games in the world and you have to buy NFTs in order to play. These ‘monster’ NFTs are the cost of entrance, but players can then earn rewards in tokens which can be exchanged for cryptocurrencies. More than two million people per day play this Pokemon-style game.

In a word – Beeple.

Mike Winkelmann aka ‘Beeple’ is a digital artist creating quirky pictures, often featuring famous people like Donald Trump, naked or sliced up or suckling Joe Biden at his fleshy teet. (Yes that is as grim as it sounds). Think Banksy but digital.

He was scraping by, never selling his artwork for more than $100 a pop, until he started selling his work as NFTs and then his first big collection sold at a Christie’s auction for $69 million. $69 million. I’ll say that one more time. Sixty-nine million dollars.

The Beeple auction set the NFT world alight. Suddenly people were creating artworks by the dozen and selling them by the million.

One of the oldest NFT projects, CryptoPunks, started selling particularly well. These pixelated punk rocker cartoon images go for millions of dollars per punk in some cases. Total CryptoPunks sales have topped $2 billion.

In spring 2021, a startup called Yuga Labs created a collection of NFTs called Bored Apes. The genius of this collection was that it became more than a collection of 10,000 cartoon apes, it became a community, The Bored Ape Yacht Club. Buying a Bored Ape gives a person membership and perks, such as free NFTs that have also proved to be valuable. Many communities have sprung up in the wake of the BAYC.

Twitter got in on the act by allowing people to connect their crypto wallet to their Twitter account. That way they can prove that they own an NFT and then can use the image as their profile pic in a special exclusive hexagonal frame.

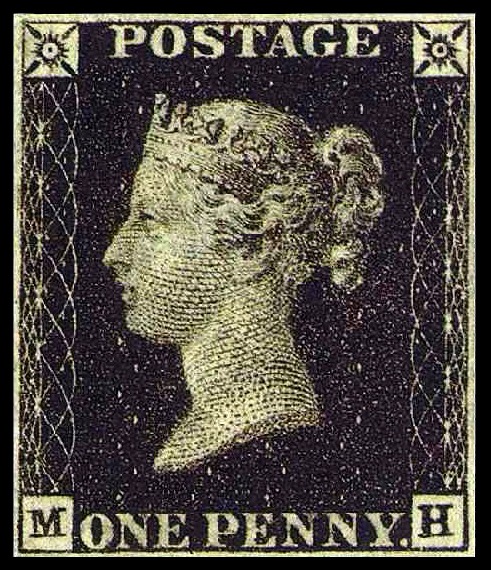

Rarity and collectability are highly prized in the NFT space. It’s not a million miles away from collecting rare stamps, wine or baseball cards. People often make the point that your image can be ‘stolen’ simply by someone right clicking and downloading it. But to collectors, that’s irrelevant, because there’s only one real Bored Ape #5809, the one owned by the person with the NFT on the blockchain, protected by their private key (password). All the copies are just fakes.

Critics of course scoff at this justification, but to the people who enjoy being in these communities, the proof-of-ownership matters. It matters to the tune of billions of dollars.

In 2021, celebrities and sports stars came running for their share of the loot. NBA Top Shot showed the huge potential of NFTs for the collectibles market. ‘Moment NFTs’ were the NBA’s gambit to sell collectibles to fans, and it paid off in spectacular fashion.

These NFTs celebrate American basketball highlights by including a short video of a ‘top shot’ along with player name, game score and other details.

Cynics say “you can watch the same shot on YouTube for free” but afficionados say “take my billion dollars”, for that is how much has been spent on NBA Top Shots since late 2020, when it was launched. Some of LeBron James’ Moments have sold for more than $230,000 each.

Heard of the metaverse? Of course you have. It’s the media buzzword of our era. Mark Zuckerberg even renamed his company Meta. The idea – originating from Neal Stephenson’s prophetic novel Snow Crash – is that in the future we will be spending a lot of our time jacked into glasses/goggles/brain implant that gives us access to a virtual world where we will interact with other real human beings through their online avatars. We’ve already seen early incarnations of this idea in games like Second Life, Minecraft and Roblox.

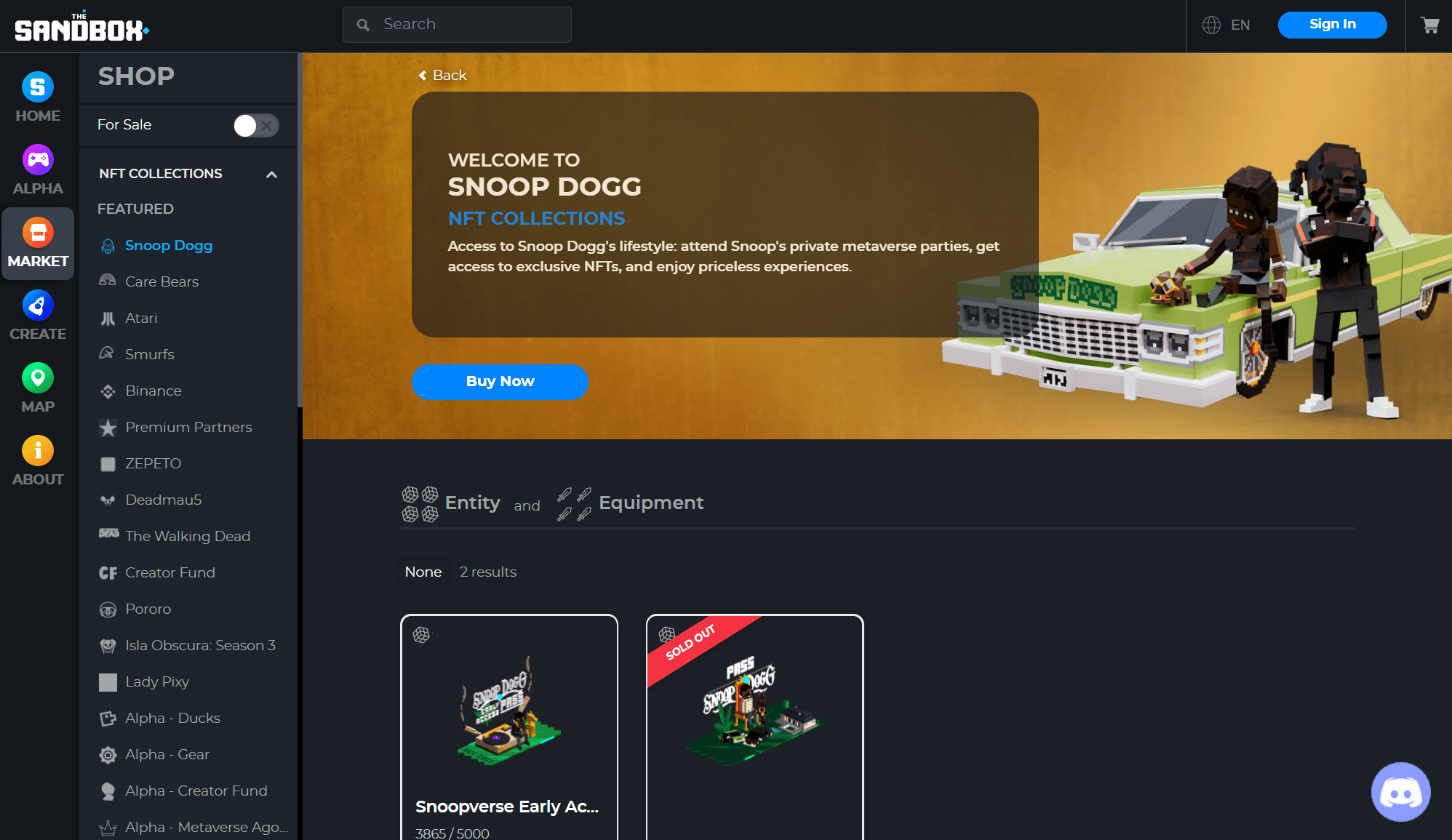

Beyond the gaming uses of NFTs we discussed earlier, the metaverse offers boundless possibilities to make use of the technology. After Mark Zuckerberg made his very public pivot to the metaverse, the prices of metaverse cryptocurrencies like Sandbox and Decentraland went ballistic, doubling and doubling again. These fledgling metaverses allow people to buy virtual land plots and other unique in-game items as NFTs. Celebrities like Snoop Dogg have quickly got in on the act.

In late 2021, Beeple collaborated with Louis Vuitton to create an NFT-collecting game. The CEO of the fashion house said “This is not a commercial experience, but a pedagogical, educational experience that must be fun, emotional and dynamic.” Whatever.

Gucci were at it too, creating “ultra-limited NFTs” coupled with ceramic sculptures. This is one of the more successful marketing ideas NFT creators use – offering physical keepsakes to couple with your digital collectible. In the future, fashion houses like Gucci may take the tie-up between the physical and the virtual even further by using an NFT to give you a link between – say – a new physical handbag and a virtual version. This would allow you to track the provenance of your handbag from owner to owner, and help you prove your bag is an original and not a knock-off copy.

Yes really. NFTs are now being used by some organisations to award people with NFT collectables if they do good deeds. They can then display their NFTs publicly to inspire others (and to show off).

If you’re starting to overdose on celeb hype and marketing stunts, fear not, because the future of NFTs is much more heavyweight. The current NFT world is (like the game we mentioned) a virtual sandbox, where people are trying out all kinds of ideas to see what catches on. Widespread experimentation will hopefully allow the bad ideas to wither and the good ideas to bloom.

The key characteristic of NFTs is their ability to provide proof of ownership. For years people have talked of the possibility of “tokenising everything” using cryptocurrency – giving every physical object a virtual existence so it can be traded between different people more easily. NFTs make this a tantalising prospect.

For example, on February 12th 2022, a house in Florida was sold as an NFT through auction. The property’s ownership transferred from one person to another automatically, through the execution of a smart contract, when the auction ended. The $653,000 payment moved in the opposite direction.

It’s clear that automation will increasingly be the future of society, and it seems smart contracts and NFTs could be a major part of that. If every physical item is given an identity and a unique address in cyberspace, it can be easily searched for, found, given a value in a marketplace, bought and sold in a secure fashion.

The Decentralised Finance (DeFi) arena is also starting to utilise NFTs. Decentralised crypto exchange Uniswap now represents liquidity provider positions as NFTs. If you don’t have a clue what I just said, don’t worry about it. The point is, NFTs have uses in the specialised end of finance as well as in regular transactions like real estate sales.

As with artwork, one of the main hopes for NFTs in the future is that they’ll allow songwriters and musicians to be properly paid for their work. It was once hoped that mp3s would liberate musicians from record companies, but it didn’t quite work out as planned. Many musicians now complain that they can’t make a living through the royalties they get from streaming platforms like Spotify.

NFTs allow musicians to sell copies of their work and then track the reselling of those copies. They could collect royalties every time a copy of their music is sold on to another buyer.

The reason this is one ‘for the future’ is that NFTs are still in a legal grey area. Buying an NFT does not automatically confer legal ownership rights to the buyer. This goes for images as well as pieces of music or video. No doubt this will be clarified in the courts in the years to come.

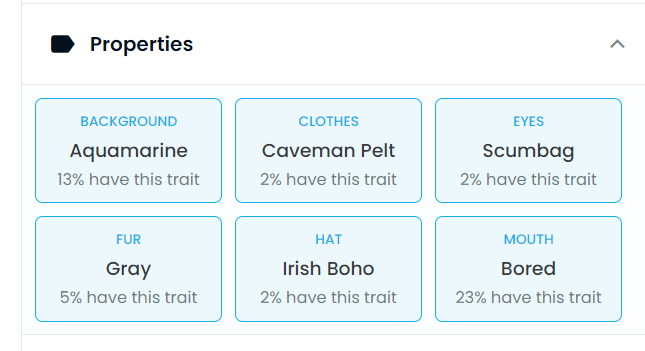

The more unique a particular image is in a collection, the more it tends to be worth. For example, on OpenSea – a popular NFT site – I clicked on a Bored Ape which is up for sale for a cool $176,000. Its ‘Properties’ section tells me the following:

This is a relatively rare and expensive Bored Ape because only 2% of Bored Ape images are wearing a Caveman Pelt, only 2% have an Irish Boho hat and so on. Apes that have very common traits tend to be less expensive.

Of course this scarcity is artificial, as the designers purposely gave some apes more common traits than others. But it’s like any real-life collectable such as a rare stamp. The piece of paper may be worthless, but the complete product with the rare image on it can be worth six figures.

Let’s be honest – NFTs are the latest cool plaything for the rich and famous. So the more hype they get, the more people tend to be willing to pay for them. The hype makes people assume the value will continue to go up and up. Millions of NFTs have now been created, so inevitably most of them are worthless. But the most desirable ones are worth a fortune.

Lots of accidentally-famous stars, such as the Charlie Bit My Finger video boys, have cashed in by selling their famous memes as NFTs. Charlie and Harry Davies-Carr raised £500,000 through the sale and it will cover their university fees.

This is where things get really shady. Nobody is regulating NFT marketplaces, so all sorts of old tricks that have long been banned in stock markets are commonplace in the NFT world. Crypto research firm Chainalysis says 110 traders made almost $9 million between them in 2021 by creating fake transactions to fool buyers into paying over the odds for NFTs.

This may be just the tip of the iceberg. The wash trading scam can be relatively simple. An NFT owner sets up fake accounts and addresses. The owner then sells their NFT publicly to one of their own accounts for a high price. They do it again and again, at higher and higher prices. This creates an illusion of skyrocketing demand for their NFT. Finally, an unsuspecting innocent buyer comes along and snaps up what they think is a valuable asset that will rise and rise, only to find that all the demand was artificial and their purchase is ultimately worthless.

OpenSea is where NFT newbies tend to begin their journey. It’s the biggest and most successful NFT marketplace. It also makes it easy for you to “mint” your own brand new NFTs. The whole ecosystem revolves mainly around Ethereum, but other cryptocurrencies can be used too.

The NFT-powered game Axie Infinity has its own large marketplace, for trading in Axies, which are little digital pets. This is currently the second largest NFT marketplace in the world.

Other major marketplaces include Rarible, SuperRare and Foundation.

We’ve already talked about wash trading. Criminals are also using it for money laundering, according to Chainalysis’ research. So there is a risk that you sell your NFT to a criminal and the police then come knocking, asking for the criminal proceeds you now possess!

There’s also a huge problem with people minting and selling plagiarised images and other content. This is particularly widespread wherever people are allowed to mint new NFTs for free. OpenSea recently admitted the scale of the problem in a tweet thread.

However, we’ve recently seen misuse of this feature increase exponentially.

Over 80% of the items created with this tool were plagiarized works, fake collections, and spam.— OpenSea (@opensea) January 27, 2022

Because NFTs are so new, the tools to protect them are still developing. Of course crypto wallets are protected by private keys. But considering some NFTs are worth millions of dollars, these protections are not what we’d call ‘institutional-grade’. Phishing and hacking are major risks, even for advanced techies who consider themselves wise to the risks. Criminals are becoming more sophisticated.

The other major risk is physical attacks. There are now many cases of people being kidnapped and robbed for their passwords. This is partly why so many NFT owners protect their anonymity and communicate only through avatars.

The number one essential is a Metamask wallet. It is a crypto wallet available as a mobile app and a browser extension. When you visit a marketplace site like OpenSea, you can connect your Metamask to the platform. You can store your NFTs in the wallet.

One good place to begin your search for your dream NFT is rarity.tools. This site uses its own rarity rankings to indicate which new NFTs might be valuable in the future. Of course there are no guarantees, but some people find it very useful.

If you come across an NFT collection you find particularly interesting, it’s wise to immerse yourself in its community. Learn as much as possible about the people behind it and where they see the project going. Head over to the collection’s Twitter account and join the inevitable community Discord channel. A lot of NFT gossip happens on Discord, so a good first step is to join r/NFT Community which has more than 100,000 members!

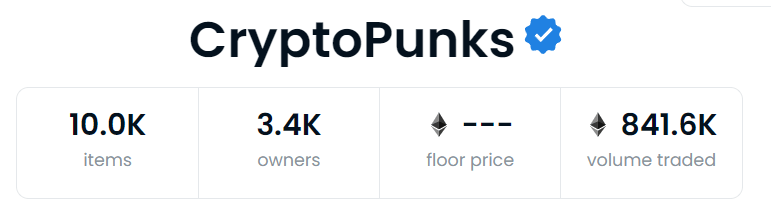

One good way to check that a collection is genuinely popular on OpenSea is to look at the ratio of items to owners.

As you can see, CryptoPunks have a 3:1 item to owner ratio, which doesn’t raise any red flags. But if you find a collection has – say – 10,000 items and only 100 owners then be worried. Some of these ‘whales’ could crash the prices of the whole collection if they decide to sell all at once.

NFTs are super-high-risk investments, and as any good investor knows, high risk tends to equate to high reward… or total loss. The area is almost entirely unregulated, so if you get scammed, it’s unlikely anyone’s coming to your rescue.

It can be very hard to gauge how much a particular NFT will be worth in the future. Some people see them as nothing more than lottery tickets, but by following the guidance we’ve provided, it’s possible to improve your odds of success. People who immerse themselves deep into the community sometimes get an early heads-up on promising projects and snap themselves up a bargain or two.

It’s likely that the two areas will eventually merge. Much of the contemporary art displayed in physical galleries already includes digital and multimedia elements. The promise of the metaverse is an almost seamless connection between ‘real’ life and the virtual world. Think of augmented reality games like Pokemon Go that combine the physical and virtual worlds in a single experience.

Nope. Many NFTs are sold for pennies, and you can mint your own for free on many sites. Unfortunately there are ‘gas’ fees to pay for crypto transactions. But if you use alternative blockchains to Ethereum, it can be much cheaper.

In most countries, yes. In the UK, most wealthy NFT investors will pay Capital Gains Tax. But there is no tax if their profit is below the CGT tax-free threshold.