March 22, 2022 Updated October 22, 2023

295

1 votes

Reading time: 12 minutes

One important chart pattern is a reversal pattern. You use stock charts so you can visualize when prices may change direction into a new downtrend. One of those indicators is called the Hanging Man pattern. By understanding how to read this pattern, you can learn when o get out of an investment.

All candlestick patterns help you visualize the price action of an asset. The Hanging Man is one of those patterns.

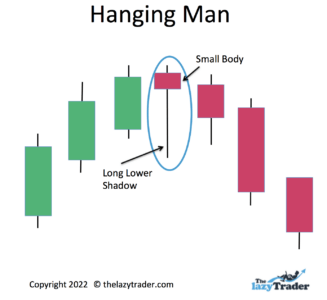

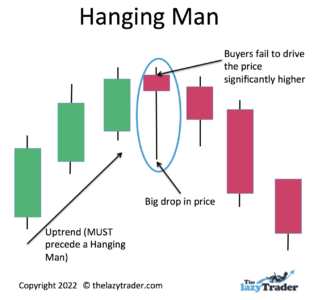

This pattern shows that buyers tried to push the price higher but failed. The Hanging Man has a small body and a long lower shadow. The long shadow indicates that the price dropped significantly, but the body shows that the open and close prices were close together.

Sellers were about as numerous as buyers. Buyers seem to be exhausted and it is reasonable to expect there may be fewer of them the next day and after. This example does not indicate that prices always drop after a Hanging Man, only that they can.

The Hanging Man and other candlestick patterns can and do work–some of the time. Look at them as a tool. A tool is only as good as the craftsperson using it. You must study charts and track your own trades to get better at using the Hanging Man. And even “experts” make mistakes when reading this pattern.

When you use charts to make trading decisions, you are doing technical trading. This means you use trends and price action as opposed to learning about company sales and profits (fundamental trading).

Every trading tool has good points and bad points. Let’s look at some of them

The Hanging Man pattern is a proven technique – The Hanging Man and other types of candlesticks date back to 18th century Japan. A rice trader named Munehisa Homma created candlesticks to track his trades. He became wealthy. The Hanging Man pattern has been used successfully since then.

The pattern is accessible and easy to understand – Almost any charting site offers a candlestick view of prices. Once you learn to read it, the Hanging Man pattern is simple to read.

It helps to provide clarity – Visualizing price action with the hanging man pattern makes things much clearer than trying to figure out why prices fall just by examining how the company is doing.

It reflects the psychology of the market – Price action is a consensus – an average of what people think an asset is worth. The Hanging Man suggests that buyers are hesitating.

It makes trading more objective – You are less likely to get emotional about your trades. There is no such thing as “believing” in a company or trusting its sales projections for technical traders. A technical trader ignores feelings about what should happen and trades based on what is happening. The Hanging Man is a warning sign no matter how well the company is doing.

You can spot trend reversals – Because the Hanging Man is a reversal pattern, you can take action early and be “ahead of the game” in knowing when to get out of an investment.

Viable trade setups can be invalidated by unpredictable news or data releases – You can overlook important news about a company because you are convinced about what a price pattern seems to be telling you. You may also overlook economic reports. For example, if the economy is headed into a recession, many patterns will fail. You can be caught “off guard” by focusing on price action for an asset and ignoring the economic environment.

It tends to be visible only in a short timeframe – This is a one-day pattern, so to catch one, you need to look at charts every day,

The Hanging Man is a weak indicator – By itself, this pattern is more of a “heads up” than a definite signal. You have to trade this pattern cautiously and look for confirmation that prices are headed down.

You may tend to choose healthy companies – Knowing a company’s growth, sales, profit trends, and market share helps you gravitate toward companies that are doing well. This way you are less likely to buy shares in a losing business.

You will be more likely to ride out the dips – If you have done your due diligence, it is reasonable to expect a company that has a rough quarter to recover. You won’t sell every time there is a pullback.

Understand what you are trading – You make your decisions based on how well you understand the company’s products and services, and what the demand for them might be. Some technical traders may take chances on companies they don’t understand just because the chart pattern looks good.

You can confuse revenues and profits –A company can be taking in a lot of money but may have expenses that are eating up its profits.

You may miss some “ground floor” opportunities – A young company may not have the fundamentals you find attractive, so you might be ignoring a promising up-and-comer. Which indicators are the most reliable–technicals or fundamentals? The realistic answer is that both methods fail and succeed. No market analysis is 100% accurate all the time.

Charles Dow refined technical trading, including the use of the Hanging Man. He was a founder of Dow Jones. When you read about the Dow Jones Industrial Average (“the Dow), you are referring to the index he created in 1884.

Jack Schwager is considered an expert on technical analysis, and his book Market Wizards gives several examples of how to use The Hanging Man. In India, Sudarshan Sukhani is famous as a technical analyst. Certified as a financial technician, he serves as President of the Association of Technical Analysts.

This pattern varies in a few ways..

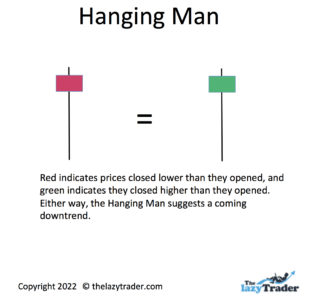

First of all, the candlestick can be either red or green.

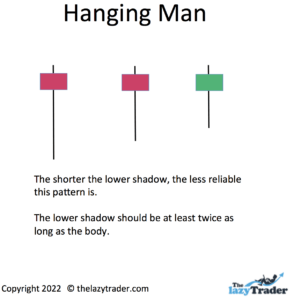

Next, the Hanging Man can have a shadow of varying lengths.

You could say there are an infinite number of possible Hanging Man patterns since the lower shadow can vary in length. But remember, the lower shadow must be at least twice as long as the body.

A price pattern on a chart is all about psychology. You can understand what traders are doing if you practice one technique: tell yourself a story. Think about the people behind the price action.

Let’s look at an example.

Here is the story you could tell: After an uptrend, buyers hesitated. You can see this by the long lower shadow that shows prices dropped dramatically. Even though buyers stepped back in and raised the price, the open and the close were very near each other. This hesitation suggested buyers were losing enthusiasm and prices could drop further.

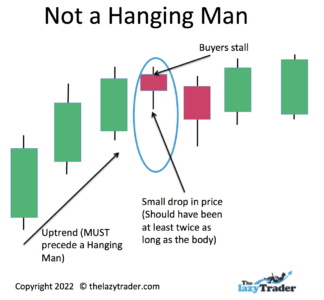

Let’s look at a story that would suggest the pattern is not a Hanging Man.

Story: After an uptrend, buyers stalled, but there was no major drop in prices, so a coming downtrend was not indicated.

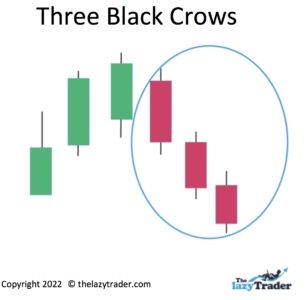

Related pattern: Three Black Crows

If you want to wait for confirmation of the downtrend, you can wait for a pattern that looks like the Three Black Crows.

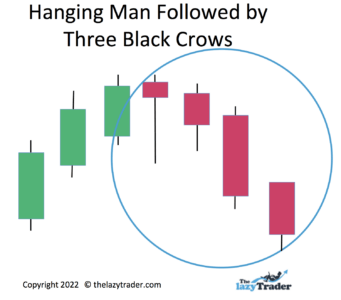

Though this is a significant pattern there, is no Hanging Man in this example. Let’s look at what happens when we combine the Three Black Crows with the Hanging Man.

The three down days of the Three Black Crows following the Hanging Man are a stronger indication of a downtrend beginning.

Waiting to sell on the third or fourth day means taking more losses, but it helps prevent you from making a mistake.

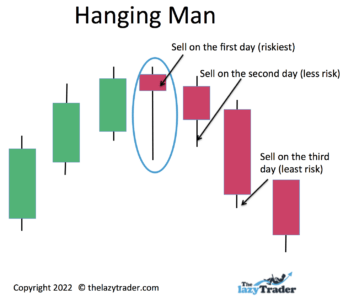

You have three basic trade entries to consider.

As you can see, the three entry points show less risk the longer you wait. Of course, the longer you wait to sell, the more money you lose, so you need to make a decision within three to four days.

If you sold early and the price goes back up, wait until the price is above the previous high before you buy back in. This will break the downward pattern and indicates buyers are again enthusiastic.

Your strategy should not be based on emotional reactions. Let the chart tell you what to do. Manage your risk by having a plan, such as getting out when you lose a certain percentage. Stick to your discipline.

Whenever you are trading, you have to be aware that things change. Although a disciplined trader will stick to their trading plan, occasionally a piece of news may change things.

You should therefore be prepared to take your profit earlier than you had anticipated. It is better to have a smaller gain and recycle your capital into a new trade than lose money or worse your capital be stuck in an unsuccessful trade.

You can also achieve this by adjusting your position size. For example if you sense that new information may affect your trade negatively, why not just reduce your position by half. If you are wrong you will still profit, if you right you have only risked a small amount of your capital.

There is no substitute for knowledge. You are an investor, not a gambler. Don’t roll the dice by making wild guesses. Read, study, and listen. to experienced traders.

Trade What You See–How to Profit from Pattern Recognition by Larry Pesavento

This is a book to help you recognize patterns in charts. It is especially useful for learning to find patterns while they are developing, instead of merely identifying them after they have developed.

Trading In The Zone by Mark Douglas)

This book on general trading principles covers things like eliminating bad habits and remaining consistent in your strategy. It shows how to trade probabilities and ignore anomalies.

Thomas Bulkowski’s Encyclopedia of Candlestick Charts.

This book allows you to study many technical patterns, with an in-depth look at the Hanging Man.

Courses are the best way to get a systematic education in technical trading.

Udemy Technical Trading

Udemy offers a comprehensive guide to all aspects of technical trading, and it is a reliable source for valid information. Though the company promotes othercourses as part of this course, you won’t get tacky come-ons to draw you into long-term commitments.

Travis Rose

This is a good place for beginners to start. Rose covers all the basics and leads you through the analysis of technical patterns such as the Hanging Man.

Bullish Bears

A learn-as-you-go approach works well at Bullish Bears. You build your trading skills systematically while actually trading. You can elect to make practice trades with no money invested.

Blogs can be good if they are offered by a pro with a track record. Look for blogs that walk you through various technical setups in the actual market. Keep score and see how often the blogger is right.

Here are some to look at:

Adam H. Grimes

Grimes has more than 20 years of experience and covers all types of trades, from breakouts to reversals of trends. His posts walk you through trades and keep you abreast of trends in the current marketplace.

Top-Down Charts

The emphasis here is on the macro trends. Great for learning how significant trends affect individual charts. While you do want nuts-and-bolts training on how to trade, this focus on trends and the economy is essential to giving context to your trading strategies.

Marc to Market

This daily blog focuses on Forex. Note that many of the technical trading principles of Forex apply to trading stocks as well.

Be aware that forums allow anyone to express an opinion. Take all advice in stride, as you don’t always know the credentials of the poster.

Some popular ones:

Elite Trader

Elite Trader offers forums on every type of trading style and approach. It is a good idea to join forums that may be outside of your current interests so you can learn about various methods. Look at the general technical forums first, and then launch into discussions on stocks, Forex, commodities, and so forth.

Morningstar

Morningstar forums have some quality input from experienced technical traders. You will not find any wild observations or insights here, but keep in mind that not everything in a forum is reliable.

Look for newsletters from seasoned pros. A good newsletter will give you tips and specific recommendations.

The Technical Indicator–Marketwatch

Here you will find in-depth chart analysis. This is the most helpful way to learn because each newsletter uses current technical trade setups. You can see actual patterns developing in the marketplace. This can be especially helpful in identifying the Hanging Man.

Morningstar Investor Newsletters

There are a variety of newsletters here to choose from. Select those areas of technical analysis you want to learn, and follow them regularly to get a knack for spotting trends and trading patterns.

Podcasts are like newsletters but choose an expert, not just someone selling something.

Allstarcharts Podcast on Technical Analysis Radio

This podcast offers timely insights into technical setups, trends, and reversals such as the Hanging Man.

Investing with IBD

Investor’s Business Daily has a particular focus on the “cup with handle” pattern. This is a fairly reliable pattern. Each podcast helps you recognize this pattern developing and may give you entry points for your trades. You can then use the Hanging Man to find your exit points.

YouTube is the home for many a fake guru, so beware.

Examine:

The Only Technical Analysis Video You Will Ever Need

While the claim made in the title is a bit over-the-top, this 45-minute video does take you through many technical analysis examples in detail.

Webinars can be thinly disguised sales pitches. Make sure you learn nuts-and-bolts information.

Online Trading Academy

This gives a solid approach to technical trading, with examples.

Technical Analysis–Fidelity

Fidelity is a reliable name, and the variety of technical trading webinars here adds to a comprehensive and trustworthy series that can help you profit and avoid pitfalls.

Because a Hanging Man formation occurs in one day, it is not as reliable as patterns that take longer to form. If you have a low risk tolerance, you can sell on the first day to avoid losses. If you have a higher risk tolerance, You may want to wait a day or two to see if the Hanging Man fails.

You must watch for a Hanging Man pattern daily, especially if prices have been in an uptrend for an extended period (weeks or months). Then, when you see the Hanging Man pattern, you must act quickly. This is not a time to take a break from reading charts. It is an intense period of weighing what the price action means.

One of the problems with using a Hanging Man pattern is that you can get in the habit of nervously selling every time there is a down day. Expect ups and downs, and do not overreact. You could become a day trader instead of a long-term investor. A long-term approach means being patient.

Never put any more than 1-2% of your trading account value into any single trade.

Once you set your trading rules, stick to them. For example, if you decide you will sell anytime there is a price drop of 5%, either place an automatic sell order at that level or do it manually. Getting emotional and breaking your own rules leaves you with no guidance and leads to emotional trading.

It can be easy to move on from one trade to the next without ever evaluating how you are doing. Keep track of all trades and how they turned out. Review and learn from your trading mistakes.

This platform allows traders to communicate like you do on Twitter and Facebook. You can share trading ideas and experiences with other traders. One helpful feature is the ability to examine professionally managed stock portfolios.

Ava offers platforms for multiple experience levels. You can automate your trades and follow expert traders to learn from their insights.

This platform is not available in the U.S. Naga allows you to copy the best traders on the platform. You can trade stocks, cryptocurrencies, and forex across the world.

This Forex and CD broker makes it easy for traders to start quickly. You can trade forex, stocks, commodities, metals, and cryptocurrencies.

FP uses the Autotrade tool. This allows traders to copy-trade, and it offers live statistics, along with risk-management systems. You can see the entire trading history of the most successful traders and mimic their methods.

The platform allows a low minimum deposit. Those trading for the first time can get started here. A demo is available.

Body (or Real Body) is the colored part of the candlestick. This indicates where trading opened and where it closed.

Shadow refers to the “wick” of the candlestick, the black line showing the highest and lowest prices of the day.

Trend means the overall direction prices have been headed.

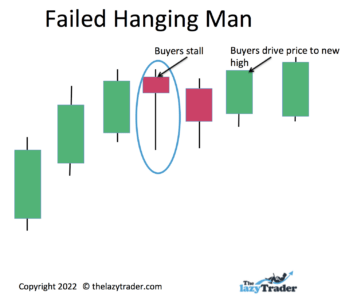

Failure of the Hanging Man pattern indicates that prices continued to rise and the pattern was a false indicator in that case.

Stop-loss is an order you place to sell the stock if it drops to a specific price or if it drops a certain percentage.

Bear indicator means a signal that prices may drop into new downward trend. The Hanging Man is a bear indicator.

The Hanging Man can be your friend, warning that danger lies ahead. It is useful when you have already bought an asset and want to protect yourself from losses. Try not to get emotional, trading based on fear. If the market flashes a Hanging Man pattern, sit up and take notice.

Decide in advance how much you are willing to lose on your asset, and sell when prices drop that far. Of course, a Hanging Man that occurs long after you bought the asset means you will be taking profits. It is a fair indicator to sell and take your profits.

A Hanging Man candlestick is not reliable most of the time. A little more than half of them fail. You improve your chances if you see a follow-through of the downward price action the following day and sell on that day or after. It also helps if trading volume increases as the price drops.

A second Hanging Man candlestick that forms within a day or two of the first is a confirmation that prices may drop.

No. It can be either green or red. Either way, it indicates buyers are failing to push the price higher.