Is the NFT Bubble About to Burst?

If you ask some investors, a better question might be: "Has the NFT bubble already burst?" That's because it's clear we are in the middle of a bear market for both cryptocurrencies and non-fungible tokens (NFTs).

If you ask some investors, a better question might be: "Has the NFT bubble already burst?" That's because it's clear we are in the middle of a bear market for both cryptocurrencies and non-fungible tokens (NFTs).

If you ask some investors, a better question might be: "Has the NFT bubble already burst?" That's because it's clear we are in the middle of a bear market for both cryptocurrencies and non-fungible tokens (NFTs).

A bear market is generally defined as the decline of an asset's price (often securities) of 20 percent or more over previous highs. As of this writing, Bitcoin is down 51 percent year-to-date. Ethereum has plummeted 56 percent.

Sales of NFTs (most of which are tied to the Ethereum blockchain) hit a twelve-month low in June, down a staggering 92 percent from last year's high point. This NFT marketplace collapse has spelled disaster for many speculators, especially those who got in at the tail end of the frenzy. However, despite the marketplace turmoil, we will discuss why recent events might not bode so badly for NFT's long-term prospects.

Takeaways

Takeaways

The NFT bubble has grown fueled by speculation and media hype.

The NFT market has followed the collapse in the cryptocurrency market

The utility approach to NFTs might be a better long-term strategy for investors

The firm's main research and development office is based in Tel Aviv Israel. It originally specialized in Forex and indices spreadbetting and CFDs but has recently expanded in stock trading also. At the time of writing, eToro has 2.2 out of 5 star on Trust pilot. The comments suggest that the platform offers some impressive features but withdrawing money can be difficult. Having said that, some of the negative reviews appear to be rants rather than constructive criticism. This can be examples of traders losing money through their own recklessness rather than eToro's fault. You should therefore take this reviews with a pinch of salt. OANDA is a global financial services company providing advanced currency solutions to both retail and corporate clients all over the world. In this article, we are going to review this broker’s trading options, tools, platforms, spreads, commissions, security measures, and educational resources to help traders make the right choice. AvaTrade offers a wide variety of trading solutions (spread trading, CFDs, and social trading), and peace of mind with its comprehensive regulation, covering the EU, Australia, Canada and South Africa. Clients can use a variety of platforms for discretionary and automated trading.![]() Best Award Winning Brokers

Best Award Winning Brokers

How the NFT bubble grew so large, so fast

The starting point for the rise of NFTs was the now-famous 2008 whitepaper by the pseudonymous Satoshi Nakamoto outlining Bitcoin and blockchain technology. The other key to making NFTs a reality was when the Ethereum network went live in 2015.

The Ethereum blockchain introduced smart contracts—code stored on the blockchain and connected to a digital asset, such as an NFT. These smart contracts automatically execute when certain conditions are met. They also confirm that the NFT in question is unique and traceable.

Digital artists were among the first to see the potential to use NFTs to sell their artwork for cryptocurrency. They realized they could use an NFT's smart contract to ensure they earned royalties on their artwork even when the artwork was resold on the secondary market.

Fast forward to 2021, which proved to be an extraordinary year for NFTs. The buzz took off in March when famed luxury auction house Christie's auctioned off a token by digital artist Beeple. An NFT of Beeple's "Everydays: The First 5000 Days" sold for a record-smashing $69 million.

News of the sale caught many by surprise. Christie's participation helped promote a sense of legitimacy in the NFT marketplace. Seemingly overnight news stories covering the intersection between NFTs, crypto, and Web 3.0 began seeping into both tech news and eventually into mainstream business news as well.

One of the most well-known NFT collections is the Bored Ape Yacht Club, a collection of 10,000 caricatures of ape avatars that launched in May 2021. Ownership of a Bored Ape gives the holder access to members-only benefits, including admittance to a private Discord server and special online and in-person events.

Owning a Bored Ape NFT carries with it certain bragging rights as a status symbol for wealth and exclusivity. Celebrities like Jimmy Fallon, Stephen Curry, Mark Cuban, and Madonna are all Bored Ape owners.

At first, Bored Ape tokens sold for around $300 each. It wasn't long before speculators were re-selling their Apes on the secondary market for well over $100,000 each. By October 2021, the frenzy had reached a fevered pitch, with Sotheby's auctioning off a Bored Ape for $3.4 million. This capped off a banner year for NFTs, which saw sales soar from about $82.5 million in 2020 to $17.7 billion in 2021.

By early 2022, the NFT market began showing signs of serious weakness. Talk of an NFT bubble dominated finance and investing news. NFT sales plunged from a high of $12.6 billion in January 2022 to a little over $1 billion in June.

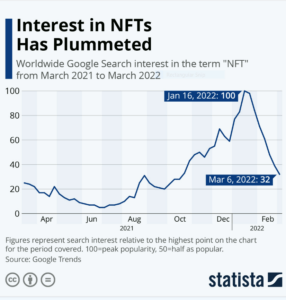

As this Statista infographic shows, Google search interest in NFTs began its ascent in July 2021, peaking in January of 2022, and drastically falling thereafter.

Many experts say the popping of the NFT bubble is linked to the crash in the broader cryptocurrency market. While this is certainly one factor, there are other factors to consider.

Months before the crypto crash began, people were already questioning the hype surrounding NFT sales. The overblown prices and rampant "flipping" of NFTs on the secondary market were tell-tale signs speculation was driving the market. Once it became clear these high valuations were no longer sustainable, many speculators cashed out and fled the market. This caused demand and prices to tank.

Another factor that had a negative impact on the market was the massive amount of fraudulent activity. NFT collectors have been plagued by ongoing cyber-attacks, phishing scams, and hacks. The purpose of this activity is to steal valuable tokens and/or drain crypto wallets.

One private intelligence company recently identified almost 200 NFT scams with an estimated $1.3 billion in fraudulent activity. One phishing scam alone targeting Bored Ape owners led to the loss of $3 million. Unfortunately, the decentralized and anonymous nature of blockchain means victims don't have much recourse if they fall prey to scams.

When discussing the future of NFTs, the conversation often turns to the potential that lies in "utility NFTs." The premise behind utility NFTs is that the token is more than just a digital art collectible. It can also be a way for holders to access certain benefits and privileges.

There are many use cases proposed for utility NFTs, some of which have already been tested. Event promoters have sold NFTs as tickets to online or live events. The promoters can encode the NFTs to give holders extra benefits and rewards. This includes front row seats at a concert, entrance to exclusive parties, or free merchandise.

For example, entrepreneur and VaynerMedia CEO Gary Vaynerchuk launched his VeeFriends NFT project in May 2021. Token buyers received access to the VeeCon conference and access to different events depending on which token they purchased.

Companies are using NFTs to build brand loyalty. In April, Nike launched its first collection of virtual sneakers named Cryptokicks through a series of NFTs. Because Nike issued a limited number of NFTs, the launch relied on scarcity and the desire for community status among self-proclaimed "sneakerheads" to drive sales. Apparently, it worked. One Cryptokicks NFT sold for $134,000.

Car manufacturer Alfa Romeo is using NFTs to verify service records on the blockchain. The company said it will issue a token with each sale of its new Tonale sport utility vehicle. The car's maintenance records will be encoded onto the NFT. This will provide the owner with proof that the car has been well-maintained, something that will have a positive impact on the vehicle's resale value.

Lastly, it's important to remember that a bubble bursting is part of a cycle that doesn't necessarily doom an asset class. Equities, real estate, and tech stocks have all experienced asset bubbles that have burst. These events were certainly painful for speculators who lost money.

However, they did not signal the end of the asset class itself. We still have housing and equity markets with plenty of profitable opportunities for the investor with a long-term horizon. Likewise, the rapid decline of NFTs doesn't mean an end to the NFT market. In fact, if the many NFT creators and enthusiasts are to be believed, it may just be the beginning.