November 16, 2021 Updated October 22, 2023

590

1 votes

Reading time: 1 minutes

An engulfing candlestick sounds like something that would set your house on fire, but it’s one of the imaginative names for trading patterns on a chart. The engulfing candle pattern can tell you when an upward or downward trend is reversing. Use this guide to understand how to recognize this type of candle. And more importantly, use it to create an entry and exit strategy for each trade. You can boost your trading success by understanding this one candlestick pattern. Candlestick trading was created way back in the 18th century Munehisa Homma, who used them to trade rice. Engulfing candlesticks were one of his early developments. Steve Nison brought the concept to the West with his book a Japanese Candlestick Charting Techniques. The engulfing candle became prominent because it is easy to recognize.

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also. At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers Show Search Filters

Show Search Filters

76% of retail investor accounts lose money when trading CFDs with this provider.

76.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing

76% of retail investor accounts lose money when trading CFDs with this provider.

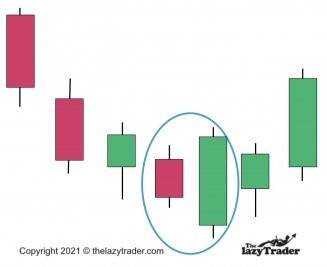

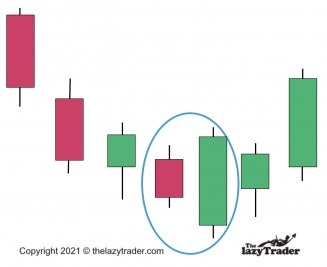

A bullish engulfing pattern indicates the price action may reverse its downward trend and start a new uptrend. “Engulfing” refers to the fact that the body of the candle goes both higher and lower than the previous candle. This is what an engulfing candle looks like. The price dropped at first, then buyers stepped in and drove the price up. This pattern appears at the bottom of a downtrend. How can you be sure it is the bottom? You cannot. But the bullish engulfing pattern indicates it could be. We will discuss how to get in and protect yourself later.

A bullish engulfing pattern indicates the price action may reverse its downward trend and start a new uptrend. “Engulfing” refers to the fact that the body of the candle goes both higher and lower than the previous candle. This is what an engulfing candle looks like. The price dropped at first, then buyers stepped in and drove the price up. This pattern appears at the bottom of a downtrend. How can you be sure it is the bottom? You cannot. But the bullish engulfing pattern indicates it could be. We will discuss how to get in and protect yourself later.

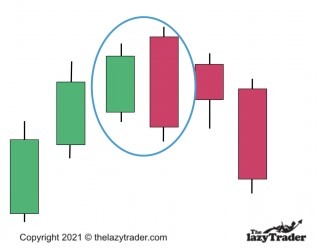

A bearish engulfing candle suggests the price action will reverse into a downtrend. The upward trend tops out at a candle that shows the trend tried to continue upward, but sellers took over and the price closed lower. Although buyers have tried to push the price higher they have failed, which explains why there are bar chart was initially positive for buyers. No pattern is a sure thing, but this bearish candlestick pattern is a strong indicator. Learning to use it correctly is what you need to work next!

A bearish engulfing candle suggests the price action will reverse into a downtrend. The upward trend tops out at a candle that shows the trend tried to continue upward, but sellers took over and the price closed lower. Although buyers have tried to push the price higher they have failed, which explains why there are bar chart was initially positive for buyers. No pattern is a sure thing, but this bearish candlestick pattern is a strong indicator. Learning to use it correctly is what you need to work next!

Books about candlesticks can walk you through best practices. Look for books that offer a nuts-and-bolts approach instead of those that are trying to sell you a “secret method.”.

Here are two recommendations:

If you are going to take a course on candlesticks, find one that offers basics and fundamentals. Avoid those that offer some kind of “trick” and promise outrageous returns.

A good blog tells you how to do, not what to do. That means perhaps showing some candlestick patterns developing and commenting on them. Anyone who says “buy now” is being irresponsible. They do not know your trading goals and risk tolerance, and no trade is a sure thing.

Be careful with forums. Traders of all levels will weigh in on topics. You can get a lot of bad advice and believe some things that are not true. Use them to learn, but do not take any advice about jumping into a trade immediately.

These can be more useful than forums if they come from a seasoned pro. Avoid get-rich-quick newsletters.

Timely, meaning many podcasts will comment on the current market and candlestick setups they observe. Do not rush to make a trade just because you hear it is a good idea. You must understand why it is good.

Sadly, YouTube is the gathering place for pitching the uninformed courses and books that overpromise and under-deliver. Be wary when someone waves fists-full of cash at the camera.

Free webinars are usually teasers to sell you something. You can learn from them, but beware of pitches that get you over-enthused or fearful. You can make bad decisions when you are emotional.

Engulfing patterns can be useful, but you have to be prepared to embrace technical trading. This type of trading evaluates trades based on price chart patterns, rather than merely looking at underlying economic and financial conditions.

Candlesticks occasionally require quick action, but your approach overall should be long-term. Follow long trends in a chart and do not panic every time there is a small drop. Watch your candlesticks to see if a drop is a reversal or a mild pullback.

Candlesticks can tell you when to get in, but they cannot tell you what to get into. Choose your investments for the long term and use candlesticks to determine entry and exit points.

There is no such thing as a sure thing in investing. Never invest more than 1-2% of your trading account value in any trade.

Use stop-loss orders to get out of your position automatically if you start to lose too much. Lose a battle to fight another day and win the war.

One of the biggest mistakes traders make is changing their investment strategy. Candlesticks are a technical trading method, meaning they rely on chart patterns. When you hear about a company that is a “hot stock” and decide to buy stock, or when you hear about a favorable exchange rate, you are using a fundamental approach. Do not keep changing your approach or you will lose focus and chase the latest information.

Look for a platform that offers safety measures to protect your money and is regulated by the country where it is located.

Here are some suggestions:

Use a spreadsheet or journal to track your trades. Note your winners and losers and review why the outcomes occurred. Did you misread the candlesticks or was the market behaving in an unusual manner?

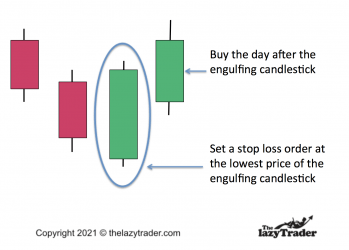

So how to get into (and out of) a trade when you see a bullish engulfing candle? Let’s break it down.

Enter the next day after the engulfing candle.

For greater safety, wait two days before entering to see if the upward reversal gets confirmed by more buying.

Wait for this pattern to fully form, meaning wait until trading ceases for the day. Then make your decision the next day, or wait a couple of days to see if more upward candles form.

It is difficult to set a price at which you will sell. Instead, keep an eye on this pattern and watch for a reversal in the other direction. Set a stop-loss order at the lowest price of the engulfing candlestick. Sell when you see a bearish trend reversal pattern. This is the earliest trade you should make. You can wait two or three days to see if the trading action confirms the reversal. Bullish engulfing candle trading strategy success rate. This pattern is reliable about 60% of the time. Note, however, that this pattern is most reliable at the bottom of a trend. A long downtrend will shake out all the sellers, and when buyers step in, the price action forms the bullish engulfing candle.

It is difficult to set a price at which you will sell. Instead, keep an eye on this pattern and watch for a reversal in the other direction. Set a stop-loss order at the lowest price of the engulfing candlestick. Sell when you see a bearish trend reversal pattern. This is the earliest trade you should make. You can wait two or three days to see if the trading action confirms the reversal. Bullish engulfing candle trading strategy success rate. This pattern is reliable about 60% of the time. Note, however, that this pattern is most reliable at the bottom of a trend. A long downtrend will shake out all the sellers, and when buyers step in, the price action forms the bullish engulfing candle.

When an upward trend starts to reverse, look for the bearish engulfing candle, make sure you have a strategy in place. Do not improvise.

If you already have a long position, place a sell market order the day after the bearish engulfing candle is formed.

For those who short positions, short on the day after the bearish engulfing candle.

If you have shorted, get out of the short position the day after a bearish trend reversal. In the event you are waiting to go long, buy the day after a bullish trend reversal. You may be unsure on the first day after the engulfing candle, you may want to wait two or three days to see if the reversal gets confirmed. Bearish engulfing candle trading strategy success rate. This pattern is reliable 60-70% of the time. Note that it is most accurate at the top of an uptrend.

If you have shorted, get out of the short position the day after a bearish trend reversal. In the event you are waiting to go long, buy the day after a bullish trend reversal. You may be unsure on the first day after the engulfing candle, you may want to wait two or three days to see if the reversal gets confirmed. Bearish engulfing candle trading strategy success rate. This pattern is reliable 60-70% of the time. Note that it is most accurate at the top of an uptrend.

While many trading platforms are good, some are better for beginners. Go here to find some good suggestions for those just starting out.

Success with candlesticks is as much an art as a science. You use them to gauge the psychology of traders, and that interpretation can be subjective. Make up stories with them: “This candle shows that buyers were eager at first but something spooked them and they started selling.”

Engulfing candles are a one-day event. Though many use them to get into the trade the next day, the market can be finicky. Always set stop-loss orders.

Also, engulfing candles do not take into account the fundamentals of the underlying investment. Make sure the investment makes sense in terms of sound economics or finances.

Another risk is focusing on one to three days of candlesticks. Zoom out on a chart and look at the larger trend.

Engulfing candles can be easy to find, and often serve as strong indicators or a new direction. They are suggestions, possibilities. Know them well and practice using them, and you will become adept at using them. Do not get overexcited when you find one. Be patient, watch it, and if you trade based on it, watch it daily for surprises.

Q: Can you teach yourself how to use the engulfing candle pattern?

A: You now only can teach yourself, you should. Even guidance from courses requires you to internalize the lessons and make judgments for yourself. Make sure you use credible sources for learning candlesticks and the engulfing pattern, and do not forget that you can be a credible source. That means that at some point you should have your own insights and not wait for others to give them to you.

Q: How do I know when to use them?

A: Use them as part of every analysis you do. They are a tool in your toolbox, now a replacement for good judgment.

Q: What are the weaknesses of using engulfing candles?

A: An engulfing candle is not 100% reliable. Until you learn to spot good entry points after an engulfing candle, wait for two or three days to see if a reversal direction gets confirmed.

Q: Do people fail when using engulfing candlesticks?

A: Yes. Many do. But that is not because these candlesticks are not good to use, it is because many trade on a superficial level, jumping in when they see one without an exit plan, an understanding of the underlying investment vehicle, and an awareness of the economy.